Summary: All of the main US indices made new all-time highs this week. The indices appear to be supported by strong breadth, with 7 of the 10 SPX sectors also making new highs. This post reviews several studies that suggest price momentum is likely to carry the indices higher over the next several months and through year-end. That does not preclude an interim drawdown of at least 5%—we regard that as very likely, sooner rather than later—but any weakness has a strong probability of being only temporary.

SPX, NDX, COMPQ, DJIA and NYSE all made new all-time highs (ATH) again this past week. The lagging small cap index, RUT, closed less than 1% from its ATH. The primary trend remains higher.

The new highs for the US indices were accompanied by ATHs in a majority of sectors: technology, industrials, consumer discretionary, utilities, staples, healthcare and materials. With broad indices like the NYSE (which includes 2800 stocks) and 7 of 10 sectors at new ATHs, it's hard to say that healthy breadth is lacking (more on breadth in a new post here).

SPX has risen 8 of the past 10 sessions. The only two loses were a mere 0.05% and 0.12%. The recent persistence of trend has been fairly remarkable and is likely to continue to provide a tailwind for equities.

Our overall message from last week remains unchanged and is paraphrased below:

SPX has risen 7 days in a row; that type of trend persistence has a strong tendency to carry the markets higher over the next week(s). Investors should not expect the bull market to be near an important top. Markets weaken before they reverse, and the existing trend has yet to weaken at all.

That said, the month of June is seasonally weak and there are a number of reasons to suspect it will be again this year, not the least of which is the FOMC meeting mid-month. Markets anticipate the Federal funds rate will be hiked for a 4th time: the prior three rate hikes have coincided with notable drawdowns in equities (as well as a fall in treasury yields).

In February, we reviewed "a number of compelling studies suggesting that 2017 will probably continue to be a good year for US equities": that post is here.

This week, we can add several more studies that further bolster the bullish case for equities over the next several months. That does not preclude the potential for an interim drawdown, but any weakness has a strong probability of being bought for at least a retest of the prior high.

Let's review.

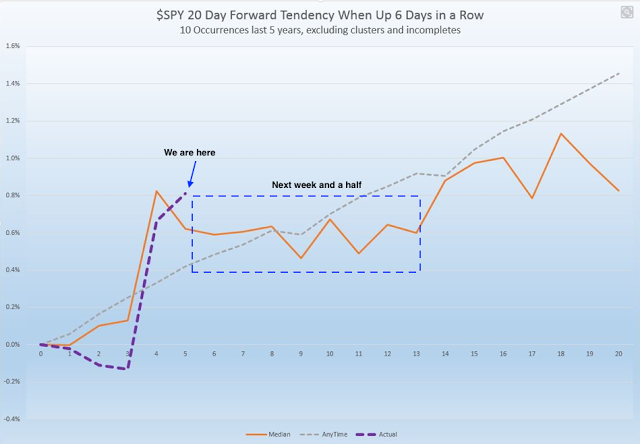

First, when SPX (via SPDR S&P 500 (NYSE:SPY)) has risen at least 6 days in a row, as it did last week, then SPX has closed higher 10 to 20 days later in 90% of instances since 2012. As the chart below shows, the typical pattern is for SPX to consolidate or retrace some of its gains in the middle of this period (corresponding to the next week and a half), followed by a higher high (from @Twillo using data from indexindicators.com).

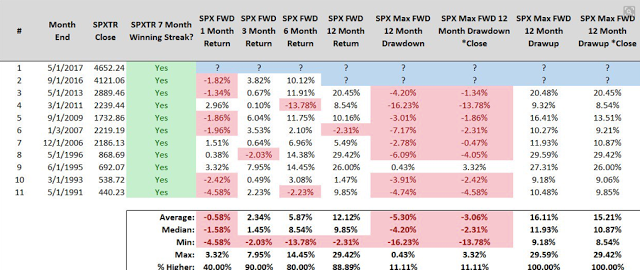

Second, SPX (including dividends) rose a 7th month in a row in May for only the 11th time since 1991. In the prior 10 instances, SPX closed higher either 3 or 6 months later every time, for an average gain of 2.3% and 5.9%, respectively. A year later, 8 of 9 instances closed higher by an average of 12%. The average drawdown during the next 12 months was 5% (from @SJD10304).

Of note: SPX (including dividends) has risen 8 months in a row only 3 times (1996, 2007 and 2011) and risen more than 8 months in a row only once (in 1995, to 10 months in a row). In short, these streaks don't tend to go longer, something to keep in mind for June and July.

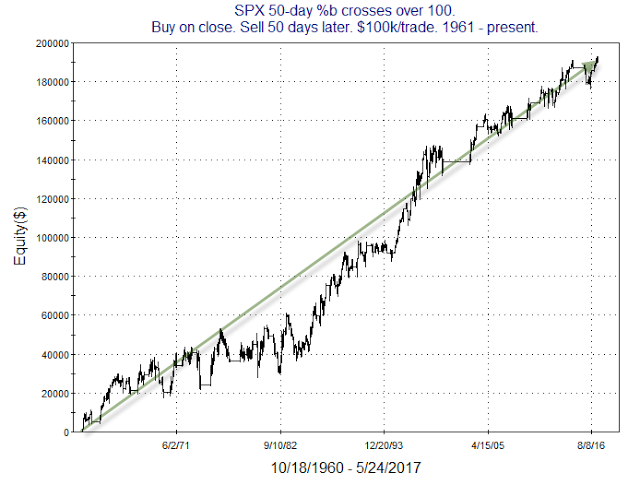

Third, the recent trend has been so strong that on Thursday, SPX closed above its 50-day, 2-standard deviation Bollinger® Band. That level of strength greatly favors further upside over the next two months. That has especially been the case over the past 30 years (from Rob Hanna).

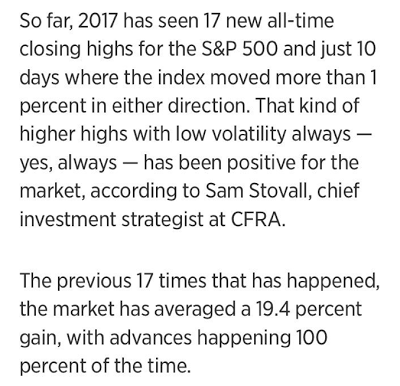

Fourth, 2017 has so far been marked by both a persistent uptrend (with more than 17 new ATHs) and little volatility. In the 17 prior years when this combination has occurred, the index gained an average of 19% for the year. All 17 instances ended the year higher (from Sam Stovall).

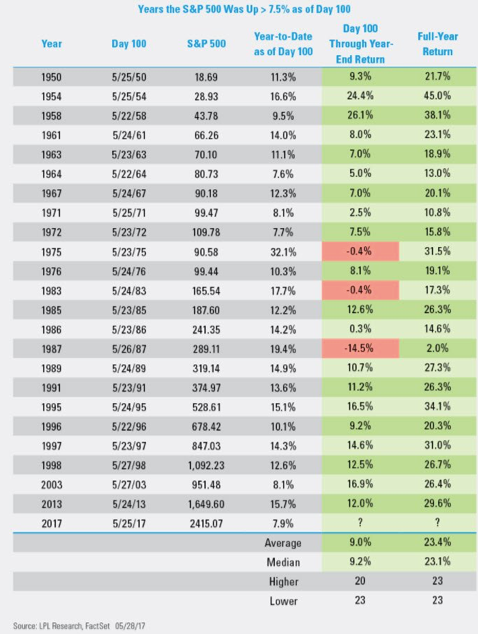

Similarly, when SPX has been up at least 7.5% on the 100th trading day of the year (which was this past week), it has added to those gains during the remainder of the year 20 of 23 times (86%). The average and median additional gain through year-end has been 9%. There was only one major failure, in 1987; the other two closed just 0.4% lower (from Ryan Detrick).

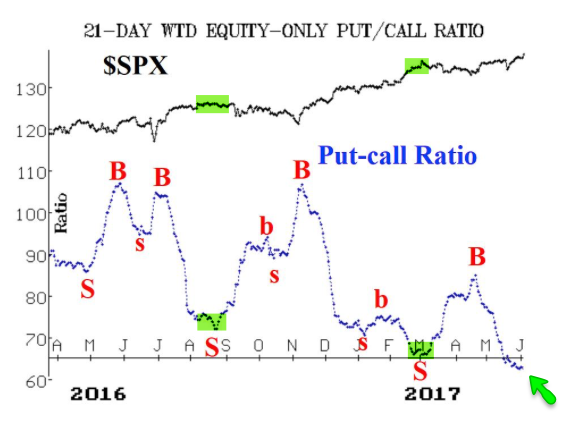

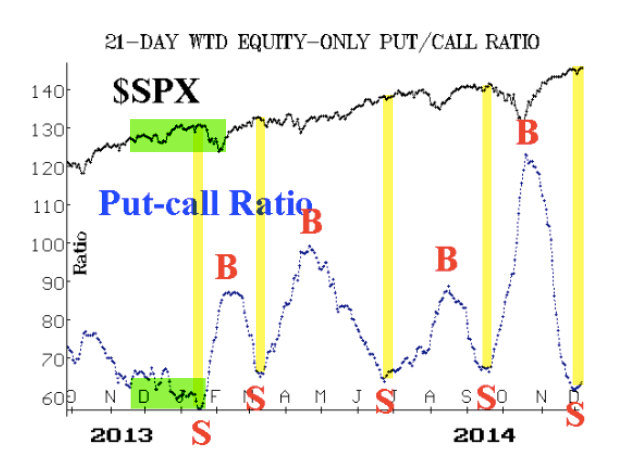

Last week, we reviewed a few reasons June could show seasonal weakness (read here). One of these became more acute this week: the one-month weighted average equity-only put/call ratio is now at it's lowest since December 2014: SPX fell 5% in the next month. Prior to that, this ratio reached current levels in mid-November 2013: SPX chopped sideways until the holidays, then rose 2% by early January before falling 6% later that month (green shading in the second chart). There are mixed messages from some of the recent sentiment data but, on balance, contrarians should be alert for a reversal into the upcoming FOMC meeting on June 14 (from Larry McMillan).

A new review of the latest macro data, which was marked by creeping weakness in employment, retail sales (ex-gas) and housing, can be found here.

The calendar is light for this week: durable good orders on Monday and testimony from former FBI Director James Comey on Thursday.