by Pinchas Cohen

The Week That Was

Last week opened with a bang, as centrist candidate Emmanuel Macron beat far-right candidate Marine Le Pen in the French presidential election. Still, the global equity relief rally quickly stalled. Only Japan's TOPIX held on to its record gains. South Korea’s KOSPI made a fresh record but then took a step back, after liberal candidate Moon Jae-in won the country's presidential election. He's been very open about his preference to improve relations with North Korea rather than, as he puts it be a US puppet.

The MSCI Asia Pacific Index climbed over 150.00, its highest level since June 2015.

A slew of Fed speakers brought the dollar back to life. After a brief decline it discounted the shock and geopolitical implications of President Donald Trump’s firing of FBI Director Comey and returned to its current level.

After an 18.60% decline between April 12 and May 5, oil bounced back 9.85%, after US crude stockpiles surprised. Non-US oil producers are prepared to keep the production cuts that were instituted at the beginning of the year in place into 2018, but will it be enough to offset continually rising US production?

Retail sales fell short of expectations. Earnings revealed that brick-and-mortar retailers have been especially hard hit, losing to online retailers. However, valuations are wildly divergent among the physical and virtual stores, many of whom are now trading at 56 times earnings. As such, physical retailers continue to provide better value as an investment.

The S&P valuation expansion is still below what it was at the time of the tech bubble. Nevertheless, all stocks are approaching valuation peaks. If you're looking to buy equities, balance that with earnings growth prospects and revision momentum, and of course valuation relativity. Recall that in the last couple of years the equity market got a boost, as bond investors sought a positive yield in the equity market by treating dividends as yield, and to hell with the actual price of the equity. That has not changed.

What To Look For This Coming Week

Geopolitics

Chinese President Xi Jinping's two-day, Silk Road summit on trade and infrastructure begins today. It's an effort to promote China's leadership as a defender of globalization and ambition for greater economic cooperation between Asia, Africa and Europe, in direct opposition to Trump's protectionist stance.

President Xi Jingin participated in the World Economic Forum at Davos this past January. This was the first time a Chinese president did so. He championed the importance of globalization. This came after Trump’s victory in the election, as well as after Trump's anti-China rhetoric. World leaders participating include Russian President Vladimir Putin, Turkish President Recep Tayyip Erdogan, Italian Prime Minister Paolo Gentiloni, as well as IMF Managing Director Christine Lagarde. Xi wishes to restructure global trade patterns in China’s favor. In Beijing, May 14-15.

At the close of the summit, Turkish President Recep Tayyip Erdogan, will visit President Donald Trump in the White House.

Iran holds presidential elections on Friday May, 19.

Also on Friday, President Donald Trump embarks upon his first overseas trip later this week. He'll visit Saudi Arabia, Israel and the Vatican.

Economics

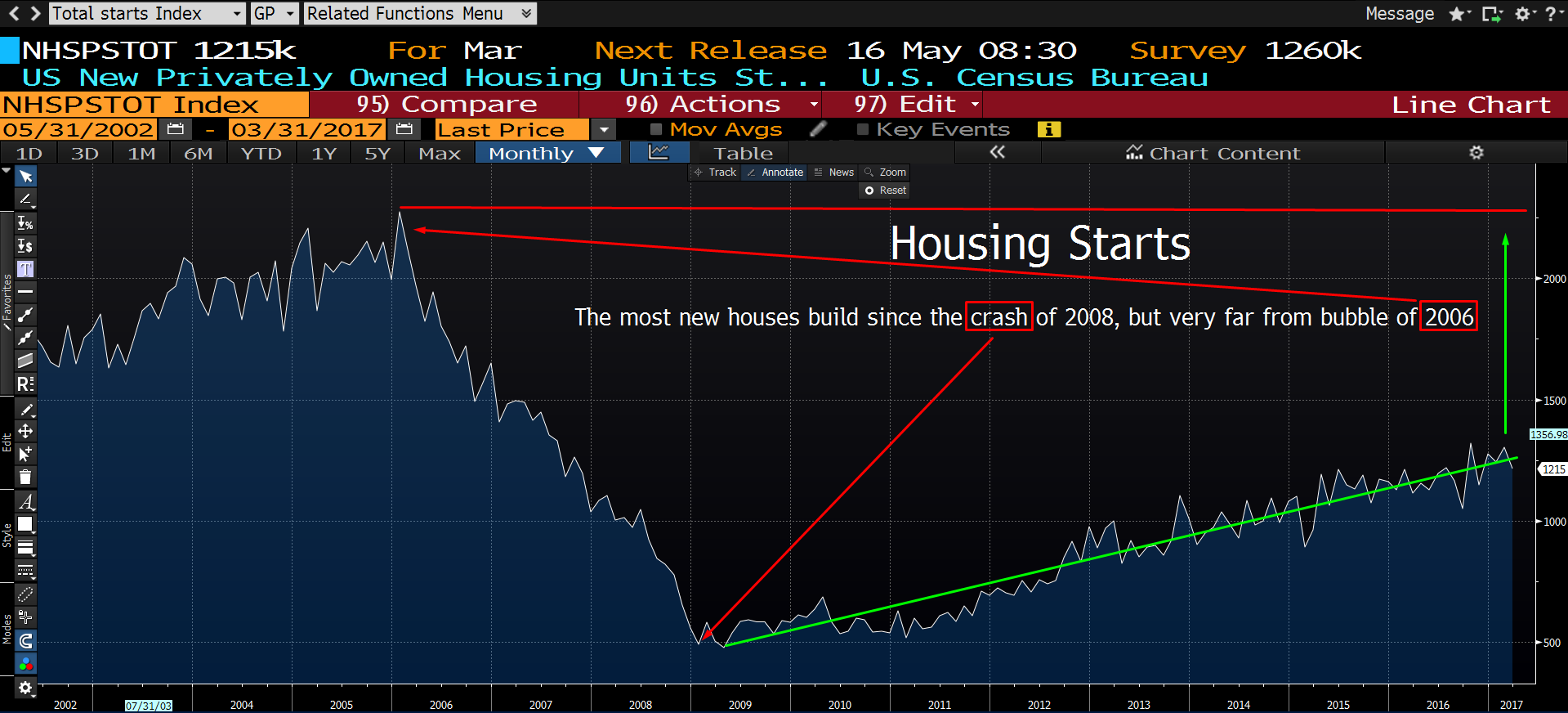

Economists expect that US housing starts and industrial production grew in April, to reflect that the country's economy is bouncing back from a weak first-quarter.

Interest Rates Meetings: Mexico, Poland, Indonesia, Chile

Earnings Reports This Week

Cisco Systems (NASDAQ:CSCO)., Target Corp. (NYSE:TGT), Wal-Mart Stores (NYSE:WMT), Campbell Soup Company (NYSE:CPB), Tencent Holdings (OTC:TCEHY), Alibaba Group Holding (NYSE:BABA).

Events

Google (NASDAQ:GOOGL) may surprise with a product announcement, as it holds its annual I/O developer festival in Mountainview, CA beginning May 17. In the past the company has used this venue to introduce new products and product upgrades.

Google and Fidelity control 8.333 percent of Elon Musk's SpaceX, which is set to launch another satellite tomorrow. Will the Tesla CEO's privately held company spur additional interest in Alphabet, Google’s parent stock?

Monday

China announces industrial production and retail sales data for April. Consensus has industrial output contracting, while retail sales remains flat. If the forecasts are right, it would indicate that manufacturing orders slowed, but consumer demand did not. This divergence cannot continue for long. Either consumer demand will weaken further, in light of reduced manufacturing, or manufacturing will be forced to catch up to a relatively higher demand.

Smart Money is forced to show its hand. May 15 is the deadline for US money managers with more than $100 million of US stock under management to disclose their holdings to the SEC. Most hedge funds file today. It always pays to know where the smart money is and what they're holding.

The US and Mexico have reached an impasse in an ongoing trade dispute over refined sugar, and the US has threatened to remove subsidies and impose tariffs. Mexico has threatened to bypass the US and trade with China, which is what Chinese President Xi is trying to do with his summit.

US Commerce Secretary Wilbur Ross and Mexico’s Minister Ildefonso Guarjardo are meeting to resolve the trade dispute.

The price of the commodity has lost 25% since February. It has the most bearish net-short positions in almost 20 months.

At the same time, the Mexican peso has crossed over a down trend line and the 200 dma against the dollar for the first time since late 2014. Currently, the currency pair is developing a “descending triangle,” which is statistically followed by a strong move down, upon the breakout of the bottom of the pattern. Might failed talks provide the fundamental cause for the technical momentum in the chart?

Tuesday

Housing starts in the US are expected to have risen in April, reflecting the rising momentum since after the crash which began with housing. The release is at 8:30 EDT. This sign of economic growth is expected to be buttressed by rising US industrial production for April, release at 9:15 EDT.

JPMorgan Chase (NYSE:JPM), the largest bank in the US, holds its annual shareholders meeting. On the docket is the proposal to compensate executives who leave the private sector for government service. Labor organizers are lobbying against this practice, as it’s become a reoccurring theme, especially within the administration of US President Donald Trump who has habitually been recruiting Wall Street’s finest.

Why would banks be willing to pay executives leaving them for government office? Interesting question; could it be because of potential interests served? If that’s the case a vote to end the practice might push the financial stock lower.

Turkish President Recep Tayyip Erdogan visits Washington to meet with President Donald Trump. Top of the agenda will be Trump’s decision to arm Kurdish groups in Syria who are regarded as terrorists by Turkey. The visit legitimizes Erodgan, who has been increasing his power base at the expense of democracy. The visit lasts through Wednesday May 17.

Ironically, Erdogan's recent moves may help the Turkish lira, which has been forming a bullish pattern as traded against the dollar. Should Trump provide Erodgan with any concessions, lira could receive an additional boost.

ECB Governing Council member Ewald Nowotny speaks about monetary policy at an event hosted by the Principality of Liechtenstein, 17:30 in Vienna (11:30 EDT).

Will that be enough to help the euro continue its current uptrend after it finally crossed over its 200 dma? It hasn’t been able to remain over 1.1000, since reaching above it on May 8.

- CENTRAL BANKS: Reserve Bank of Australia releases minutes of its May rate-decision meeting. It’s Cash Target Rate is 1.50 and no change is expected. The Australian dollar had lost over 5% since March and there's no momentum change in sight.

- EARNINGS: Home Improvement retailer Home Depot (NYSE:HD) posts earnings. Consensus expectations for 2017 are for EPS of $7.13 on sales and growth of 4.6%.

- ECONOMY: Euro area GDP – Previous: 0.5%, no change expected. A positive surprise may be what the euro needs to overcome its March high.

- ENERGY/COMMODITIES: American Petroleum Institute weekly oil inventory report.

Wednesday

The Federal Reserve Bank of New York will release its first quarter U.S. Household Debt and Credit Report which discusses recent trends in borrowing and indebtedness, including data about mortgages, student loans, credit cards and auto loans. This may provide a gauge for continued consumer demand, an important driver of a developed economy. On the other hand, there have been concerns of late that there's a rising trend of student loan borrowers who, once they've completed their education, are unable to find good paying jobs.

EARNINGS: Cisco Systems Inc. and Target Corp. also report results. Cisco's Fiscal 3Q17 revenue, EPS guidance in-line with consensus, reflecting growth in new products, software.

ECONOMY: U.S. MBA mortgage applications (weekly). The previous week’s read was a 2.4% growth. Since we’re bullish on housing starts, this should follow. But then again, while US manufacturing orders declined, retail sales remained steady. These things do tend to ebb and flow.

Thursday

UK politicians on the campaign trail—except for PM Theresa May who has refused to participate—begin the first major televised debate since the snap election was called.

This could really move the pound, which, after crossing the 200dma mid-April for the first time since the Brexit vote, could not get above 1.3000. Will it be able to get through the 1.3 mark, which is resistance since the post Brexit vote price action, July - September?

Japan’s economy probably accelerated in the first three months of the year, posting a fifth straight quarter of expansion. That would be the longest consecutive period of growth since 2005-2006.

EARNINGS: Alibaba (NYSE:BABA): Consensus expects Alibaba's revenue to grow 48% in 4Q, up from 39% a year ago.

Friday

Iran’s presidential election will be held. Incumbent Hassan Rouhani seeks a second term against conservative challengers, including a clerical ally of the Islamic Republic’s supreme leader. No candidate has vowed to scrap the landmark 2015 nuclear deal with the West, but the vote will determine the future of Iran’s economic engagement and could set U.S. relations on a more contentious path.

There will be a runoff election a week later if no candidate wins more than 50 percent of the vote. After North Korea, Iran is the biggest global threat according to President Trump. These elections and the results are expected to impact the dollar.

EARNINGS: American equipment manufacturer Deere & Co (NYSE:DE) products, including agricultural equipment and construction machinery are in demand. Expectations forecast 4% growth in sales.

Soup maker Campbell's (NYSE:CPB), net sales dropped 1.4% in 2Q despite the fact that the dollar strengthened—which should have given its sales a sizeable boost. This is very bearish.

ENERGY/COMMODITIES: Commodity Futures Trading Commission report on futures and options positions; Baker Hughes weekly U.S. rig count, whose continuous rise has foiled any possible benefits of OPEC and NOPEC production cuts. The weekly rise in US rigs is expected to continue.