Friday offered the opportunity for more but in the end it was honors even between bulls and bears.

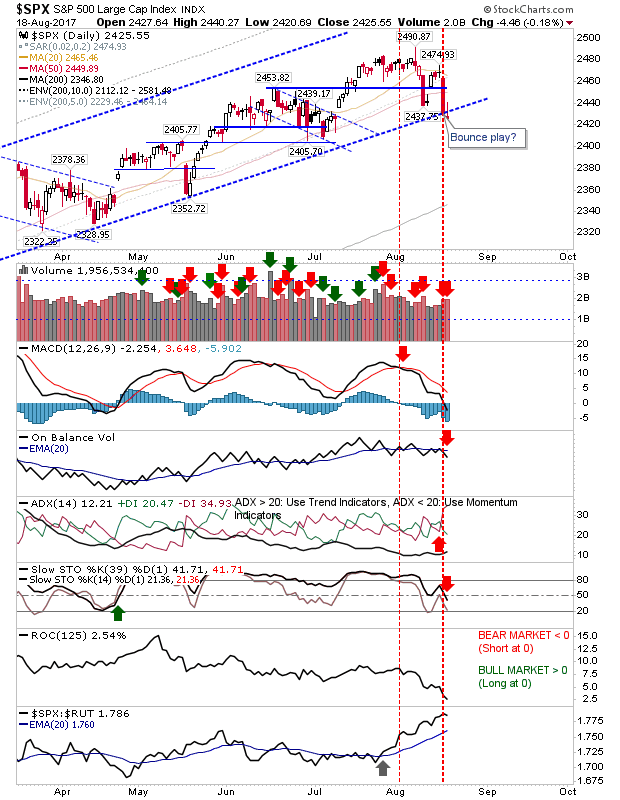

The S&P finished the week on bearish net technicals on higher volume distribution. One positive was a potential doji (and a chance for a 'bullish morning star' on Monday) which is a chance for bulls to buy the open with a stop on a loss of 2,420. Another is the very strong relative performance – when money comes into the market it's the S&P where it's going.

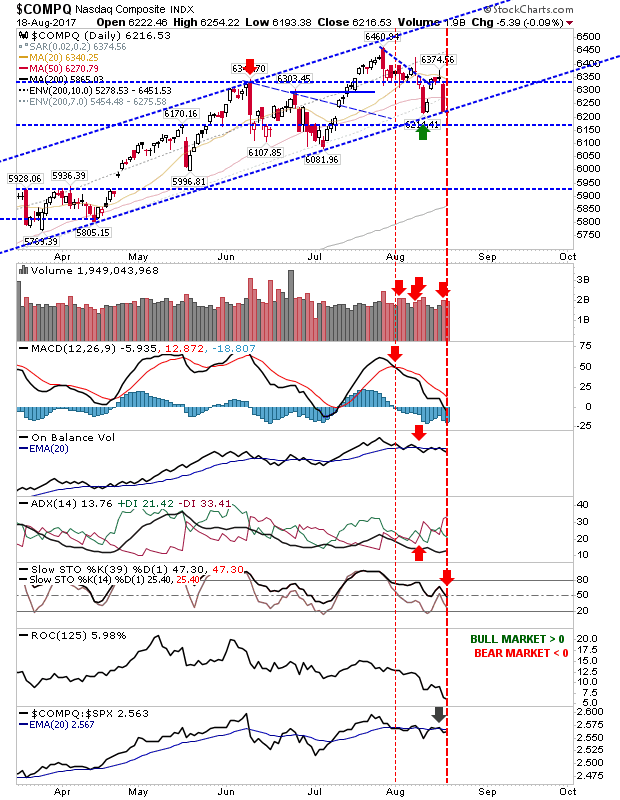

A second bite of the cherry for bulls? The prior week saw a successful support test but it didn't amount to much. Whether there is something here will depend on how markets (and the NASDAQ) open on Monday. Technicals are net negative along with weak relative performance so perhaps holding off on new positions may actually be the most prudent thing to do.

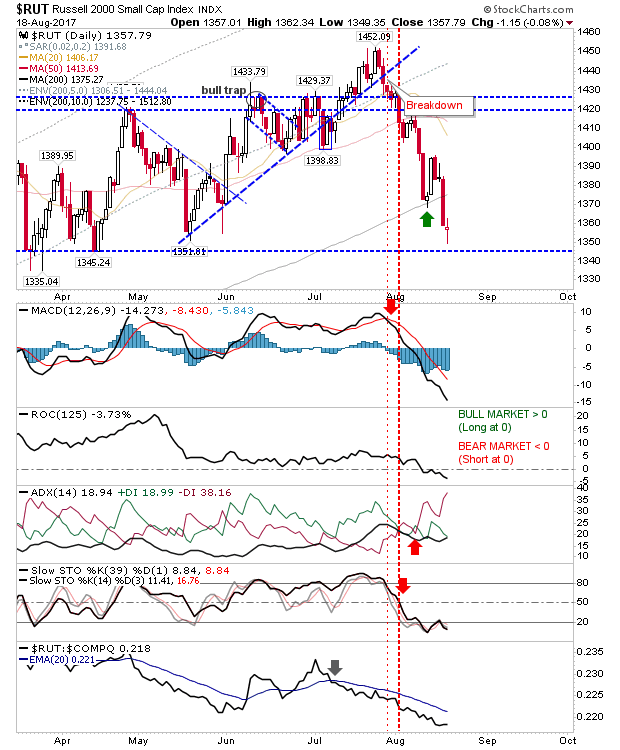

The Russell 2000 may be the index to take a long punt on. Friday's 'spinning top' speaks more of indecision but with the NASDAQ and S&P on support and this index heavily oversold (look at intermediate and short term stochastics) then it may be time to buy with a stop on a loss of 1,350.

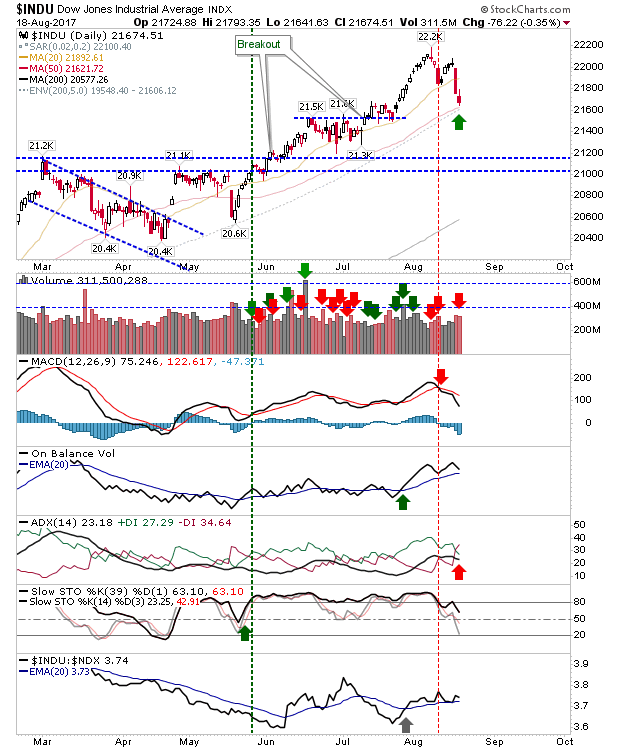

The Dow had the worst of Friday's action but with the convergence of 20-day and 50-day MAs there may be something for bulls to work with. Look for a bounce off the moving averages.

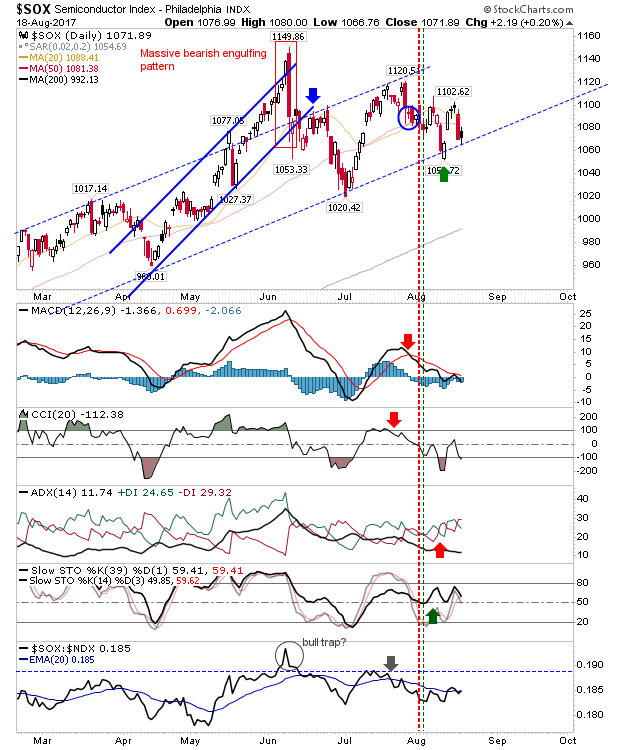

The other index to watch is the Semiconductor Index. Friday's black candlestick is not the bearish warning such candlesticks play when they appear in a top. This time with the index at channel support it might instead be viewed as a positive pullback support retest; stops on a loss of 1,050.

A few opportunities to watch on Monday. Please note, I will be on vacation until September 3rd. Hopefully, Donald Trump will not have nuked the world before I return.