Tuesday February 13: Five things the markets are talking about

Euro equities are trading steady despite a late down swing in Asia, as investors wrestle to find direction after this month’s early collapse.

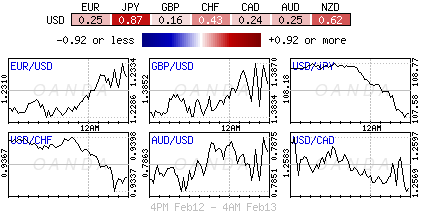

The dollar has weakened against G10 currency pairs while Treasuries have edged a tad higher along with gold. Crude is heading for its first advance in eight sessions.

Investors are looking to tomorrow’s U.S. consumer-price data for some clues on direction, given that pressure on stocks have been stemming from the outlook for inflation.

The market is expecting U.S. consumer-price index to probably increase at a moderate pace last month along with U.S. retail sales – both due out tomorrow.

Note: Lunar New Year celebrations for the Year of the Dog begin, affecting China, Hong Kong, Taiwan, Singapore, Malaysia and Indonesia. Chinese mainland markets are closed Feb. 15-21.

1. Stocks mixed review

In Japan, the Nikkei share average closed at a four-month low overnight as investors turned somewhat risk averse as the yen rallies outright. The Nikkei ended -0.7% lower, its lowest closing level in four months.

Down-under, Aussie shares tracked Wall St into positive territory. The S&P/ASX 200 index rose +0.6% at the close of trade, after a -0.3% yesterday. In S. Korea, the KOSPI climbed +0.35%.

In Hong Kong, stocks rose overnight, tracking a global rebound, on bargain hunting. At close of trade, the Hang Seng index was up +1.29%, while the Hang Seng China Enterprises index rallied +0.88%.

In China, stocks rebounded, supported by investor sentiment aided by signs of government support and record bank lending last month. At the close, the Shanghai Composite index was up +1%, while the blue-chip CSI300 index was up +1.19%.

In Europe, regional indices trade mostly lower taking the lead from weaker U.S futures. The FTSE trades little changed following a slightly hotter CPI reading, as Gilt yields pare declines.

U.S stocks are set to open in the ‘red (-0.6%).

Indices: Stoxx600 -0.1% at 372.7, FTSE flat at 7173, DAX -0.1% at 12266, CAC-40 -0.1% at 5133, IBEX-35 -0.6% at 9708, FTSE MIB -0.5% at 22215, SMI -0.3% at 8799, S&P 500 Futures -0.6%

2. Oil prices firm on weaker dollar, gold higher

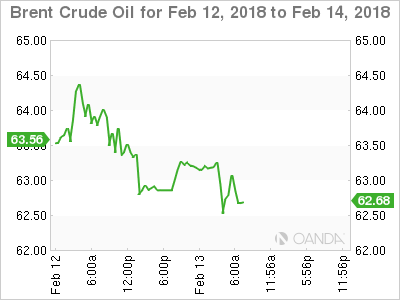

Oil prices are better bid, supported by a rebound in global equities, as well as by a weaker dollar, which potentially supports more fuel consumption.

Brent crude futures are at +$62.97 per barrel, up +38c, or +0.6% from Monday’s close. U.S. West Texas Intermediate (WTI) crude futures are at +$59.60 a barrel, up +31c or +0.5% from yesterday’s settlement.

The stronger prices came after crude registered its biggest loss in two years last week as global stock markets slumped.

Nonetheless, rising U.S. production continues to undermine the efforts led by the OPEC and Russia to tighten markets and prop up prices.

Note: U.S. oil production has rallied above +10m bpd, overtaking top exporter Saudi Arabia and coming within reach of top producer Russia.

There are also strong signals the output will rally further. Data last Friday showed that U.S. energy companies added 26 oilrigs looking for new production, boosting the count to +791, the highest since April 2015.

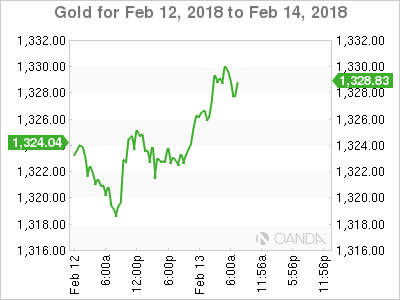

Gold prices have hit a one-week high overnight, aided by a weaker dollar and as the market awaits for tomorrow’s U.S. inflation data for clues on the pace of interest rate hikes. Spot gold is up +0.4% at +$1,327.81 an ounce.

Note: Yesterday, the yellow metal rose +0.5%, its biggest single-day percentage gain in more than one week.

4. Sovereign yields fall

G7 sovereign bond yields look attractive across the curve after yields rallied on a recovering global economy and on expectations central banks will tighten policy faster than previously thought.

With the lack of economic market news the fixed income market looks attractive and reason why yields fell in the overnight session.

The yield on U.S. 10-year Treasuries fell -3 bps to +2.83%, the biggest drop in more than a week. In Germany, the 10-year Bund yield declined -2 bps to +0.74%, the lowest in a week, while in the UK the 10-year Gilt yield has dipped -1 bps to +1.601% despite the higher inflation print (see below).

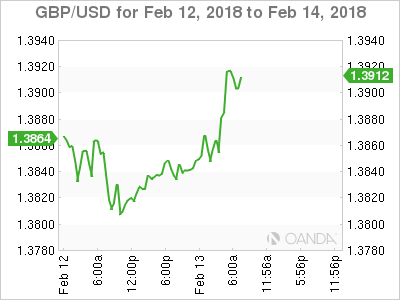

4. Sterling reaction muted

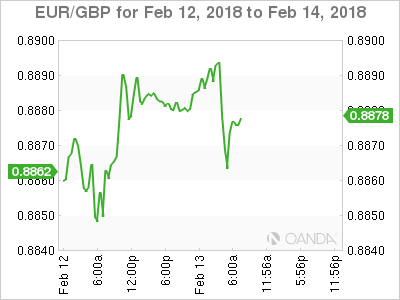

The pound (£1.3896) has edged a tad higher after U.K January annual inflation unexpectedly remained at +3% (see below) as worries about the U.K. getting a transitional deal after breaking up from the E.U persist. EUR/GBP trades down -0.1% at €0.8868. Although the high inflation number will add to expectations for another BoE hike, futures prices would suggest that the market has priced in two rate increases for the next 12-months.

Note: PM Theresa May’s government will aim to address the Brexit transition in a series of six speeches by the prime minister and other senior ministers in the next few weeks, which her office dubbed “The Road to Brexit.” May’s first speech is to be delivered at a conference in Munich next Saturday, while Foreign minister Boris Johnson will begin the series with a speech tomorrow.

Elsewhere, the USD is modestly lower as President Trump’s proposed budget brings into focus the U.S twin deficits. The EUR/USD (€1.2337) is higher by +0.2%, while USD/JPY (¥107.55) is lower by -0.9% as fixed income dealers ponder the limits of an expansionary BoJ policy.

5. UK inflation above target in January

Data this morning showed that UK consumer prices rose +3% y/y in January. This headline print suggests that the Bank of England (BoE) case for higher borrowing costs is somewhat justified to bring borrowing costs back to its +2% annual goal.

The ONS said that the price gains were driven by clothing, footwear and recreational goods and services, especially tickets for zoos and gardens.

Note: Market consensus was expecting annual inflation in January to slow to +2.9%, from +3% m/m.

UK Inflation has been above the BoE’s +2% annual target for 12-consecutive months. Last week the BoE said that they expected to raise interest rates at a swifter pace than they anticipated last year to contain growth in prices.

Note: The BoE raised its benchmark rate for the first time in a decade in November, to +0.5%. Futures prices suggest that the central bank will lift it again as soon as May.