Market Brief

The USD rally is running out of steam as the latest economic indicators failed to support dollar bulls in the post-FOMC rate-decision environment. September Richmond Fed manufacturing index came in on the soft side yesterday, printing at -5 versus 2 median forecast, compared to a reading of zero a month earlier. Moreover, the dollar is lacking the catalyst to reverse the current trend of most dollar crosses. EUR/USD is getting closer to the 1.1087 support, implied by the low from September 3. On the upside, the closest resistance can be found at 1.1460 (high from September 18). We expect EUR/USD to trade mainly range-bound, given today’s light economic calendar. GBP/USD is no exception. After dropping more than 2% in a couple of days, the sterling found strong support slightly above the 1.5330 level, implied by the low from September 15.

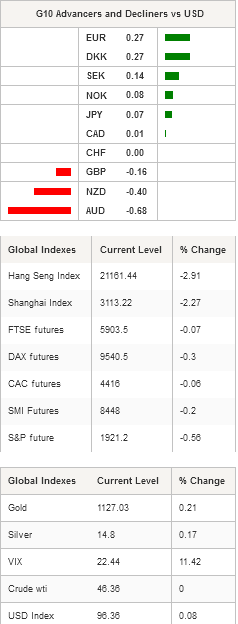

Once again, China printed disappointing PMI figures. The Caixin flash manufacturing PMI fell to 47 in September, the lowest reading since early 2009, and well below market expectations of 47.5 from 47.3 the previous month. Last week, the Fed emphasized that it was monitoring developments in emerging economies, meaning that bad news from those countries will likely spill over into developed markets. Asian regional equity markets are suffering a heavy sell-off this morning, following Wall Street’s lead and reacting to weak data from China. The Shanghai Composite fell -2.27% while its tech-heavy counterpart, the Shenzhen Composite edged lower by -2.27%. In Hong Kong, the Hang Seng was the biggest loser as it dropped -2.91%. Meanwhile in South Korea, the KOSPI index settled down -1.90%.

Yesterday was a special day for the Brazilian real. The currency hit an all-time low against the greenback. The real fell as low as 4.0665 to the dollar, losing more than 50% of its value since the beginning of the year as Dilma Rousseff’s government struggles to pass much needed austerity measures while inflation is overshooting the 2016 central bank’s target of 4.5%.

In Australia, conference board leading index came in in positive territory, printing at 0.3%m/m in August from a revised contraction of -0.3% a month earlier. Australian shares are no exception to the broad Asian sell-off. The S&P/ASX 200 fell 2.07% in Sydney, while the Aussie paired losses against the greenback as commodity prices remain under pressure.

In Europe, equity futures are mixed this morning, oscillating from positive to negative territory. At the moment, the FTSE 250 is down -0.07%, the CAC 40 -0.06%, the DAX -0.30%, the SMI -0.20%, while the Euro Stoxx 50 is down -0.16%. EUR/CHF continues to move lower and is currently trading at 1.0870; meanwhile, USD/CHF is lacking the fresh boost it needs to move above the 0.9770 threshold.

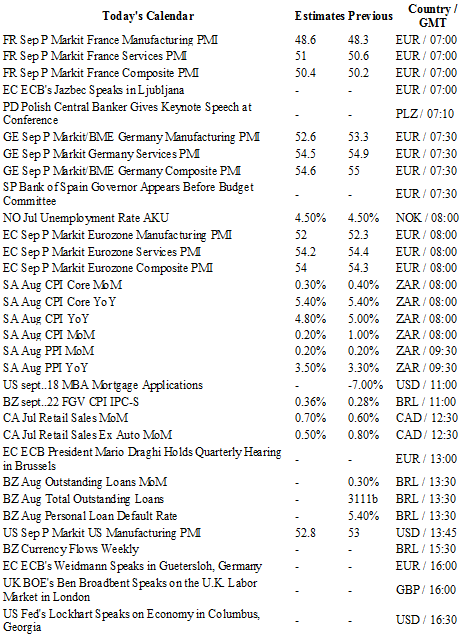

Today traders will be watching market PMIs from Germany, France and the Eurozone; inflation report and interest-rate decision from South Africa; MBA mortgage applications and Markit manufacturing from the US; retail sales from Canada; long term rate TJLP decision from Brazil.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1561

CURRENT: 1.1153

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5819

R 1: 1.5628

CURRENT: 1.5338

S 1: 1.5165

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.96

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9748

S 1: 0.9513

S 2: 0.9259