With the first month of 2015 passing us and moving to February, the outlook for the year ahead for some nations does not show too much promise. Data recently released showed the global economy weakening in 2014, and sadly for many nations, it looks to be even worse for the new year. The slumps of commodities have realized the market expectation as shifting downward.

The US economy seems to be the only light in this haze and is the main reason supporting their Dollar in rising for 7 Months in a row. US consumer spending expanded by 4.3% – its biggest rise since 2006 Q1. Consumption accounts for almost 70% of US economy, helping the annual economy growth record a four-year high at 2.4%. However, the recent GDP data also shows us the gloomy side of the story: the global slowdown has impacted the US as investments and exports are slowing down. The speculation of a Fed rate hike is cooling under this circumstance, which may be an alarming sign for bulls of the USD.

I still hold bullishness for the USD in the long term, but I’m expecting some drawbacks or consolidation in the upcoming FX market.

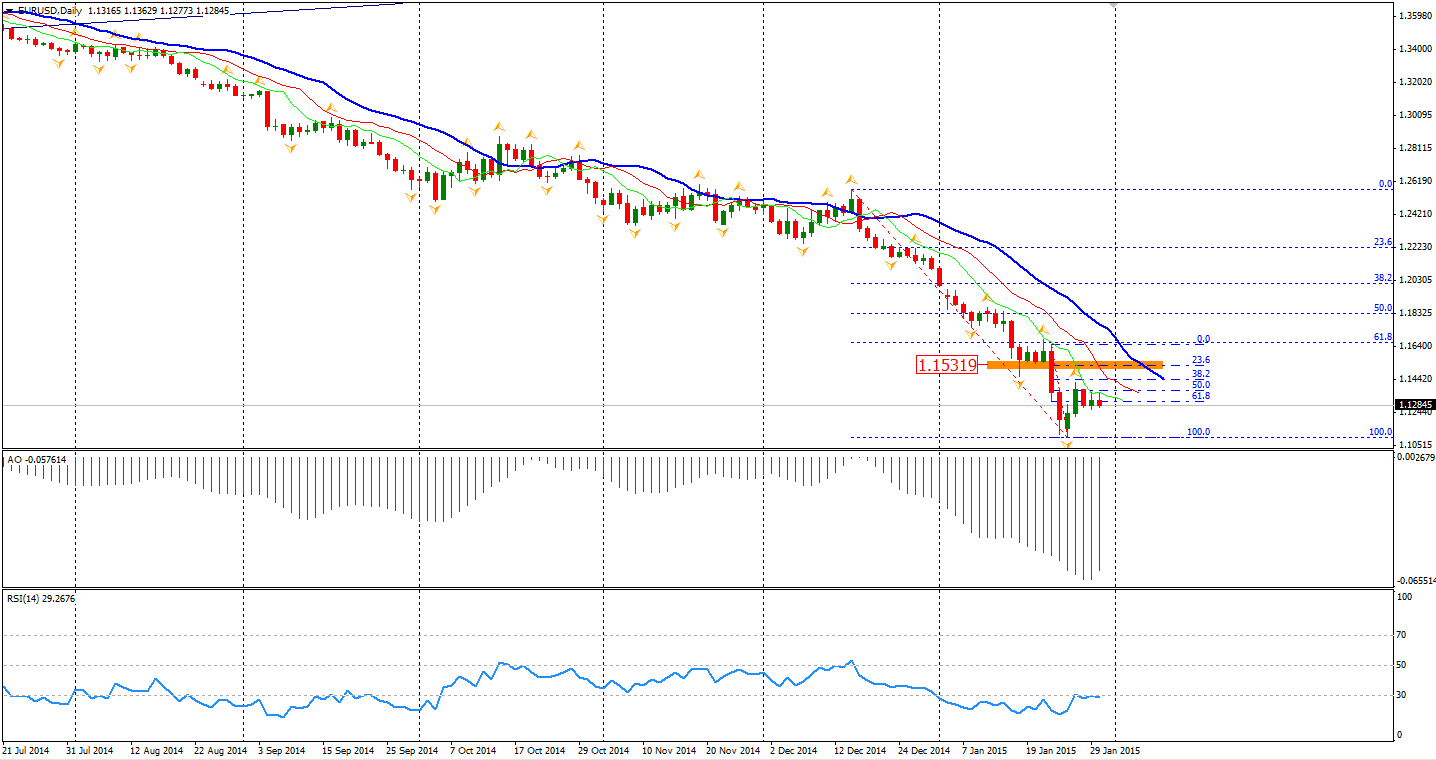

The Euro rebounded this week but was still unable to rally beyond 1.14, showing that the loss may extend into the following week – a week full of PMI data.

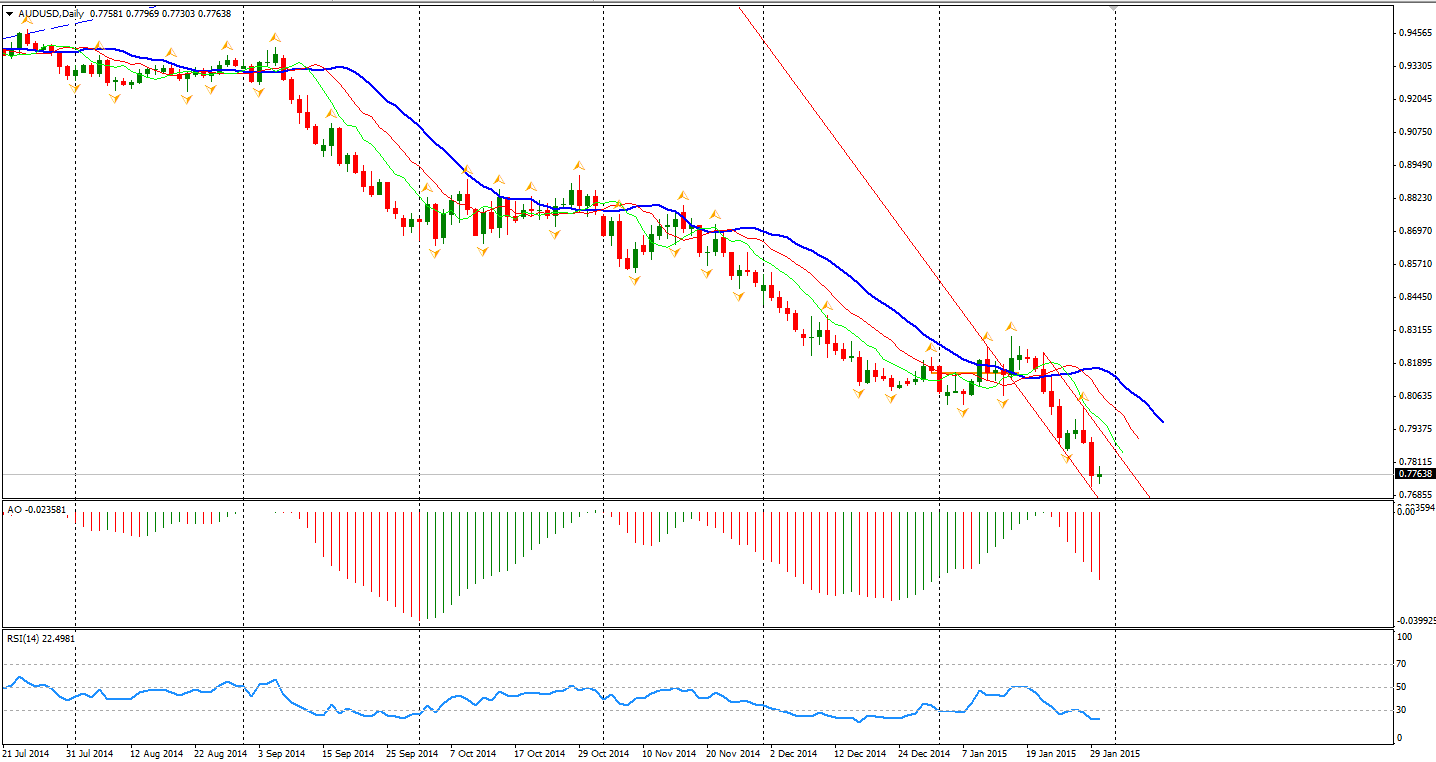

The Aussie Dollar kept below the 0.78 level on Friday. During the weekend, China’s official manufacturing PMI fell below 50 for the first time in more than two years, revealing the contraction of domestic and global demands is impacting the second largest economy. The bearish outlook of AUD remains.

Back to stock markets, the Shanghai Composite plunged by 1.59% to 3210. The Nikkei Stock Average lost 0.69%. Australian 200 rose 0.34% to 5588. In European markets, the UK FTSE 100 was down 0.9%, the German DAX lost 0.41% and the French CAC 40 Index fell 0.59%. The US market fell on downbeat GDP and Eurozone’s low inflation. The S&P 500 closed 1.3% lower to 1995. The Dow Jones 30 slumped by 1.45% to 17165, and the Nasdaq Composite Index dropped 1.03% to 4635.

On the data front, China HSBC Final Manufacturing PMI will be at 12:45 AEDST. Eurozone and UK manufacturing PMI data will be released this afternoon. U.S. manufacturing PMI will be out at 2 am AEDST midnight.