S&P 500 turns negative

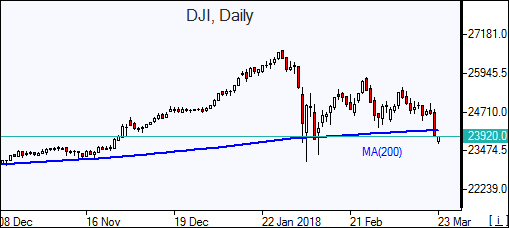

US stock indices fell sharply on Thursday as trade war fears triggered a broad selloff. The Dow Jones Industrial Average tumbled 2.9% to 23957.89, falling 10% below the all time high hit in January. The S&P 500 tumbled 2.5% to 2643.69 with ten of the 11 main sectors finishing in the red. The NASDAQ Composite fell 2.4% to 7166.68.

The dollar strengthened slighly: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up 0.03% to 89.685. Stock indices futures indicate lower openings today.

Trade war fears intensified after news the Trump administration instructed the office of the US Trade Representative to draw up a list of tariffs on Chinese products totaling up to $60 billion. The tariffs are expected to protect sensitive technologies that the US considers vital to the US economy. Equity markets had slid the previous day after the Federal Reserve had hiked rates 0.25 percentage points, and while it stuck to just three rate hikes in its guidance for 2018 it forecast 3 hikes next year instead of two as previously indicated.

Positive economic data did little to support markets: Initial jobless claims remain near the lowest levels since 1970 at 229000, and the number of people collecting benefits fell to a fresh 45-year low. And Markit’s Manufacturing PMI hit a three-year high of 55.7 in March, while the reading on services dipped to 54.1 from 55.9.

European indices fall

European stocks extended losses on Thursday on rising trade war concerns after news US plans tariffs on China. Both the euro and British Pound turned lower against the dollar. The STOXX Europe 600 index fell 1.6%. Germany’s DAX 30 dropped 1.7% to 12100.08. France’s CAC 40 fell 1.4% and UK’s FTSE 100 lost 1.2% to 6952.59. Indices opened 0.5% - 0.9% lower today.

Concerns global trade war is heating up after news Trump ordered drawing up tariffs on Chinese goods weighed on market sentiment, already undermined by weak euro-zone data: Markit’s composite purchasing managers’ index for euro-zone declined to 55.3, a 14-month low, from 57.1. The Bank of England kept its interest-rate policy on hold as expected.

Nikkei leads Asian indices retreat

Asian stocks are sharply lower today after news US prepares import tariffs on up to $60 billion of Chinese imports. Japan's Nikkei fell 4.7% to 25866.50 despite yen turning higher against the dollar. Chinese stocks are down led by technology stocks: the Shanghai Composite Index is 3.4.6% lower and Hong Kong’s Hang Seng Index is down 2.4%. Australia’s All Ordinaries Index is down 2% as Australian dollar turned higher against the greenback.

Brent rising

Brent Oil Futures prices are advancing today on Saudi comments OPEC production curbs could be extended into 2019. Prices fell yesterday on gains in US production. Brent for May settlement lost 0.8% to close at $68.91 a barrel on Thursday.