All three US indices end at records

US stock indices resumed the rally on Thursday ahead of the start of fourth-quarter earnings. The dollar weakening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.5% to 91.852. Dow Jones industrial average rose 0.8% to record close 25574.73. The S&P 500 gained 0.7% to new record 2767.56 led by energy shares up 2%. The NASDAQ Composite advanced 0.8% to all-time high 7211.78. Futures point to higher market openings today.

Retailers lead European stocks slide

European stock indices extended losses on Thursday led by retailer shares. The British Pound joined theeuro’sadvance against the dollar. The Stoxx Europe 600 index fell 0.3%. Germany’s DAX 30 dropped 0.6% to 13202.90. France’s CAC 40 declined 0.3% while UK’s FTSE 100 gained 0.2% to all-time closing high 7762.94. Indices opened 0.1%-0.3% higher today.

Asian stocks rise

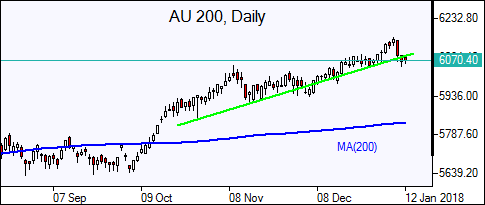

Asian stock indices are mostly higher tracking Wall Street moves overnight. Nikkei lost 0.2% to 23653.82 while yen resumed weakening against the dollar. Chinese stocks are rising despite news China’s exports and imports growth slowed in December after surging in the previous month: the Shanghai Composite Index is 0.7% higher and Hong Kong’sHang Seng Index is up 0.1%. Australia’s ASX All Ordinaries is little changed as Australian dollar fell against the greenback.

Oil slips on lower China imports

Oil futures prices are edging lower today on weak China December oil import data. Prices rose yesterday supported by US inventory drop and domestic crude output decline by 290,000 barrels to 9.492 million barrels a day. Brent for March settlement rose 0.1% to end the session at $69.26 a barrel on Thursday.