Federal Reserve two-day policy meeting starts

US stocks retreated on Monday after a report that the House of Representatives is considering phasing in a cut to corporate taxes rather than enacting them immediately. The dollar pulled back after hefty gains last week: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.4% to 94.527. S&P 500 closed 0.3% lower settling at 2572.83 led by healthcare shares. The Dow Jones industrial average lost 0.4% to 23348.74. The NASDAQ Composite index lost 2.3 points to 6698.96.

European stocks edge higher

European stocks ended higher on Monday after the central government in Madrid dissolved Catalonia’s government and decreed direct rule over the region. The euro and British Pound retraced higher against the dollar. The Stoxx Europe 600 index ended 0.1% higher. The DAX 30 added 0.1% to 13229.57. France’s CAC 40 ended marginally lower and UK’s FTSE 100 lost 0.2% to 7487.81. Indices opened mixed today.

Bank of Japan keeps monetary policy steady

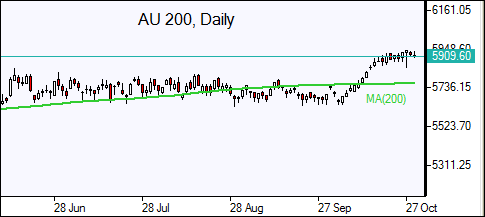

Asian stock indices are mostly lower today. Nikkei closed 0.04% lower at 22002.50 as the Bank of Japan kept monetary policy steady and yen was little changed against the dollar. The central bank maintained its inflation forecasts pointing to signs of growing strength in the economy that policymakers hope will accelerate inflation towards its 2% percent target. Chinese stocks are higher despite a report China's factory activity expansion slowed: the official manufacturing purchasing managers' index fell to 51.6 in October from 52.4 in September. The Shanghai Composite Index is 0.1% higher while Hong Kong’s Hang Seng Index is down 0.1%. Australia’s ASX All Ordinaries is down 0.2% while the Australian dollar is flat against the greenback.

Oil edges lower

Oil futures prices are inching lower today as traders took profits with recent gains raising the likelihood of increased US shale oil output boosted by higher prices. Prices rose Monday on continued optimism about global market rebalancing following talks of the possible extension of OPEC output cut deal beyond March 2018. December Brent crude rose 0.8% settling at $60.90 a barrel on Monday.