Main stock indices fall despite positive earnings

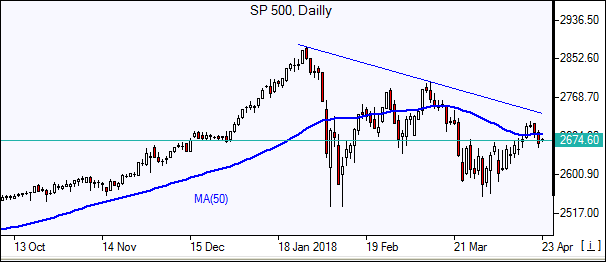

US stock indices extended losses Friday despite better than expected first quarter earnings. S&P 500 lost 0.9% to 2670.14 with ten of the 11 main sectors ending lower. S&P 500 gained 0.4% for the week though. Dow Jones industrial average dropped 0.8% to 24462.94. The NASDAQ Composite fell 1.3% to 7146.13. The dollar accelerated strengthening as 10-Year Treasury note yield hit the highest since January 2014: the live dollar index data show the ICE, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.5% to 90.31. Stock indices futures point to mixed openings today.

European stocks log fourth straight weekly gain

European stocks pulled back Friday led by consumer goods shares. The Stoxx Europe 600 Index slipped 0.03%, ending 0.7% higher for the week, however. Both the euro and British pound’s continued the slide against the dollar. The DAX 30 lost 0.2% to 12540.50. France’s CAC 40 gained 0.4% and UK’s FTSE 100 outperformed rising 0.5% to 7368.17. Indices opened mixed today.

Asian markets mostly lower

Asian stock indices are mostly lower today with traders cautious while geopolitical tensions on the Korean peninsula are easing after Kim Jong Un said he would suspend further tests of atomic bombs and intercontinental ballistic missiles. Nikkei lost 0.3% to 22088.04 despite the yen's slide against the dollar. Chinese stocks are lower: the Shanghai Composite Index is down 0.1% and Hong Kong’s Hang Seng Index is 0.6% lower. Australia’s ASX All Ordinaries is up 0.3% as Australian dollar extends its slide against the greenback.

Brent rises

Brent futures prices are edging higher today. Prices rose Friday, paring losses after President Trump’s Twitter message blaming the Organization of the Petroleum Exporting Countries for “artificially high” prices. Brent for June settlement rose 0.4% to close at $74.06 a barrel Friday.