An early rally in U.S. stocks lost some steam after President Donald Trump tweeted a complaint that China is “letting us down” by not buying U.S. farm products. Treasuries retreated after the latest American inflation reading came in hotter than anticipated, the dollar dropped for a second day and gold slipped.

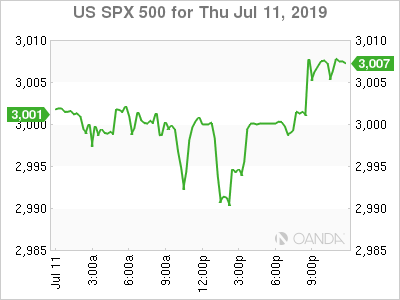

The S&P 500 tested 3,000 at the start of Thursday’s session while the Dow Jones Industrial Average flirted with 27,000 as investors weighed the latest clues on the path for monetary policy. Health-care shares gained after the Trump administration pulled the plug on a proposed overhaul of drug rebates. Technology and media shares also gained.

Federal Reserve Chair Jerome Powell, who struck a dovish tone in questioning before a congressional panel Wednesday, is back on Capitol Hill today to answer senators’ questions. Traders will be eyeing that testimony for further clues after a measure of U.S. consumer prices rose more than forecast in June.

“Inflation appears to have stabilized and this will put a wrench in some Fed rate-cut bet forecasts,” Edward Moya, senior market analyst at Oanda, wrote in a note. “With wage pressure not delivering a powerful effect on inflation, we should still see day two of Fed Chair Powell’s testimony keep the rate cut expectations in place for the July 30-31st meeting.”

The Stoxx Europe 600 Index edged higher, attempting its first advance in five days as energy companies climbed. Shares rallied across most of Asia, with the South Korean and Hong Kong markets outperforming and stocks in China edging higher. Emerging-market equities jumped alongside developing-nation currencies, while the pound continued its rebound from a two-year low as the greenback fell. European government bonds were mixed.

This year’s rallies across stocks, bonds and credit got a fresh jolt on Wednesday thanks to comments from Powell that persuaded investors rates are headed lower by at least a quarter-point in July. Minutes from the central bank’s last meeting further cemented expectations for a cut in borrowing costs.

Here are some key events coming up:

Powell testifies to Senate Banking Committee on Thursday.U.S. producer prices are due on Friday.

Here are the main moves in markets:

Stocks

The S&P 500 Index gained 0.1% as of 10:14 a.m. New York time.The Stoxx Europe 600 Index rose 0.1%, the first advance in a week.The U.K.’s FTSE 100 Index fell 0.1%, its sixth consecutive decline.The MSCI Emerging Market Index increased 0.7%, the biggest climb in more than a week.

Currencies

The Bloomberg Dollar Spot Index dipped 0.1% to the lowest in a week.The euro climbed 0.1% to $1.1258.The British pound climbed 0.3% to $1.2542, the biggest increase in three weeks.The Japanese yen gained 0.2% to 108.25 per dollar.

Bonds

The yield on 10-year Treasuries climbed one basis point to 2.07%, the highest in more than three weeks. Britain’s 10-year yield jumped seven basis points to 0.827%, the largest surge in 14 weeks.

Commodities

West Texas Intermediate crude climbed 0.2% to $60.56 a barrel, the highest in seven weeks.Gold dipped 0.3% to $1,415.26 an ounce.