All three main US stock indices end at record highs

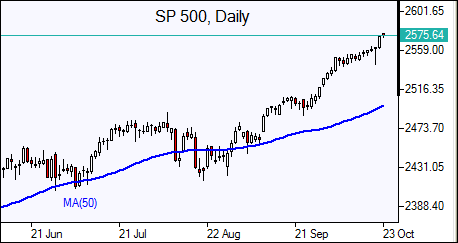

US stock indices extended the streak of record highs on Friday on revived optimism President Trump’s tax cuts may get enacted after 2018 budget blueprint approval by Senate. The dollar hit a nearly three month high: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, jumped 0.6% to 93.72. S&P 500 gained 0.5% to 2575.21 led by financial shares. The US broad market index rose 0.8% for the week. Dow Jones industrial average rose 0.7% to 23328.63. The NASDAQ Composite added 0.4 % to record high 6629.05.

European stocks advance

European stocks ended higher on Friday with gains limited by concerns over rising political tension in Spain after Catalonia referendum. The euro fell 0.6% on reports European Central Bank is not in a hurry to taper its monthly bond purchases program. The British Pound resumed gains against the dollar on Brexit talk hopes after Angela Merkel acknowledged the need for progress. The Stoxx Europe 600 index ended the session up 0.3%. The DAX 30 rose marginally to 12991.28. France’s CAC 40 gained 0.1% and UK’s FTSE 100 closed little changed at 7523.23. Indices opened mixed today.

Asian indices mixed after Abe’s election win

Asian stock indices mixed today. Nikkei rose 1.1% to 21696.65 supported by extended losses in yen against the dollar and a landslide election victory for the country’s ruling party. Chinese stocks are mixed after report China home price growth slowed again in September: the Shanghai Composite Index is up 0.2% while Hong Kong’s Hang Seng Index is 0.6% lower. Australia’s ASX All Ordinaries is down 0.2% despite a weaker Australian dollar against the greenback.

Oil slips

Oil futures prices edging lowered today. Prices rose Friday as OPEC forecast growing global demand and active US rig count fell by seven last week. December Brent rose 0.9% to $57.75 a barrel on Friday, gaining 1% for the week.