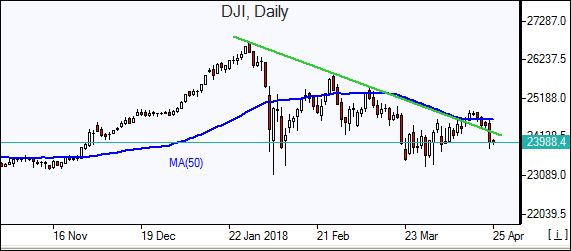

Dow logs longest losing streak in a year

US equities closed sharply lower Tuesday as 10-year Treasury yield hit 3%. The S&P 500 lost 1.3% to 2634.56 led by industrial and technology shares. Eight of 11 main sectors ended lower. Dow Jones Industrial Average slumped 1.7% to 24024.13, posting the fifth straight decline. The NASDAQ Composite index dropped 1.7% to 7007.35. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.2% to 90.755. Stock indices futures indicate mixed openings today.

Strong corporate reports failed to boost investors’ risk appetite as the 10-year Treasury yield briefly touched the psychologically important 3% level for the first time in four years. Economic data were positive: S&P/Case-Shiller national index rose 6.3% in February, compared with a year ago, hitting a four-year high. New home sales rose at annual rate of 694000 in March, a 4-month high.

European stocks pull back

European stocks ended lower Tuesday. Both the euro and British Pound turned higher against the dollar but have switched to losses currently. The Stoxx Europe 600 slipped 0.02%. The German DAX 30 lost 0.2% to 12550.82. France’sCAC 40 however gained 0.1% and UK’s FTSE 100 rose 0.4% to 7524.40. Indices opened 0.5%-0.7% today.

Weak economic data weighed on market sentiment also: the ifo business climate index fell to 102.1 points from 103.3 points in March, below forecasts of 102.6.

Asian indices dip

Asian stock indices are falling today tracking Wall Street losses overnight. Nikkei lost 0.3% to 22215.32 despite continued yen weakness against the dollar. Chinese stocks are falling led by technology shares: the Shanghai Composite Index is down 0.4% and Hong Kong’s Hang Seng Index is 1.2% lower. Australian and New Zealand markets are closed for a holiday.

Brent slips

Brent futures prices are edging lower today as traders expect US inventories rose last week. The American Petroleum Institute late Tuesday report indicated US crude inventories rose by 1.1 million barrels last week. Prices fell yesterday: June Brent lost 1.1% to $75.47 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.