Nasdaq trades back into positive territory

US stock market advanced Tuesday in a choppy trade with technology shares recovering partly after previous day selloff. The S&P 500 rose 1.3% to 2614.45 led by energy shares. All 11 main sectors ended higher. Dow Jones industrial average climbed 1.7% to 24033.36. The NASDAQ Composite index added 1% to 6941.28 cutting in half Monday’s 1.9% loss. Nasdaq turned positive for the year. The dollar strengthening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 90.14. Stock indices futures point to lower openings today.

Market volatility was high as traders worried about rising trade war tensions after China imposed retaliatory tariffs on about 130 US goods over the weekend. Escalating trade war uncertainty is the source of recent higher volatility, and will likely remain the main market driver until the start of earnings season.

DAX leads European indices pullback

European stocks ended the first session after Easter holidays lower. The euro slide against the dollar accelerated while the British Pound extended gains. The Stoxx Europe 600 lost 0.5%. The German DAX 30 fell 0.8% to 12002.45. France’s CAC 40 slid 0.3% and UK’s FTSE 100 lost 0.4% to 7030.46. Indices opened falt to 0.2% higher today.

European markets tracked Wall Street’s Monday moves after reopening. Technology stocks were the worst performers. In economic data the unchanged final reading of euro-zone manufacturing purchasing managers index for March at 56.6 was in line with expectations, at an eight-month low, according to Markit. UK manufacturing PMI at 55.1 was above an expected 54.7 reading, as reported by Markit.

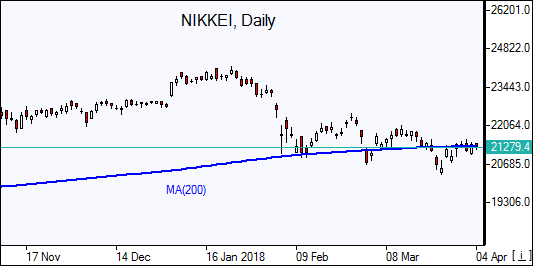

Asian markets mixed

Asian stocks are mixed today as US detailed $50 billion in tariffs against Chinese imports, targeting mostly industries China wants to develop. Nikkei rose 0.2% to 21329 with yen little changed against the dollar. Chinese stocks are falling as China’s ambassador to US vowed China will 'fight back' against US tariffs: the Shanghai Composite Index is down 0.2% and Hong Kong’s Hang Seng Index is 1.7% lower. Australia’s ASX All Ordinaries is up 0.2% with Australian dollar rising against the greenback as Australian retail sales rose in February.

Brent slides

Brent futures prices are edging lower today as traders expect US inventories rose last week. However the American Petroleum Institute late Tuesday report indicated US crude inventories fell by 3.3 million barrels last week. Prices rose yesterday: June Brent gained 0.7% to $68.12 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.