S&P 500, Dow and Nasdaq close at record highs

US stock indices ended at record highs on Monday as merger deals and tax overhaul hopes buoyed investor confidence. The dollar pulled back: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.2% to 94.722. S&P 500 closed 0.1% higher settling at record 2591.13 led by energy shares. The Dow Jones Industrial Average added 0.04% to close at all-time high 23548.42. The Nasdaq composite index rose 0.3% to record high 6786.44.

European stocks edge higher

European stock indices ended higher on Monday as positive economic data supported market sentiment. Both the euro and British Pound gained against the dollar. The Stoxx Europe 600 index ended 0.1% higher. The DAX 30 slipped less than 0.1% to 13468.79. France’s CAC 40 ended 0.2% lower while UK’s FTSE 100 added less than 0.1% to 7562.28. Indices opened 0.2%-0.4% higher today.

Reserve Bank of Australia keeps monetary policy steady

Asian stock indices are higher today tracking gains on Wall Street overnight. Nikkei closed 1.7% higher at 26-year high 22937.60 as yen resumed the slide against the dollar. Chinese stocks are rising: the Shanghai Composite Index is 0.8% higher and Hong Kong’s Hang Seng Index is up 1.2%. Australia’s ASX All Ordinaries is 1% higher led by mining stocks buoyed by rising commodity prices. Australian dollar is falling against the greenback as Australia’s central bank held rates at record low 1.5% for a 14th straight policy meeting, signaling it would maintain easy monetary policy stance for months to come amid stubbornly low inflation.

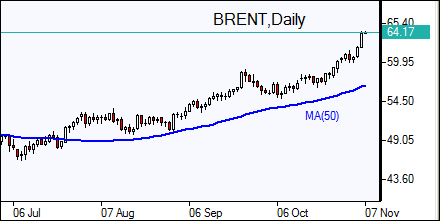

Oil rally intact

Oil futures prices are inching higher today. Prices surged Monday after officials and members of the royal family were detained in Saudi Arabia over the weekend. Tensions between Saudi Arabia and Iran also rose further as the Saudi Arabia-led military coalition fighting against the Houthi movement in Yemen said it was closing all Yemeni air, sea and land crossings. January Brent crude jumped 3.5% settling at $64.27 a barrel on Monday.