Fed minutes show support for June rate hike

US stocks ended higher on Wednesday erasing earlier losses after Fed minutes indicated support for June rate hike. TheS&P 500 rose 0.3% to 2733, with six of 11 main sectors finishing higher. The Dow Jones added 0.2% to 24886.81. NASDAQ Composite index gained 0.6% to 7425.96.The dollar strengthening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.4% to 93.927 but is lower currently. Stock indices futures point to mixed openings today.

Stock market reversed earlier losses after the May 1-2 Fed meeting minutes showed policy makers supported a gradual pace of interest rate increases and will likely not opt for more aggressive monetary tightening. Treasury yields declined after the Federal Reserve released the minutes. Economic news were positive: Markit’s manufacturing purchasing managers index for May inched up to 56.6 from 56.5 in April with the composite PMI rising to 55.7 from 54.6 as the services index gained also. And the drop in 1.5% new home sales fell in April to a 662,000 seasonally adjusted rate was smaller than expected.

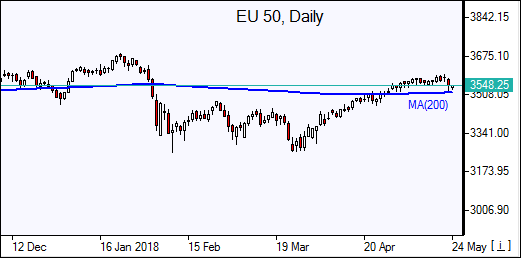

DAX drops the most among European indices

European stock indices retreated on Wednesday as investors’ risk appetite was undermined by weak data . The British Pound rejoined euro’s slide against the dollar but both are rebounding currently. The Stoxx Europe 600 lost 1.1%. Germany’s DAX 30 dropped 1.5% to 12976.84. France’s CAC 40 slumped 1.5% and UK’s FTSE 100 ended 1.1% lower at 7788.44. Markets opened mixed today.

Euro slide continued after report the composite flash purchasing managers index for the euro-zone declined from 55.1 in April to 54.1, an 18-month low, when no change was expected. The pound fell after UK inflation unexpectedly slowed to 2.4% in April from 2.5% in March. Reports the US may not extend the exemption for the European Union on steel and aluminum tariffs also weighed on market sentiment. The Trump administration had proposed cutting European Union’s steel exports to the US by 10%.

Asian indices mixed

Asian stock indices are mixed today after the US government launched a national security probe into car imports that could lead to new tariffs. Nikkei ended 1.1% lower at 22437.01 as yen slide against the dollar slowed. China’s stocks are lower as Trump on Wednesday called for “a different structure” in any trade deal with China, raising uncertainty over the negotiations: the Shanghai Composite Index is 0.4% lower while Hong Kong’s Hang Seng Index is up 0.4%. Australia’s ASX All Ordinaries is up 0.1% as Australian dollar turned higher against the greenback.

Brent slips after US crude stock build

Brent futures prices are retreating today after the US Energy Information Administration reported that domestic crude supplies jumped unexpectedly by 5.8 million barrels last week. Prices rose yesterday as July Brent crude added 0.3% to $79.80 a barrel on Wednesday.