Dow closes at new record high

US stocks resumed the rally on Tuesday on expectations of strong earnings season. The dollar weakening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 93.25. The S&P 500 added 0.2% settling at 2550.64 led by consumer staples stocks. Nine out of 11 main sectors finished higher. Dow Jones Industrial Average rose 0.3% closing at fresh all-time high 22830.68, led by 4.5% jump in Wal-Mart (NYSE:WMT) shares. The Nasdaq composite index gained 0.1% to 6587.25.

European stocks slip

European stocks closed marginally lower on Tuesday ahead of Catalonia President regional parliament speech. Both the euro and British Pound extended gains against the dollar. The Stoxx Europe 600 slipped 0.01%. German DAX 30 fell 0.2% closing at 12949.25 despite positive exports data. France’s CAC 40 closed less than 0.1% lower while UK’s FTSE 100 rose 0.4% to 7538.27. Markets are trading higher after opening today.

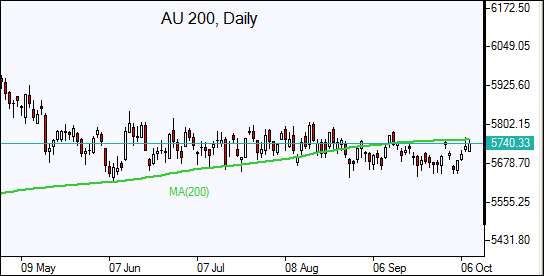

Asian markets rise

Asian stock indices are rising today following a strong lead from Wall Street overnight. Nikkei rose 0.3% to 20881.27 with yen little changed against the dollar. Chinese stocks are higher: the Shanghai Composite Index is 0.3% higher and Hong Kong’s Hang Seng Index is little changed. Australia’s All Ordinaries Index gained 0.6% as Australian dollar pared earlier gains against the greenback.

Oil advances

Oil futures prices are extending gains today on signs of rising demand as global economic growth improves and OPEC output cut deal helps rebalance the supply glut. The International Monetary Fund forecasted global economic growth would accelerate to 3.7% in 2018 from 3.6% this year. The American Petroleum Institute industry group will report later today US crude stocks. Prices rose yesterday on lower US oil output as nearly 59% of US Gulf of Mexico oil production remained offline on Tuesday. December Brent crude rose 1.5% to $56.61 a barrel at ICE Futures exchange in London on Tuesday.