European markets closed lower on Wednesday, amid concern over the violence in Iraq. Wall Street rose with the Dow and S&P 500 bouncing back after a two-day decline, as speculators wagered the economy is rebounding from its worst quarterly performance in five years. Asian equity markets rose on Thursday following gains on Wall Street overnight but escalating tensions in Iraq limited gains. The Hang Seng was up by 0.94% while Nikkei 225 was up by 0.32% and a CSI 300 was up by 0.51%. Hong Kong stocks rose, with the benchmark index heading for a two-week high, as casino shares advanced and companies climbed on earnings.

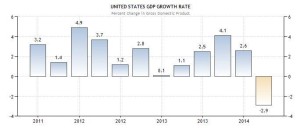

The Federal Reserve’s lower-for- longer interest rate stance is spurring stocks and bonds as volatility subsides. It’s also fueling inflation expectations that threaten to bring asset prices tumbling down. The U.S. economy contracted in the first quarter by the most since the depths of the last recession as consumer spending cooled. It turns out the slump in US growth was much worse than anticipated. Growth for the March quarter fell 2.9 per cent — the weakest growth outcome in about five years. This is a fairly sizable downward revision from the second estimate by the way, which initially showed a 1 per cent falls.

Driving the downward revision was weaker consumer spending, revised down to 1 per cent from 3.1 per cent — and exports. Markets largely ignored this release — largely but not entirely — as rates eased further. Equities instead focused on the view, which I think is the right one, that the dip in growth is temporary.

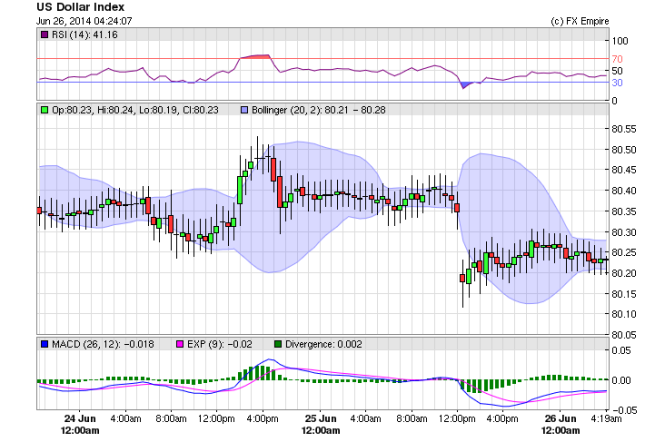

The US Dollar wasn’t as lucky as the equities markets as the greenback tumbled to trade at 80.23 tumbling from 80.39 before the data release, compounding the decline in GDP was also a lackluster print for durable goods orders which fell below expectations. The dollar slid 0.14 percent to a month low against a basket of major currencies after the weak U.S. gross domestic product and durable goods data signaled the likelihood of a continued dovish stance from the Federal Reserve. The weakness in the US dollar allowed the euro to climb to trade at 1.3631 and while the GBP traded on a 50 pips range it ended little changed at 1.6983. As for the Australian Dollar, its sits at 0.9406, about 45 pips higher than yesterday afternoon. The US dollar is buying around 101.86 Japanese Yen. Today traders will be closely monitoring a slew of US data ranging from weekly unemployment data to person spending.