Market Brief

Greece will walk into the negotiation room today (6 pm CEST in Brussels) knowing that it is its last chance to reach an agreement with its European creditors. Greece has a new finance minister, Euclid Tsakalotos, after Yanis Varoufakis was asked to resign by Alexis Tsipras with the purpose of showing goodwill regarding today’s key negotiations. However, Tsakalotos is not seen as pro-austerity, and it may be as difficult for EU finance ministers to negotiate with him as it was with Varoufakis. By declaring that “Greek people want a sustainable solution,” Greece’s new finance minister announced its line of negotiation and it seems that it is not much different from its predecessor. EUR/USD moved sideways in the Asian session as market participants patiently wait the outcome of the last-chance talks. Greek 10-year government bond yields rose to a 2.5-year high at 18.09%, while Italian and Spanish yields increased substantially at the short-end of the curve, with 2-year bond yields reaching 0.43% and 0.44% respectively.

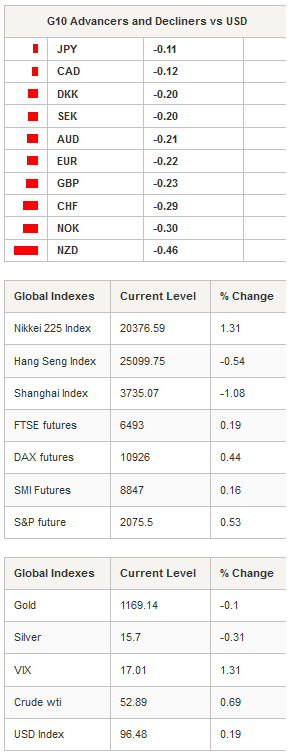

In the Asian session, equity markets are mixed this morning, with the Nikkei up 1.31%, the Kospi down -0.66%, the BGK up 0.35% and the Sensex up 0.23%. In China, the equity sell-off continues as the Shanghai Composite falls -1.08%, while its tech-heavy counterpart drops -5.35%, despite the PBoC’s move to try to restore investor confidence in the stock market. USD/JPY is treading water around 1.2260 and will find support around 121.45 and resistance around 124.45.

As expected, the Reserve Bank of Australia (RBA) maintained its cash target rate unchanged at record-low 2%, and reiterated its call for an accommodative monetary policy. AUD/USD swung widely on the news, but stabilised around its pre-announcement level of 0.7480. The Aussie lost more than 3% since July 1st, and we anticipate the Aussie falling further against the US dollar.

The US dollar is up against all G10 currencies this morning amid risk-off moods. Its recent strength has more to do with global mounting uncertainties than the soundness of the US economy. The yen edges lower by -0.11%, the loonie retreats -0.12%, while the biggest looser is the kiwi, which dropped -0.46% and the NOK down -0.30%. However, the release of the FOMC minutes from June 16-17 meeting due tomorrow will likely awake some sleepy traders. The dollar index is gaining upside momentum, and is currently testing the 96.56 resistance (Fib 50% on April May debasement). We expect currency market to stay focused on the Greek negotiations today, and to move sideways while awaiting fresh news.

Today, traders will be watching Norway’s May industrial production and Halifax house prices; UK’s May industrial and manufacturing production; Brazil’s inflation report; US trade balance and JOLTS job opening.

Today's Calendar Estimates Previous Country / GMT SZ Jun Foreign Currency Reserves 515.7B 517.5B CHF / 07:00 DE May Industrial Production MoM - -0.70% DKK / 07:00 SW Jun Budget Balance - 20.3B SEK / 07:30 SW May Household Consumption (MoM) - - SEK / 07:30 SW May Household Consumption (YoY) - - SEK / 07:30 SW April and May Household Consumption released on the same day. - - SEK / 07:30 NO May Industrial Production MoM - -4.90% NOK / 08:00 NO May Industrial Production WDA YoY - -3.40% NOK / 08:00 NO May Ind Prod Manufacturing MoM - -2.90% NOK / 08:00 NO May Ind Prod Manufacturing WDA YoY - 0.20% NOK / 08:00 UK May Industrial Production MoM -0.20% 0.40% GBP / 08:30 UK May Industrial Production YoY 1.60% 1.20% GBP / 08:30 UK May Manufacturing Production MoM 0.10% -0.40% GBP / 08:30 UK May Manufacturing Production YoY 1.80% 0.20% GBP / 08:30 IT Bank of Italy Report on Balance-Sheet Aggregates - - EUR / 09:00 SA Jun SACCI Business Confidence - 86.9 ZAR / 09:30 BZ Jun FGV Inflation IGP-DI MoM 0.70% 0.40% BRL / 11:00 BZ Jun FGV Inflation IGP-DI YoY 6.25% 4.83% BRL / 11:00 CA May Int'l Merchandise Trade -2.55B -2.97B CAD / 12:30 US May Trade Balance -$42.70B -$40.90B USD / 12:30 UK Jun NIESR GDP Estimate - 0.60% GBP / 14:00 US May JOLTS Job Openings 5300 5376 USD / 14:00 US Jul IBD/TIPP Economic Optimism 48.9 48.1 USD / 14:00 UK Jun Halifax House Prices MoM 0.30% -0.10% GBP / 22:00 UK Jun Halifax House Price 3Mths/Year 8.30% 8.60% GBP / 22:00 EC ECB Governing Member, BOF Governor Noyer Speaks at Conference - - EUR / 22:00

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.1023

S 1: 1.0955

S 2: 1.0819

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5558

S 1: 1.5488

S 2: 1.5171

USD/JPY

R 2: 125.86

R 1: 124.45

CURRENT: 122.70

S 1: 121.45

S 2: 120.64

USD/CHF

R 2: 0.9719

R 1: 0.9543

CURRENT: 0.9442

S 1: 0.9151

S 2: 0.9072