Friday January 26: Five things the markets are talking about

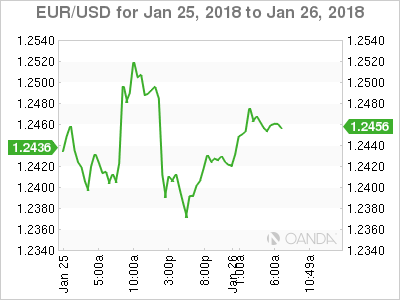

President Trump’s self-proclaimed ‘gift of gab’ temporarily gave aid to the struggling US dollar Thursday, just a day after his Treasury Secretary endorsed a "weak dollar."

His Davos “strong dollar” comments managed to temporarily jolt capital markets' reserve currency of choice out of a three-day tailspin.

The forex market has been jarred first by US Treasury Secretary Mnuchin’s unusual favoring Wednesday of a weaker greenback that’s good for trade and also by ECB President Draghi's comments post-ECB’s rate announcement Thursday, that the eurozone’s regional growth justified gains in the common currency.

Elsewhere, stocks are little changed after erasing earlier gains as investors assess the impact of the greenback’s gyrations. Corporate results had set the tone on most regional bourses.

Note: The dollar’s decline in recent months has partially been driven by brightening prospects for growth outside the US, which have bolstered investors’ expectations for ‘tighter’ monetary policy elsewhere.

With President Trump expected to deliver a keynote closing speech at Davos’ World Economic Forum later this morning, investors should be expecting further dollar volatility.

Note: President Trump is expected to address the Worlds Economic Forum at 8 am EDT.

1. Stocks under pressure from currency strength

In Japan, the Nikkei has closed out the week lower in choppy trade on Friday as investors locked in profits ahead of the weekend, while mining shares and financial firms underperformed the market. The Nikkei closed -0.2% down, wile the broader Topix slid -0.3%. For the week, the Nikkei declined 0.7 percent.

Note: Australia was closed for a bank holiday.

In Hong, the Hang Seng ended the week at a record high, capping its seventh consecutive week of gains, amid optimism toward global economic recovery and accelerated money inflows from China. At close of trade, the Hang Seng index was up +1.53%, while the Hang Seng China Enterprise (CEI) rose +2.51%.

In China, equities closed out at a high, but are off their two-year highs with the Shanghai up for the sixth-week in a row, supported by gains in real estate and transport firms. The Shanghai Composite index was up +0.3%, while the blue-chip Shanghai Shenzhen CSI 300 index was up +0.39%.

In Europe, regional indices trade higher across the board, rebounding from yesterday’s losses as positive earnings in Europe and the US has helped lift markets.

US stocks are set to open in the ‘black’ (+0.2%).

Indices: STOXX 600 +0.5% at 400.4, FTSE +0.4% at 7642, DAX +0.2% at 13322, CAC 40 +0.9% at 5531, IBEX 35 flat at 10595, FTSE MIB +0.3% at 23787, SMI +0.7% at 9551, S&P 500 Futures +0.2%

2. Oil firms as dollar falls further, gold higher

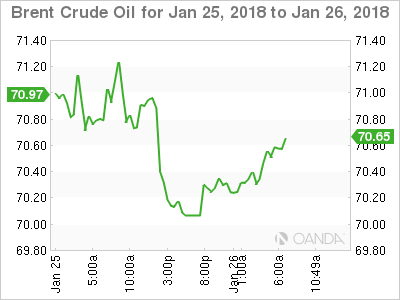

Ahead of the US open, Oil have reversed its earlier fall as ongoing weakness in the US dollar is seen as supporting fuel consumption.

Brent crude futures are at +$70.40 per barrel, down -3c from their last close, after dropping as low as +$70.07 in the Asian session. US West Texas Intermediate (WTI) crude futures are at +$65.52 a barrel, up +1c from their previous close, recovering from an overnight session-low of +$64.91 a barrel.

Casting a shadow over this weeks oil rally is the presence of growing output of US shale oil, as higher prices encourage more investment in expanding supplies.

Note: US crude oil production is expected to surpass +10m bpd next month, and on the way to a record ahead of previous forecasts according to the US government’s EIA.

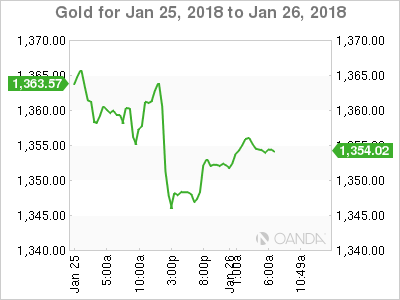

Gold prices have rallied to an 18-month high this week, buoyed as the US dollar hit three-year lows after "weaker" currency comments from US Treasury Secretary Mnuchin. Spot gold has rallied +0.3$ to +$1,350.86 per ounce. The yellow metal has gained +1.5% so far this week.

3. German Bund yields close out on a high

This morning, German bund yields have managed to gravitate away from their six-month lows and remain set for their sixth consecutive week of rises, a day after the ECB surprised markets by its modestly “dovish” tone in the face of a robust EUR.

President Draghi yesterday failed to live up to the market’s dovish expectations with his communication on the exchange rate falling short of expectations for a stronger stance ahead of the ECB meeting.

Germany’s 10-Year Bund yield has fallen -2 bps to +0.54%, after having hit a six-month high at +0.579% on Thursday after Draghi said eurozone inflation should rise in the medium term.

Note: Germany – a new round of negotiations for a coalition government has begun, which could contribute to added demand for safe haven assets.

Elsewhere, the yield on United States 10-Year Treasuries has fallen -3 bps to +2.62%, while in the UK the 10-Year Gilt yield has climbed +1 bps to +1.41%.

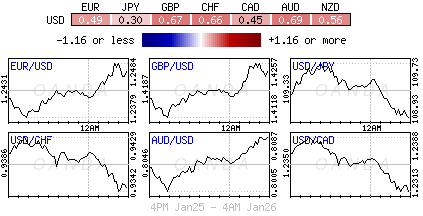

4. Dollar direction dictated by Trump's trade rants

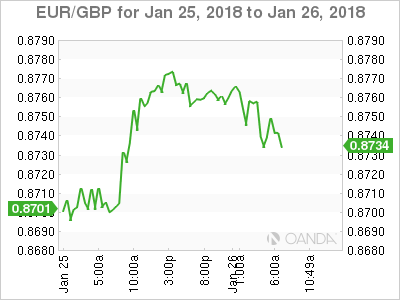

FX volatility is back in a big way, with verbal rhetoric and clarifications playing havoc with intraday ranges.

Currently, Trump’s induced dollar lift has only been temporary, as markets look beyond rhetoric to raw fundamentals.

Today, G7 currency pairs are expected to engage in wide intraday ranges with President Trump’s expected ‘protectionist’ speech in Davos.

The EUR/USD (€1.2458) is again encroaching on its three-year high just above the psychological €1.25 barrier. A level many felt overbought, especially after Presidents Draghi’s ‘dovish’ remarks.

GBP/USD (£1.42390 has received a lift following this morning’s better UK Q4 GDP data (see below). The pair tested £1.4270 after the release as expectations were skewed towards an under-shoot to the downside, rather than today’s upside surprise.

The BoJ’s Minutes release overnight of last month’s monetary policy meeting reiterated their stance that it was appropriate to continue ‘powerful’ monetary easing. Some members noted that they must “continue to look at both positive and negative effects of current policy, including effects on financial system.” Other data released, Japan’s December inflation data showed improvement towards beating deflation remains ongoing. USD/JPY remains below the ¥109 level as investor’s mull over the possibility of an announcement by the Bank of Japan (BoJ) in mid-2018.

5. U.K’s Q4 GDP beats expectations, but the annual pace is at a five-year low

Data this morning showed that the UK economy grew at the slowest pace in five-years, highlighting how uncertainty linked to its looming departure from the EU would suggest that the economy is benefiting from the recent upsurge in global growth.

The UK economy expanded +0.5% in Q3 of 2017, which translates to an annualized rate of +2.0%.

Note: It is its fastest quarterly rate of expansion in 2017, and beat market expectations – UK economy grew by +1.8% last year, the slowest rate of expansion in seven years.