President Donald J. Trump completed his first year in office on Jan 20. Since he took office, Trump has made a series of diplomatic decisions and proposed anti-trade policies. Also, the U.S. economy is witnessing exceptional growth and the stock market is firing on all cylinders.

The stock market has added $6.9 trillion in market cap since Trump was elected. This is nearly half of what the market grew by in all eight years of the Obama administration, per Bespoke. With this, the Russell 3000, which contains roughly 98.5% of the U.S. stock market cap, surpassed $30 trillion for the first time last week (read: U.S. ETFs in Focus as Market Cap Hits $30 trillion).

Meanwhile, the S&P 500 saw gains of nearly 24% in Trump's first year in office, much better than the 13% average of first-year performances since 1928. The Dow Jones surged more than 31%, representing the index's best performance during a president's first year since Roosevelt, when the index skyrocketed 96.5%.

The U.S. economy is expanding at the fastest clip in three years in best back-to-back quarters with at least 3% GDP growth and the expectation of same growth for the third consecutive quarter. This is especially true as economists in CNBC/Moody's Analytics Survey upped their median fourth-quarter GDP forecast by 0.4% to 3%. NatWest Markets raised fourth-quarter GDP to 3.5% from 2.7% while the Atlanta Fed GDPNow shows fourth-quarter growth of 3.3%, up from 2.8% earlier in the week.

The job market remains robust with the economy adding 2 million jobs in 2017 and unemployment at the lowest level of 4.1% since December 2000. Further, Americans are highly optimistic about the economy, with consumer confidence hovering near the highest level in 17 years. According to the Conference Board's index, consumer confidence hit 122.1 in December, slightly below the 17-year high of 128.6 set in November.

This combined with the optimism over the biggest tax overhaul in decades has raised the appeal for riskier assets. The massive $1.5 tax cut will save billions in the corporate world, boosting earnings and reflation trade. It would further spark a wave of share buybacks, dividend hikes and mergers & acquisitions. All these have been fueling a close to nine-year bull market (read: 10 Hottest ETF Themes for 2018).

Given this, we took a look at the winners and losers in the major areas of the market during Trump’s first year in office. Further, we have plotted each of these in the chart for a clearer view of their performance:

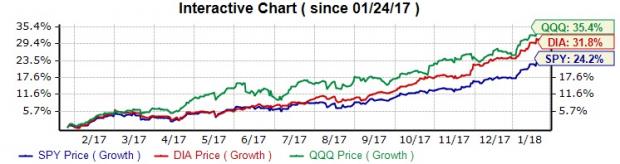

Broad Equity Market

Thanks to solid corporate earnings and improving global growth, the major indexes have hit a series of highs downplaying all the political ills including the latest government shutdown. Looking at Trump’s one-year performance, the SPDR S&P 500 ETF (AX:SPY) has risen about 24.2% and the SPDR Dow Jones Industrial Average ETF (V:DIA) is up about 31.8%. The PowerShares QQQ ETF QQQ, which tracks the Nasdaq 100 index, is the biggest winner with gains exceeding 35.4% in the past one year.

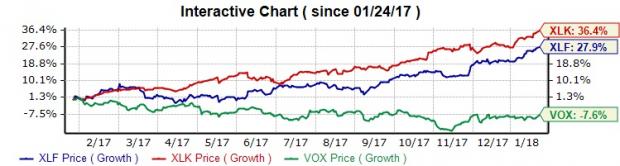

Sectors

More than half of the S&P 500 companies are up 20% or more since Trump’s inauguration and seven of the 11 S&P 500 sectors have generated double-digit returns with information technology and financials leading the way with 43.4% and 30% gains, respectively. SPDR Technology Select Sector SPDR Fund XLK and SPDR Financial Select Sector SPDR Fund XLF are up nearly 26.4% and 27.9%, respectively.

Telecommunication is the only worst performing sector, having lost 2.4% over the one-year period. Vanguard Telecommunication Services ETF (MU:VOX) , which offers exposure to companies that provide telephone, data-transmission, cellular, or wireless communication services, shed 7.6% in a year (read: 3 ETF Losers of 2017 That Can Rebound in Q1).

Bond & Gold

With three rate hikes in 2017, the Fed is on track for three lift-offs this year again with the probability of more aggressive hikes if tax reforms boost economic growth and reflation as expected. This has resulted in a rise of yields, dulling the attractiveness for both the Treasury bonds and gold. However, North Korea tension, Middle East tension, and political instability in Washington led to investors’ flight to safety. As such, iShares 20+ Year Treasury Bond ETF (V:TLT) tracking the long end of the yield curve has added 2.4% during the first year of Trump presidency while SPDR Gold Trust ETF (V:GLD) is up 9.9% (read: Prepare for Bond Bear Market With These ETFs).

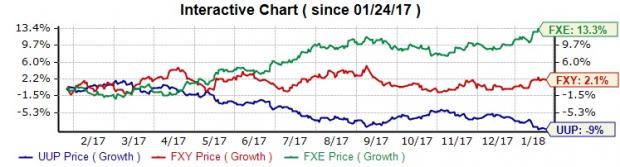

Currency

While the U.S. dollar had surged after the election in anticipation of strong economic growth and higher interest rates, the rally petered out after Trump’s inauguration amid weak economic data, geopolitical tensions, political turmoil in Washington and a dovish Fed outlook. The pain accelerated following the failure of the healthcare bill that has faded hopes in the implementation of Trump's pro-growth agenda. Additionally, rejuvenated economic growth in Europe and the prospect of an end to its cheap monetary policy era has dealt an additional blow to the greenback.

As such, the U.S. dollar suffered the first annual decline in five years, falling in double digits in 2017. PowerShares DB US Dollar Bullish Fund UUP, tracking the dollar index, shed 9% in a year (read: ETFs & Stocks to Buy on Falling Dollar).

Meanwhile, euro and Japanese yen have gained strength during this time period. Improving the European economy and the positive political development in the Euro zone pushed euro higher while yen has appreciated thanks to rising geopolitical concerns and a positive move on the Britain deal. Guggenheim CurrencyShares Japanese Yen Trust FXY is up 2.1% and Guggenheim CurrencyShares Euro Trust FXE is up 13.3%.

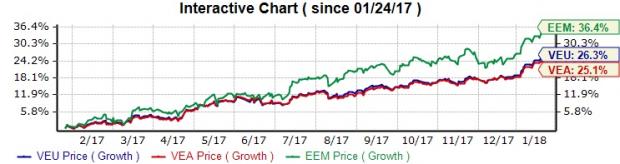

International Market Outperform

International markets outperformed during Trump’s first year in office as investors fled American equities on political instability in the United States, lofty valuation as well as the prospects to end the cheap monetary policy era. Additionally, a strong pickup in economic growth in many parts of the world added to the strength in the international bourses (read: International Markets Beat US in 2017: 3 Best Country ETFs).

Vanguard FTSE All-World ex-US ETF VEU targeting the international equity market has gained about 26.3% during one-year period. Vanguard FTSE Developed Markets ETF VEA, which holds a diversified group of stocks from developed markets excluding the United States, is up 25.1% while iShares MSCI Emerging Markets ETF (NYSE:EEM) EEM targeting emerging markets are up 36.4%, easily outpaced the gain of 24.2% for SPY (NYSE:SPY).

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

ISHARS-20+YTB (TLT): ETF Research Reports

SPDR-TECH SELS (XLK): ETF Research Reports

SPDR-DJ IND AVG (DIA): ETF Research Reports

CRYSHS-JAP YEN (FXY): ETF Research Reports

NASDAQ-100 SHRS (QQQ): ETF Research Reports

GOLD (LONDON P (GLD (NYSE:GLD)): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

CRYSHS-EURO TR (FXE): ETF Research Reports

VIPERS-TELE SVC (VOX): ETF Research Reports

VANGD-FTSE AWLD (VEU): ETF Research Reports

VANGD-FTSE DV M (VEA): ETF Research Reports

Original post