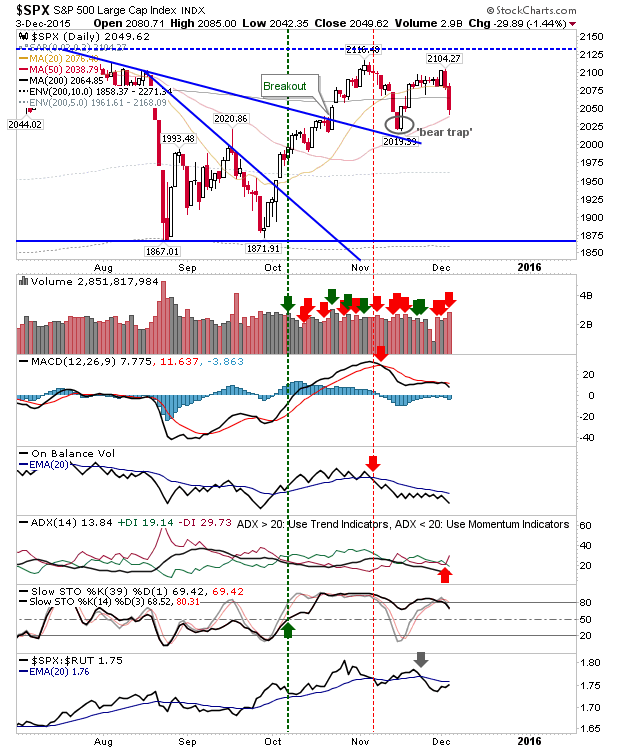

Santa was delivered a bit of a shock when sellers took Wednesday's declines and added to them. Losses were substantial - considering recent tight action - and came with confirmed distribution.

The S&P came back to its 50-day MA, which may offer bulls a chance to develop a higher swing low. However, further declines which break 2,019 will open up the play for a lower high, lower low and a new downward trend. So tomorrow will need buyers to step up off the open if Santa isn't to disappoint.

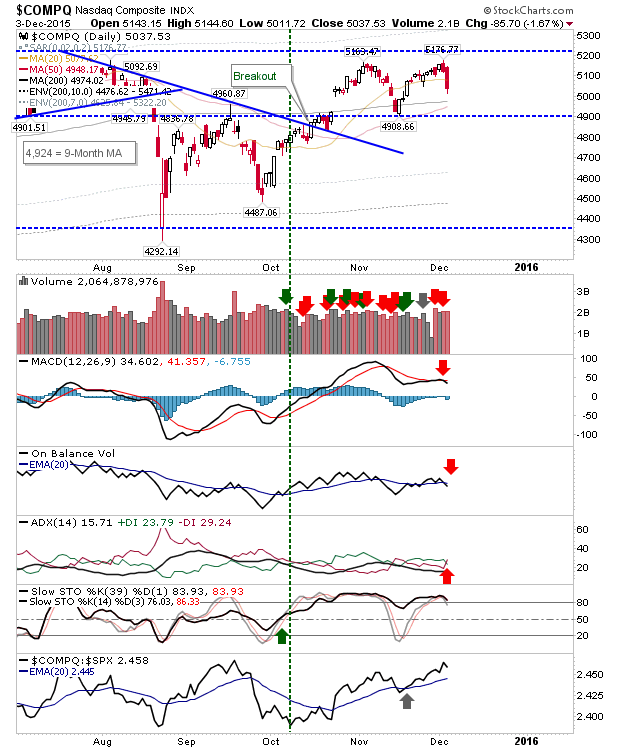

The Nasdaq is at risk of a double top with a 'sell' trigger in the MACD, +DI/-DI, and On-Balance-Volume. The 50-day MA is about to bull cross with the 200-day MA, which is what the action bulls should be looking for,

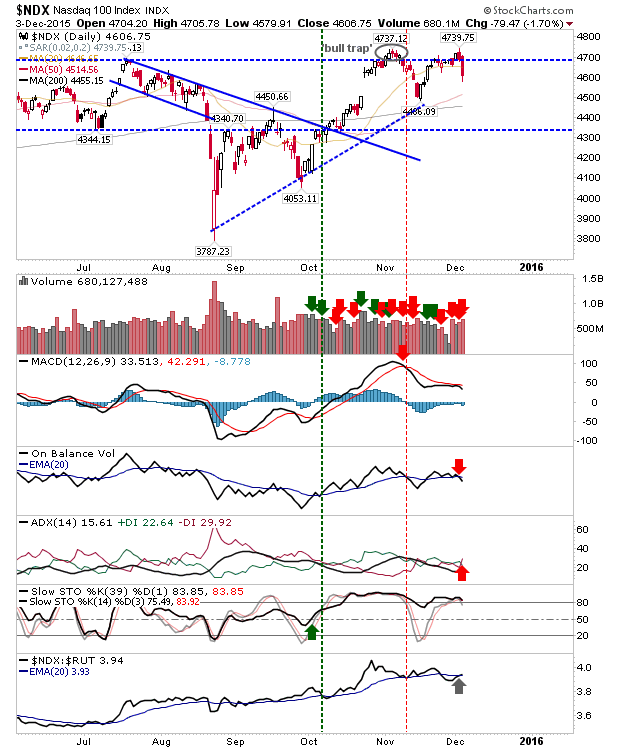

The Nasdaq 100 reversed from the 'bull trap' challenge, opening up the possibility for a double top. For this to be confirmed, a loss of 4,486 is required. Note, the 50-day MA at 5,415 will be tested first, and even a loss of 4,486 still leaves the 200-day MA at 4,455 as an opportunity for buyers to defend. Technicals saw a return of 'sell' triggers for both +DI/-DI and On-Balance-Volume.

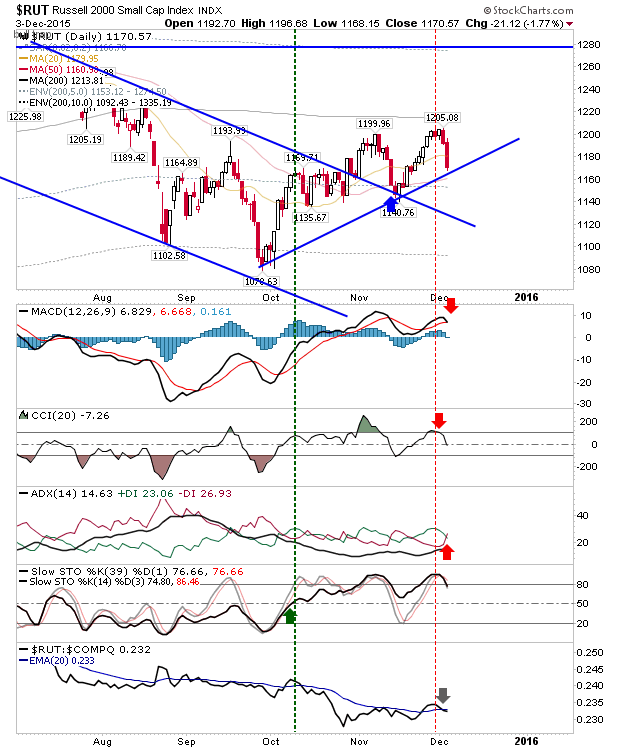

The Russell 2000 lost nearly 2%, but it will find itself testing the rising trendline tomorrow. It came with a MACD trigger 'sell' and +DI/-DI.

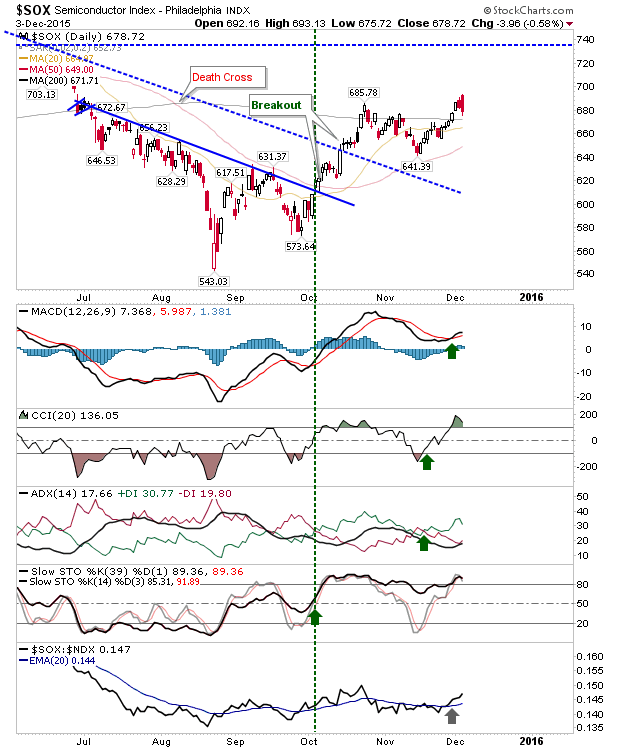

The Semiconductor Index experienced a bearish engulfing pattern but given technicals are bullish it's unlikely to play as a topping pattern.

Friday will now see how serious bulls are at buying the dip. Holding above the most recent swing low is critical for the Santa Rally, otherwise, markets are looking at a trading range to close out the year.