- High valuations suggest greater risks for US returns over the next decade

- Against this backdrop, diversifying into other stock markets may help investors achieve above-average returns

- Japan, India, and Brazil are currently good options due to their unique growth prospects and investment opportunities.

The US stock market, via the S&P 500, has returned an average of 7.2% adjusted by inflation and dividends over the last 30 years, which is pretty much in line with the 100-year 7.3% real average.

However, when we zoom in on the last decade, we notice that returns have started to move much faster. With inflation under control (until 2021) and a higher CAGR (Compounded Annual Growth Rate), the US benchmark index yielded around 9.5% above inflation over the last ten years — and that's taking into consideration last year's bear market and the inflation surge, which ate into a few of these returns.

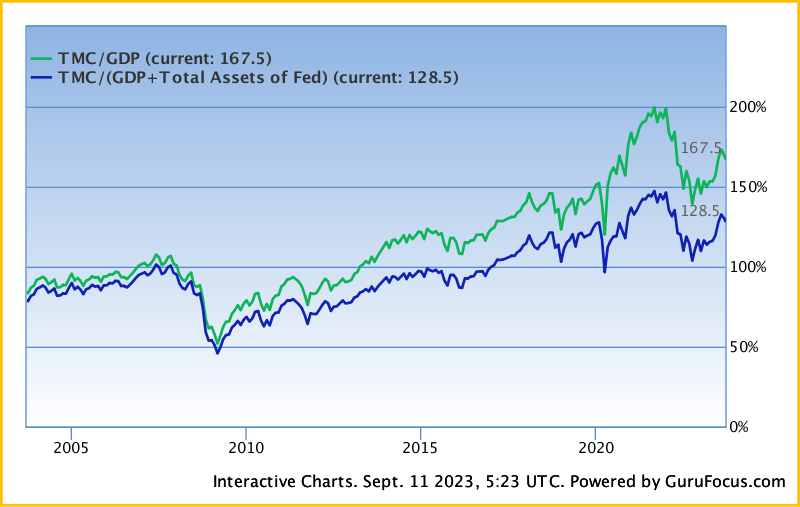

This has obviously led to stretched valuations, especially when we look at it from a historical perspective. For instance, the Buffett indicator — which measures the total market cap of the stock market against the country's GDP — is currently running at a high of 180%; a level only reached in 2020 and 2021 in the last decade.

According to the same Buffett indicator, this implies expected below-average annualized returns for the Wilshire Total Market Index in the decade ahead of only 1.2% yearly.

Looking at the "modern Buffett indicator" (which adds total Central Bank assets to the measure), US market valuations are looking a little better, with the indicator at 128%. Still, the expected yearly return sits at a meager 2.2% over the next ten years.

Source: GuruFocus

Does this mean I expect the US market to return between 1.2% and 2.2%/year over the next decade?

Absolutely not. With the US economy still leading the pack in global markets, non-stop technological developments, and a very resilient consumer force, I am still keeping the bulk of my investments in the US stock market.

However, the current macro backdrop implies higher risks than we have seen over the last few years, which must be acknowledged and dealt with when positioning our portfolios.

With either higher rates for longer or higher inflation eating into real returns, I expect total stock market yearly returns to be much lower than those from the last decade.

This, however, tells me two things:

- Stock-picking will be key to maintaining high returns over the next decade. For that, make sure to check out InvestingPro, the latest tool in the market for picking winners.

- Geographic diversification will be more critical than ever for those looking to position their portfolios for a high-growth decade, given that there are other stock markets presenting a much better growth perspective.

Both factors should be simultaneously taken into account by investors aiming to position their portfolios for a decade of above-average returns.

With that in mind, let's look at the top three stock markets to diversify into right now.

1. Japan

If there's one country that benefited from the global post-pandemic inflationary trend, that's Japan — the world's third-largest economy.

After decades of retraction on the back of a deflationary environment and bad demographics, Japan is finally witnessing what appears to be a structural rebound.

On the back of rising global pricing pressures, major Japanese corporations have recently agreed to the most significant wage hikes in three decades. This development has sparked optimism about a potential upswing in consumer spending as employees have more disposable income.

Meanwhile, the Bank of Japan has maintained its country's benchmark interest rate at historically low levels, even as other central banks around the world have opted to raise rates. This policy divergence has triggered a yen depreciation as investors seek higher returns elsewhere, rendering Japanese exports more appealing and competitive in international markets.

Furthermore, in June, Warren Buffett demonstrated his confidence in the Japanese market by increasing Berkshire Hathaway's (NYSE:BRKa) stake in five Japanese companies, namely Itochu (OTC:ITOCY), Marubeni (OTC:MARUY), Mitsubishi (TYO:8058), Sumitomo (OTC:SSUMY), and Mitsui Financial Group (NYSE:SMFG).

This comes as the Japanese market hit a low 5% share of the total global stock market capitalization, a level that once was a mighty 40% when the Nikkei peaked in 1989.

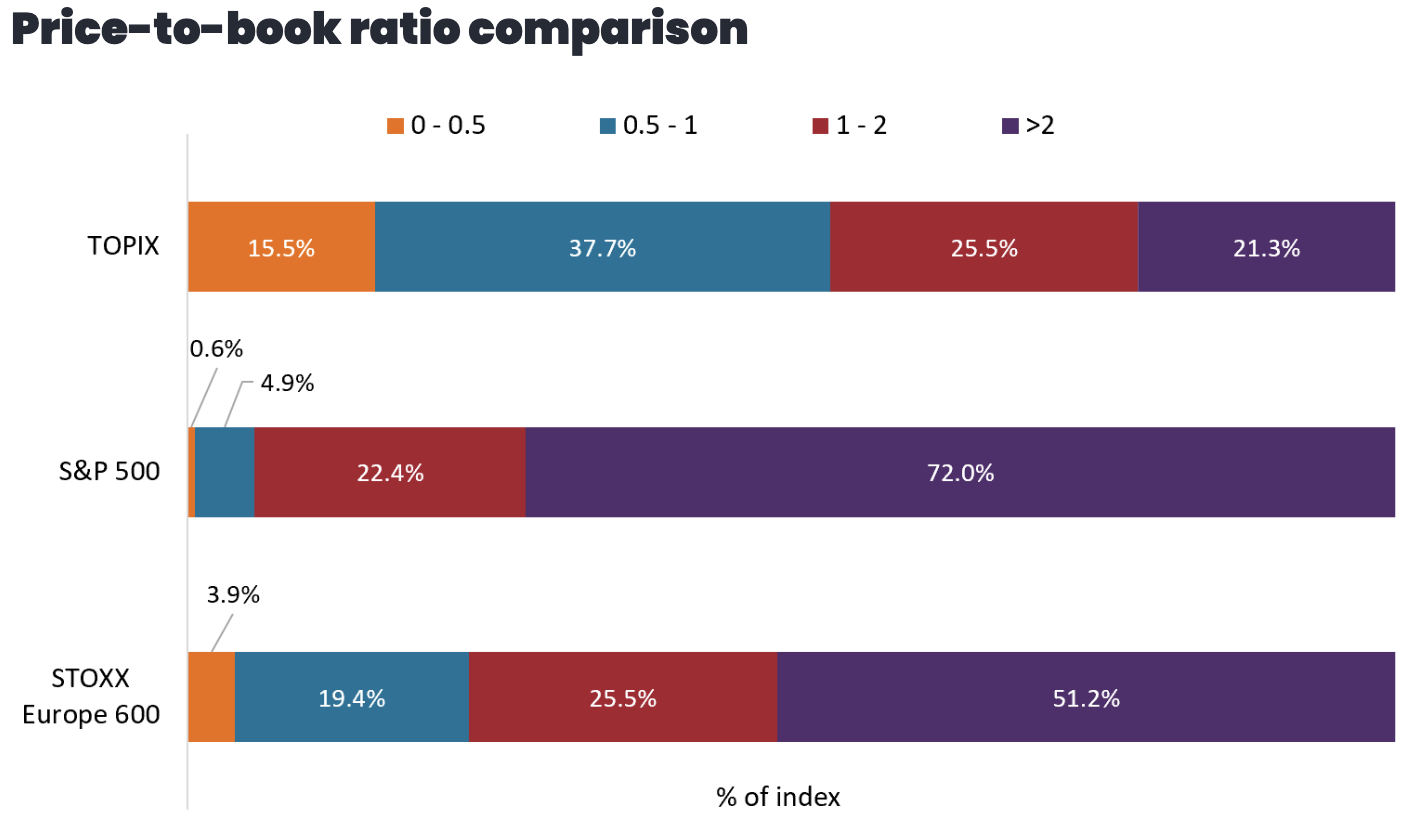

Now, as the Japanese benchmark index sits 20% away from its ATH of 38,95744 reached on December 29th, 1989, investors see renewed optimism on the back of the aforementioned macro trends and very low price-to-book levels in comparison to other markets (see below):

Source: JanusHenderson Research

*TOPIX stands for the Tokyo Stock Exchange

How to Invest in Japan?

Investors can take positions in several ETFs that track Japan's stock market performance. The top ones for US-based investors are:

- iShares MSCI Japan ETF (NYSE:EWJ)

- JPMorgan BetaBuilders Japan ETF (NYSE:BBJP)

- WisdomTree Japan Hedged Equity Fund (NYSE:DXJ)

- iShares MSCI Japan Value (NASDAQ:EWJV)

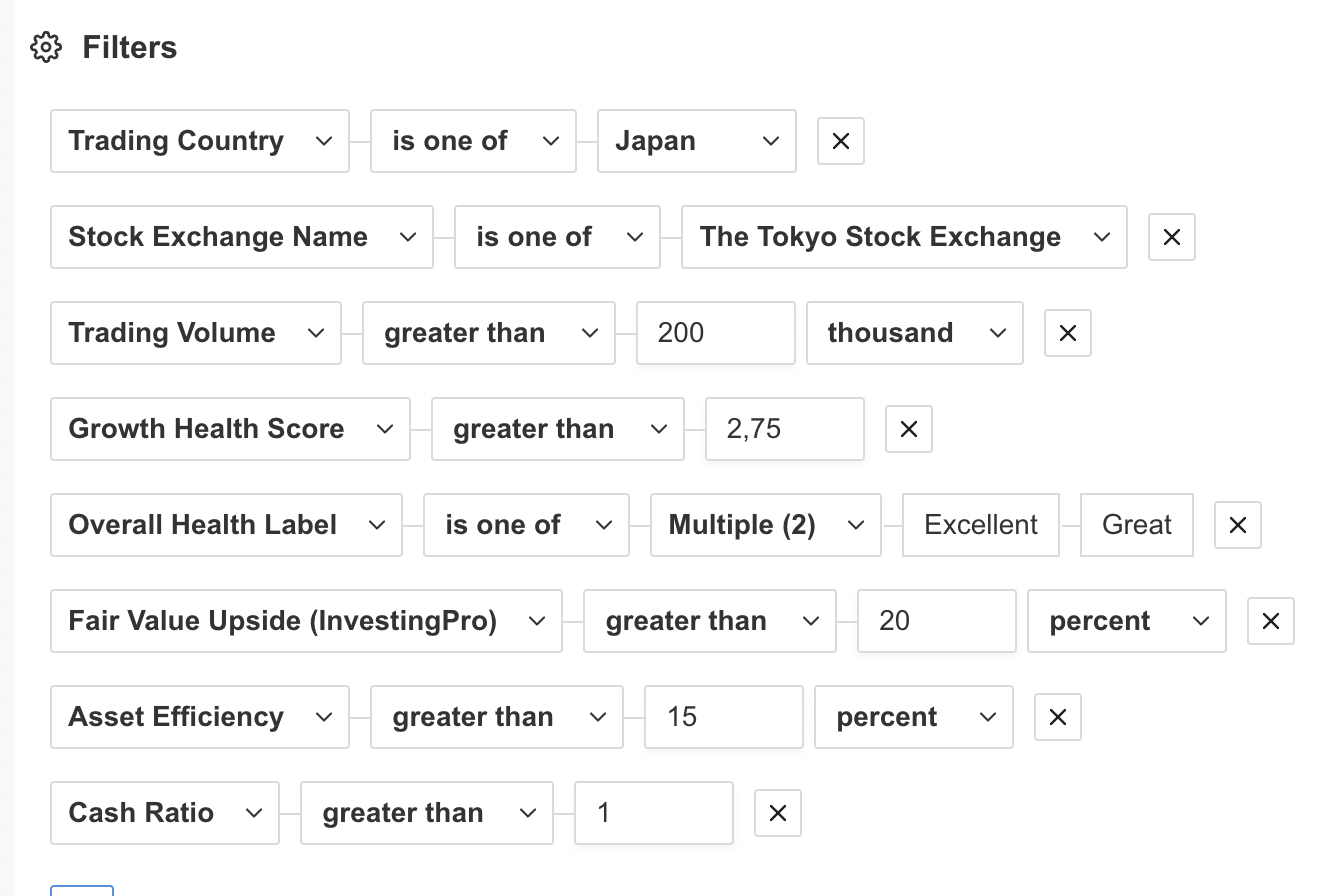

We also ran our InvestingPro scanner to find the best Japanese companies regarding their value-to-balance-sheet proposition. Using the following filters:

Source: InvestingPro

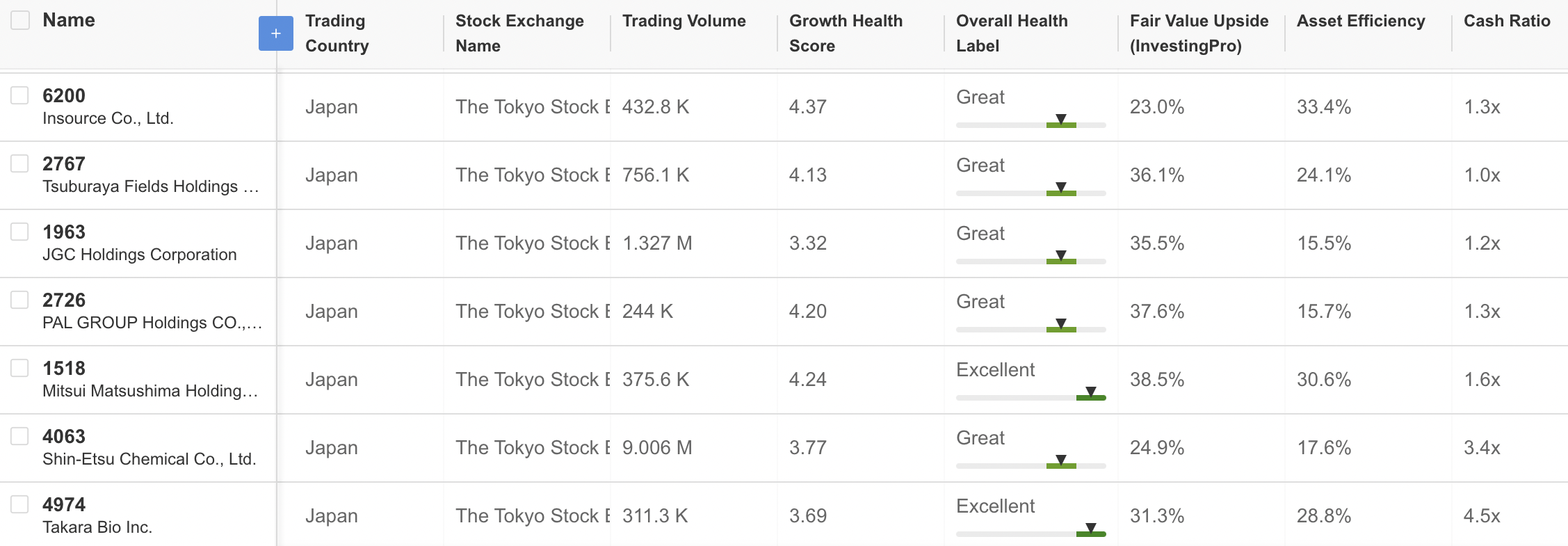

Here's our list:

Source: InvestingPro

2. India

After overtaking China for the title of the most populated country in the world earlier this year, the Indian economy appears poised to keep delivering above-average growth for the decade. Approximately 640 million individuals are projected to enter the middle-class segment over the next decade in the country alone — almost twice the size of the whole US.

With an educated, mainly English-speaking population aiming to leverage the country's economy on both the technology and industrial fronts, India appears poised to lead global growth in the next decade.

From a structural perspective, furthermore, India possesses several favorable elements that suggest an acceleration in manufacturing and an increase in income growth, which could give rise to a potent new generation of consumers within the nation. These are:

- Demographics: According to United Nations projections, by 2040, China's median age is expected to reach 48 years, whereas India's will only rise to 35, up from the current 28. Consequently, India's working-age population is anticipated to grow by nearly 100 million people in the coming decade, while China's is set to decline. Moreover, manufacturing wages in India currently stand at an annual salary of $2,000 for production workers, significantly lower than the $14,000 in China.

- Geopolitics: Recent visits by Prime Minister Modi to the United States and France have underscored the close ties between India and Western nations. This may be attractive to multinational corporations seeking to diversify their production beyond China, particularly in the technology sector. In line with the "friendshoring" trend, India has reduced corporate taxes for new manufacturing endeavors to 17%, aligning with the lowest rates in Asia.

- Reforms: Improvements in infrastructure and the business environment, along with digitalization, have made India more investor-friendly in the last few years. Challenges remain due to policy discrepancies between federal and state governments.

The headwind for investing in India comes from the valuation side. In fact, the Indian stock market outperformed major global markets over the last decade, with the Nifty 50 yielding an annualized return of 10.9% during this period.

That has made the country's average forward price-to-earnings ratio one of 22x, which is above the average. However, this could be somewhat mitigated in the long term by expectations of robust earnings growth.

Still, truth be told, successful investment in India will likely require active management, with areas of substantial growth anticipated in consumer goods, financial services, business process outsourcing, and technology support sectors.

How to Invest in India?

Investors can take positions in several ETFs that track India's stock market performance. The top ones for US-based investors are:

- First Trust India NIFTY 50 Equal Weight ETF (NASDAQ:NFTY)

- iShares MSCI India ETF (NYSE:INDA)

- WisdomTree India Earnings Fund (NYSE:EPI)

- iShares India 50 ETF (NASDAQ:INDY)

- Invesco India ETF (NYSE:PIN)

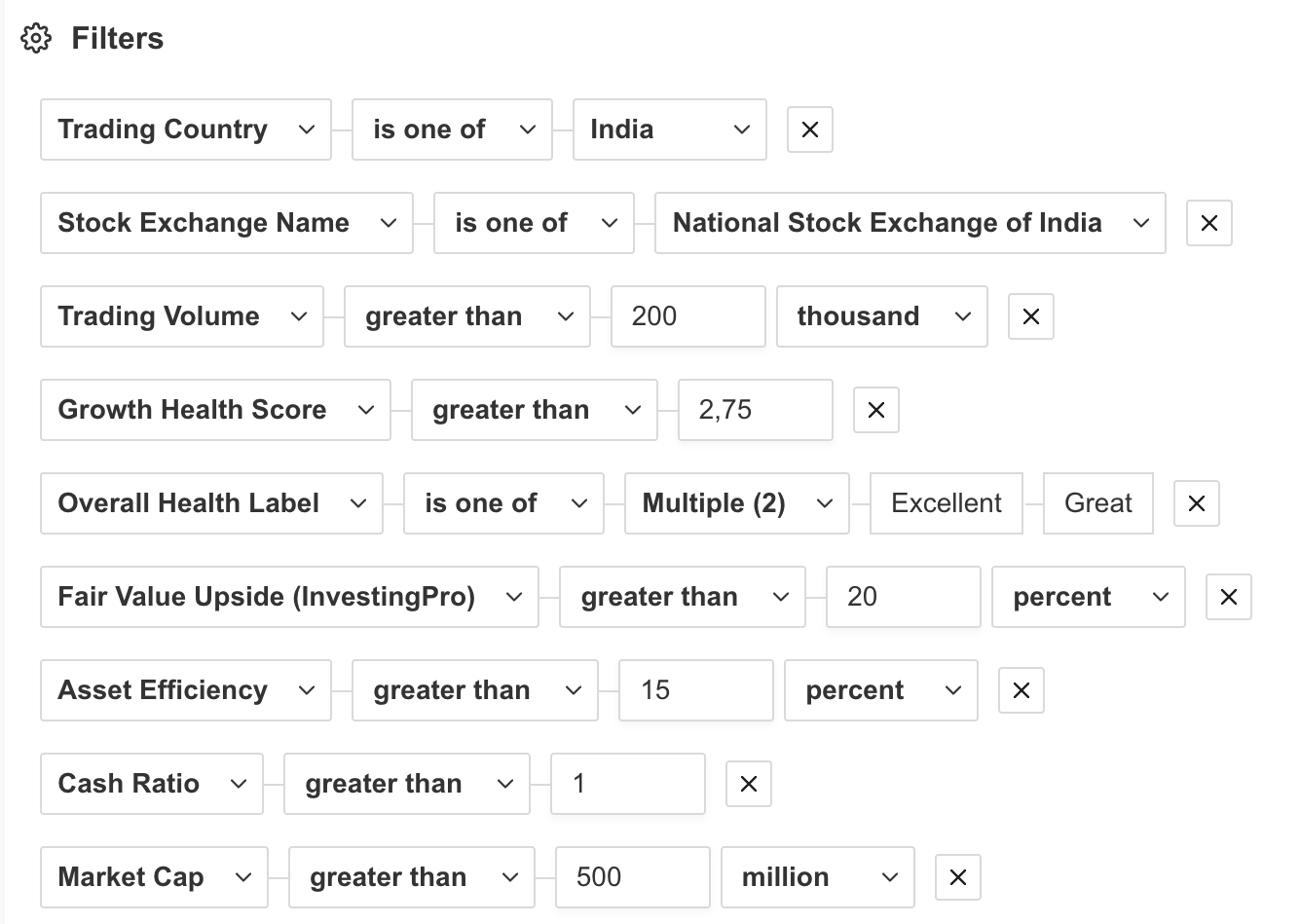

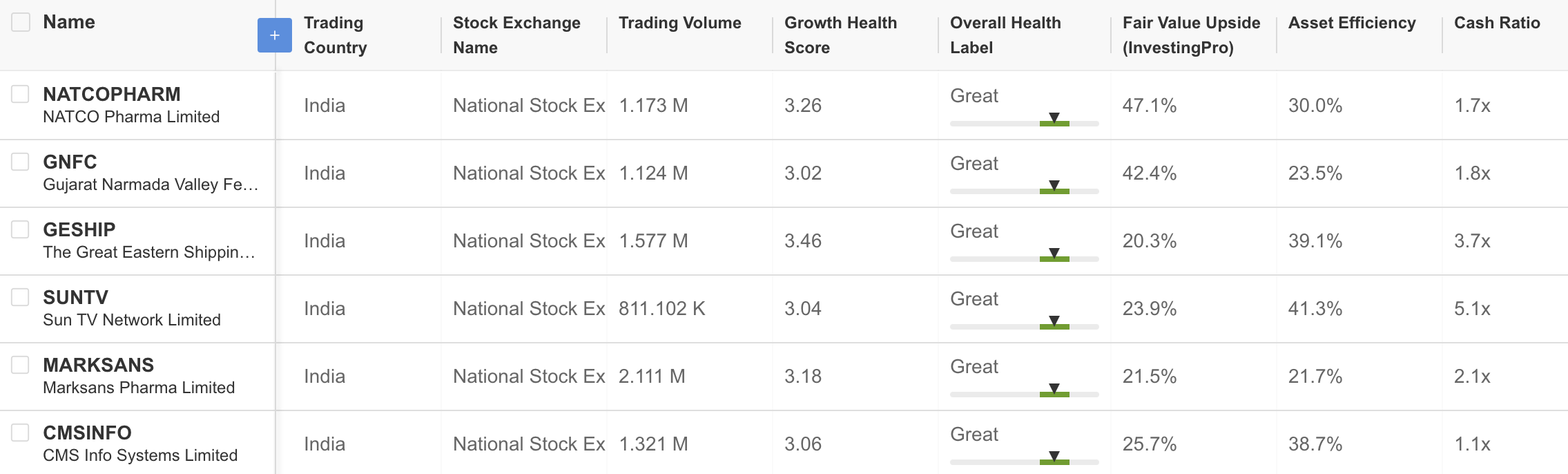

We also ran our InvestingPro scanner to find the best Indian companies regarding their value-to-balance-sheet proposition. Using the following filters:

Source: InvestingPro

Here's our list:

Source: InvestingPro

3. Brazil

One of the first major economies in the world to start raising interest rates in 2021, Brazil is now one the first to begin pivoting lower. Last month, the South American country's Central Bank cut interest rates by 0.5% —more than expected by the market — and is likely to keep the cycle at its next meeting on September 20th, as inflation remains apparently under control.

In fact, this is a market that historically yields positive returns after rate cuts. Data from the Brazilian bank Itau shows that the benchmark Ibovepa has performed on average as follows after the beginning of an interest-cut cycle:

- 1 Month: +2.5%

- 3 Months: +5.5%

- 6 Months: +12.6%

- 1 Year: +21.2%

Moreover, the country's stock market benefits from higher commodity prices, especially in the food and energy categories, as it cements its position as one of the world's breadbasket regions and alternatives to the prolonged war in Ukraine. As a matter of fact, Brazil has just overtaken the US as the world's largest corn producer-- a title it already holds for live cattle, coffee, and soy.

Despite the positive structural trends, mounting governmental debt, excessive government spending, and high political risks have dampened the country's growth over the last decade.

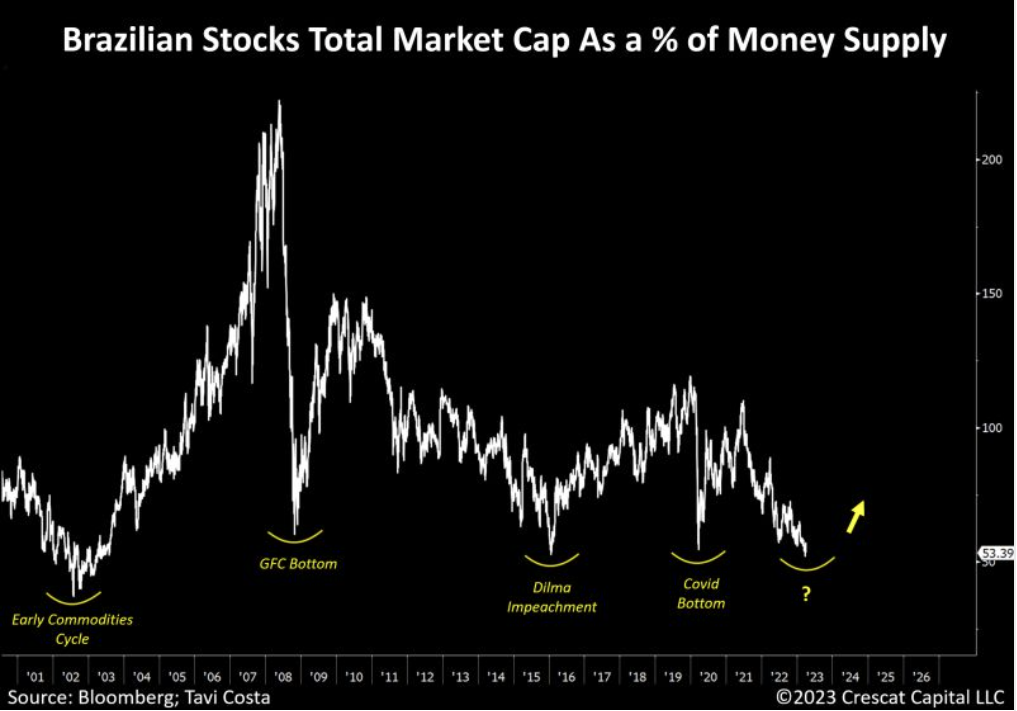

As a result, the Brazilian stock market is at historically low levels, which in the past have resulted in above-average returns. Now, as the country appears to move toward more sound governmental spending, opportunities for foreign investors appear to be on the rise.

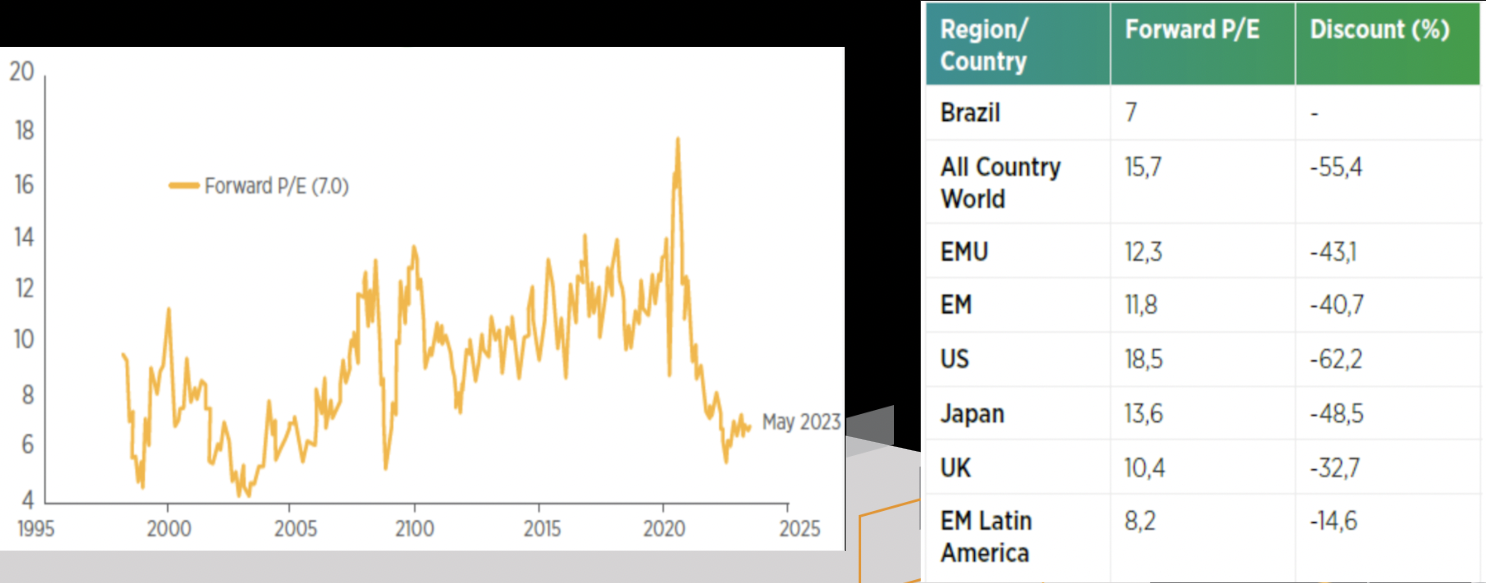

The future P/E ratio of the country's benchmark Ibovespa is significantly below the global average:

Source: Webinar Presented by Myself at Investing.com Brazil in July

The total market cap of Brazilian stocks is currently half of the country's money supply and 35% of the GDP, compared to 216% and 180% in the US.

Source: Tavi Costa

Total return relative to the S&P 500 currently sits at levels similar to Brazil's last bull run in 2003.

Source: Tavi Costa

But does all of this mean you can simply buy the Brazilian index and wait?

No! There are still plenty of risks in place for the South American giant, such as:

- We don't know the extent of the interest rate cut cycle

- Real interest rates are likely to remain high

- Currency depreciation risks

- Has inflation truly peaked?

- Political and fiscal risks.

- Corporate debt levels remain elevated.

Still, I believe that there are several very attractive opportunities out there for those who can find the right stocks in the market.

How to Invest in Brazil?

Investors can take positions in several ETFs that track Brazil's stock market performance. The top ones for US-based investors are:

- iShares MSCI Brazil ETF (NYSE:EWZ)

- ProShares UltraShort MSCI Brazil Capped (NYSE:BZQ)

- iShares MSCI Brazil Small-Cap ETF (NASDAQ:EWZS)

- Direxion Daily MSCI Brazil Bull 2X Shares (NYSE:BRZU) (for those looking for greater risk exposure)

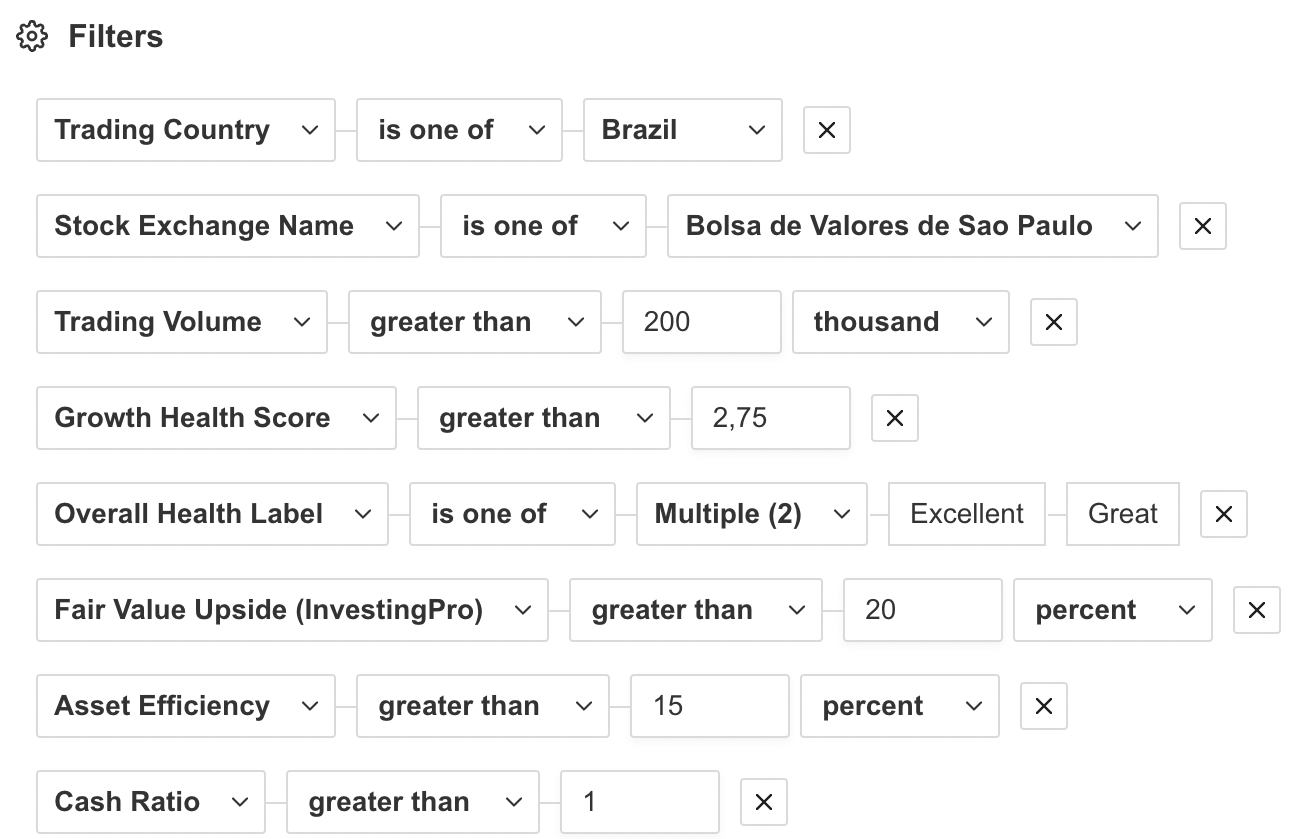

We also ran our InvestingPro scanner to find the best Brazilian companies regarding their value-to-balance-sheet proposition. Using the following filters:

Source: InvestingPro

Here's our list:

Source: InvestingPro

Bottom Line

While the US should remain the most important part of your portfolio, it's important to acknowledge the heightened macroeconomic risks in the mid-term horizon. By strategically incorporating stock-picking and geographic diversification, investors can position their portfolios for above-average returns in the coming decade.

Considering the current environment of stretched valuations and the anticipation of lower returns in the US market, diversifying into other markets such as Japan, India, and Brazil offers an appealing opportunity.

A healthy amount of diversification is key. You are not Warren Buffett — and even he is diversifying into Japan.

***

Disclosure: The author currently holds stocks in the US and in Brazil.