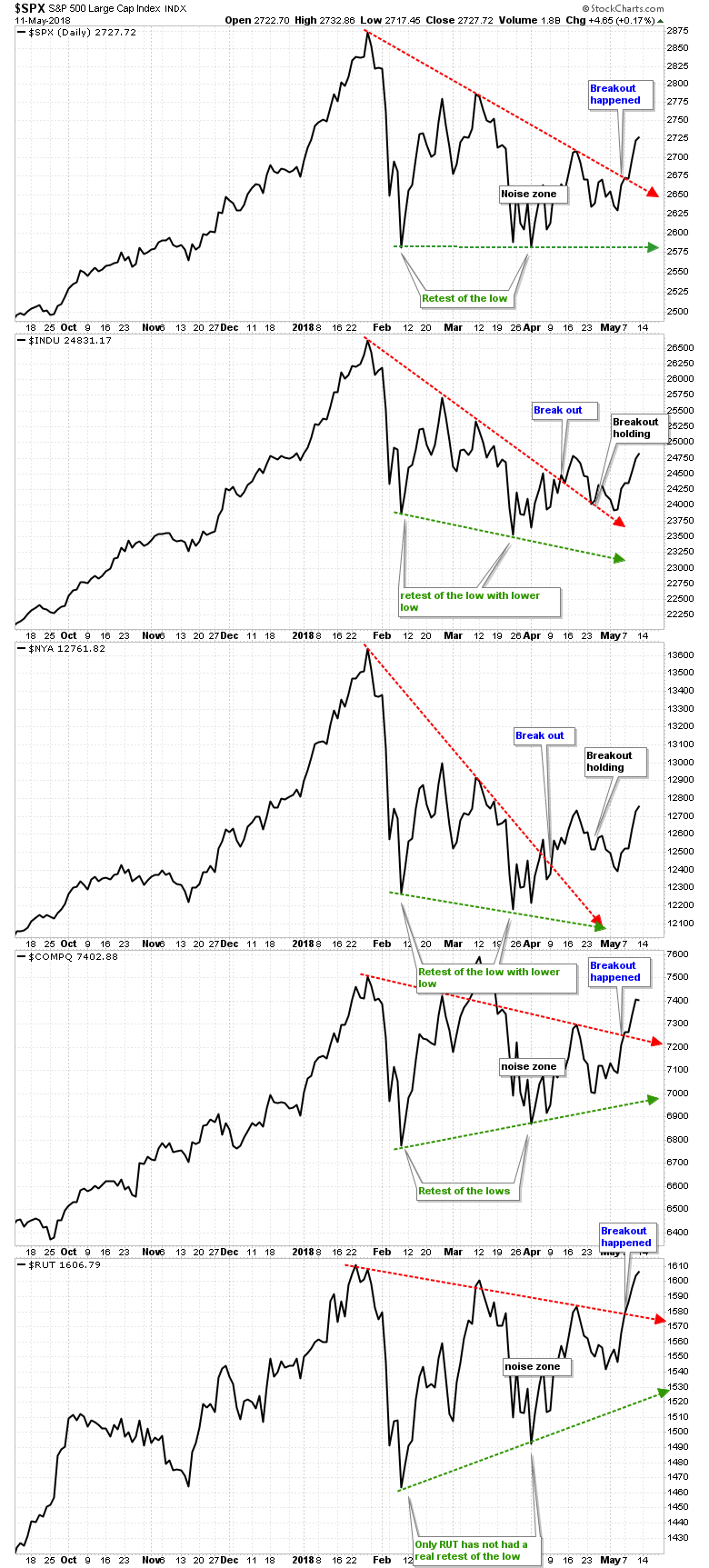

After my prior update, this will be my last update on the state of the major US stock-market indices – S&P 500, NASDAQ, DJI, NYSE, and the Russell 2000) as strike three came this week. Why strike three? Because all 5 indices have broken out above trend-line resistance in place since the January all-time high (ATH) market top: see Figure 1.

- All five major US indices have now broken out of the triangle patterns based on closing prices only. Closing price charts are more consistent and reliable charts compared to say candle sticks, as intra-day spikes, aka wigs, add a lot of scribbles/noise whereas closing price is all that matters in the end.

- All indices are thus outside their respective “noise zones” and the breakout has been confirmed by several more upside days. A breakout day followed by a reversal back inside would be bearish. This is not the case now.

- All indices are now firmly above their mid-April highs, which is Bullish as well, and the Russell very close to making a new ATH.

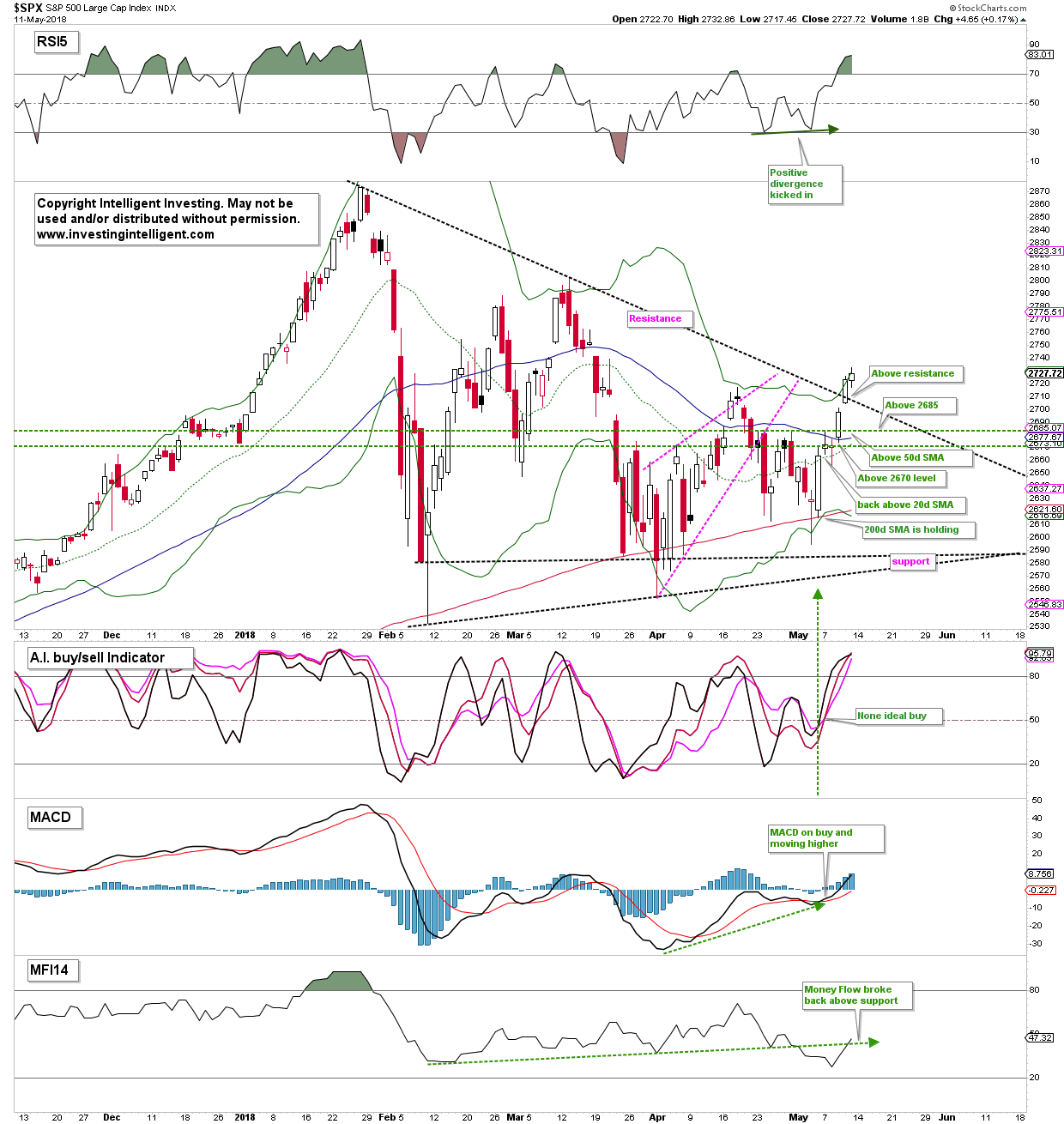

If we zoom in on the daily chart of the S&P 500 we see a lot of good things have happened over the last week, which are summarized in the chart, not to forget the breakout above the "wig-based" (dotted black) trendline. These are all Bullish developments, without 0 bearish developments. Thus, the daily chart also adds weight to the evidence that the Bullish Elliot Wave Theory (EWT) count is most likely: major-4 low is in. Major-5 to new ATHs (~SPX 3000) underway.

Though knowing which EWT count is most likely very helpful, one doesn't necessarily need to know what the real and exact wave count the market is in – as often the operable EWT count is not revealed until much later by the market – to be able to trade the market succesfully. System-based trading lets you trade regardless of all that as all it follows is price and trends. It will give an entry and exit signal, which is all that needs to be acted upon. Takes all the guessing out of the game. Elliot Wave and Technical Analysis can be great help for trading to assess if a buy trigger will be a sustainable trade/trend or not. Often it is.