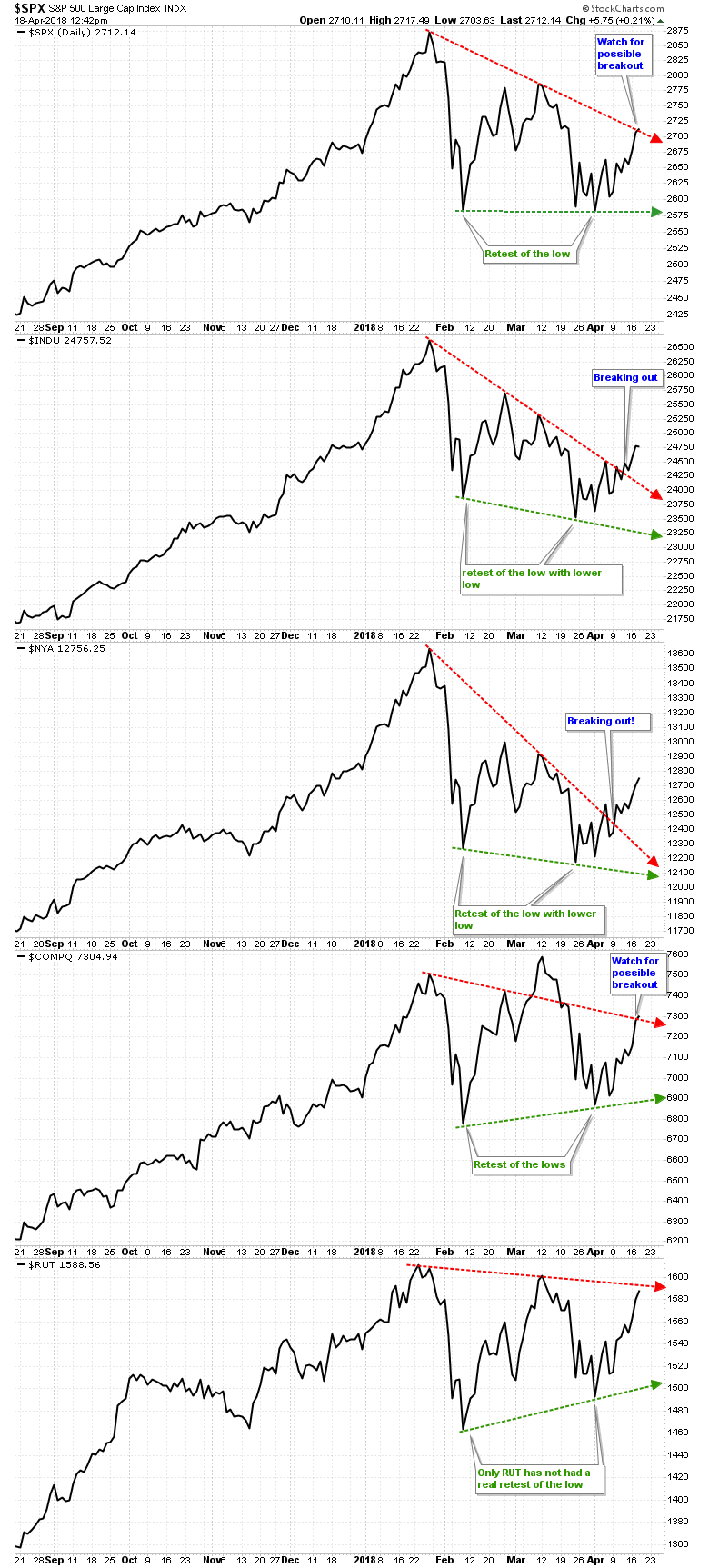

Often simple is best. And when we want to assess and understand how the major US indices are doing, a simple line chart with the two key trend lines will do. Below I've plotted the line charts of S&P 500, DJIA, NYSE, NASDAQ and Russell 2000, which I shared with my Premium Members yesterday. These indices cover the broad markets to tech to small cap and line charts are based on closing prices only, thus taking all the intra-day noise away; nice, clean, simple and easy to understand

Technical Lines In The Sand

Two lines are distinct and easy to spot: the red lines capture the price declines from the all-time highs (ATHs) and the green lines capture the retest – either higher or lower – of the low made in early February this year. These are, therefore, the defining Bull-Bear lines in the sand: over the red line and price is breaking out; below the green line and price is breaking down. In between the two and price is essentially moving sideways.

So what do we see? Price has broken out on the DJIA and NYSE and is trying to break out on the S&P and NAS. The RUT has a little more work to do but is getting close. Given that 2 of the 5 major indices have already broken out and 2 others are working on it, we can expect the RUT to follow suit.

Bears want to see a 2nd retest of the February low, but the market hardly ever revisits an important low twice. It's not impossible, but much less likely to happen. What is much more likely, based on these charts, is that price will continue to move higher over the days and weeks to come – within the markets natural ebb and flow – as it is breaking out. Those are the facts at hand. Wishful thinking doesn't make markets, but it cand and will generate poor trading results.

Bottom Line

These Breakouts Are Bullish, Not Bearish

Good charting and trading!

Arnout aka Soul