Why the U.S. dollar still reigns supreme

This post was written exclusively for Investing.com

The S&P 500 has just completed its best first quarter run since 1998, up more than 13%, and there may be more gains to come. Recession fears are quickly fading as economic indicators continue to improve. It's not just the U.S. equity market that is on fire—global markets have also risen sharply.

The possibility of the S&P 500 crossing 3,000 is no longer a distant mirage, but has become a fast-approaching probability. And it may not be long before whispers of the S&P 500 rising to nearly 3,200 start buzzing through the air.

A Return to The Fundamentals

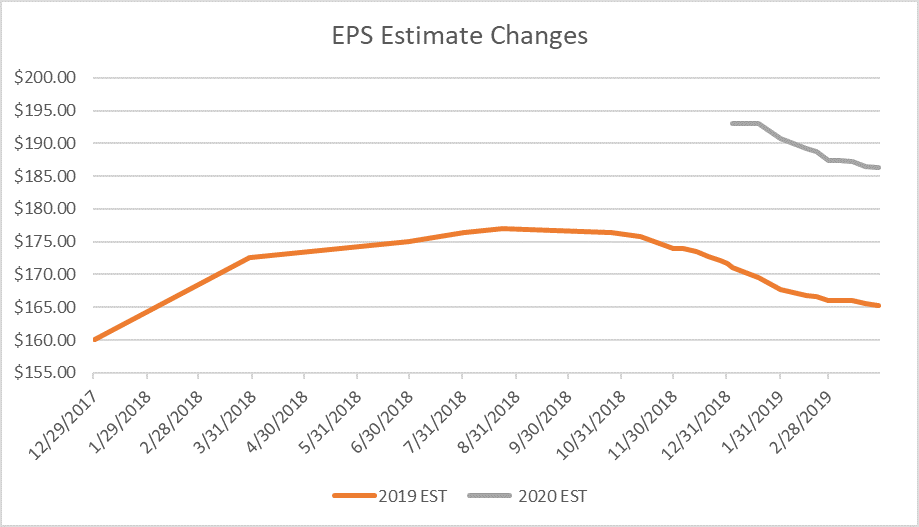

Despite all the worries, stocks always return to the fundamentals of earnings and growth. As of now, earnings growth in 2019 looks pretty healthy, and the outlook for 2020 looks even better. According to data from S&P Dow Jones Indices, earnings in 2019 are expected to climb by about 9% to over $165 per share and almost 13% to over $186 per share in 2020. It leaves the S&P 500 trading at approximately 15.5 times 2020 earnings estimates, which is pretty low for an earnings multiple based on the historical average.

Since 1988 the S&P 500 has traded on average at roughly 17 to 18 times one year forward earnings. Should the S&P 500 revert to that average throughout 2019, it could result in the index rising to around 3,260. Of course, that is only if those earnings estimates do not fall, which is precisely what they have done: from the beginning of 2019 earnings estimates for next year have dropped about 3.5% from around $193. Additionally, earnings estimates for 2019 have dropped even more, about 7% from their peak in August of roughly $177.

Should that trend continue, then the market may have much less height to climb. However, there are plenty of signs to suggest that economies around the globe have shifted from slowing growth to expectations of faster expansion, which is also an indication that earnings estimates should stabilize.

Improving Economies

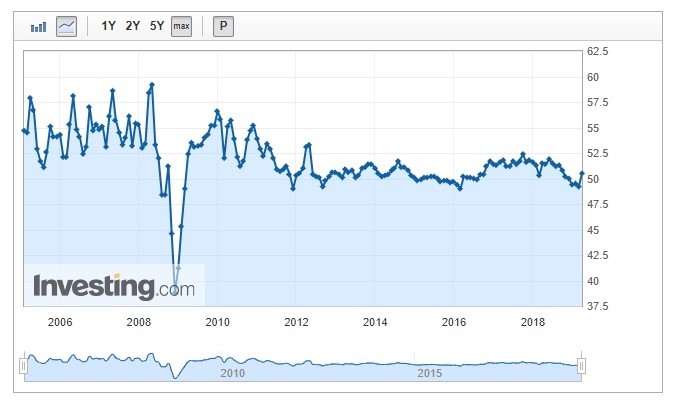

The past week offered several surprises in PMI releases from across the world, boosting hopes that growth may have restarted. China’s manufacturing PMI in March showed expansion rising to 50.5, above February’s reading of 49.2. Then there was the U.S. ISM manufacturing PMI that came in at 55.3 which was better than February’s reading of 54.2. All signs of a manufacturing sector that is expanding in the world’s two biggest economies. Then there was a report from the Atlanta Federal Reserve that points to first quarter GDP growing in the U.S. at a pace of 2.1%, far from recessionary levels.

Additionally, critical economic barometers such as copper and semiconductors are all suggesting that the economy is anything but slowing. Copper prices collapsed in July 2018, but since bottoming in late December the metal used in power and construction has risen by over 15%. Additionally, the Semiconductor sector, as measured by the Philadelphia Semiconductor Index (SOX) topped out in March 2018, but like copper, the index has risen nearly 40% since December and is now at a new all-time high. Two different measures, but two critical indicators in a modern global economy.

Even more critical are the giant gains seen in the global stock markets. China’s Shanghai Composite has risen nearly 32% from its January lows. Additionally, the German DAX has rebounded by over 16%, and the South Korean KOSPI has jumped by 11%. All three stock markets are in countries that have big export economies. It would suggest that investors are seeing global demand for those countries' key exports returning.

A Bullish Outlook

Overall, it seems hard to dispute that stock markets from around the world are sending a loud message that the worst of the global slowdown is over. Factor in an improving outlook for essential commodities and better economic data, and it would suggest that the S&P 500 is likely cheap at current levels. It paints a very bullish picture for the balance of 2019, and why the S&P 500 rising to 3,200 is now looking well within reach.

Disclaimer: Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.