We head into the new week with increasing focus from market participants around a number of red flags that suggest an elevated prospect of a tactical pullback in risk assets.

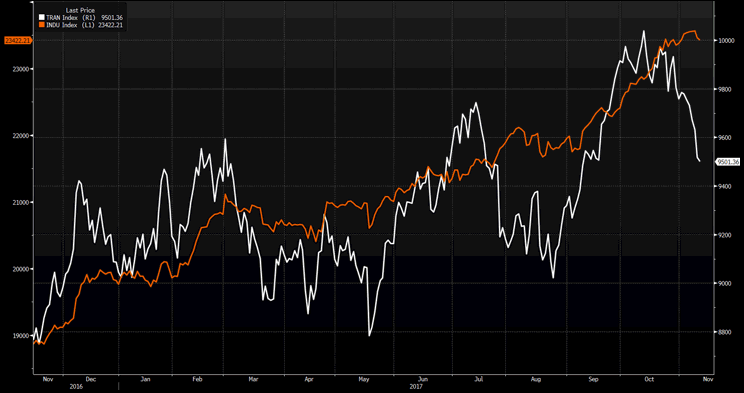

I have focused on a few of these throughout last week, although it is worth highlighting that the market couldn’t build on these to any great degree on Friday and we see the Russell 2000 (your leading indicator for all things US tax reform) closing unchanged, while the US high yield corporate credit widened a mere one basis point. High yield spreads have widened 34bp since the October low and some feel the equity market needs to play catch up here, so watch all things credit this week (retail traders are watching the iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) ETF). Also, the Dow Transport index, while it did extend the run of consecutive losses to straight seven days, has only closed down 0.2% on Friday.

S&P 500 (inverted) – orange vs US high yield credit – white

As mentioned last week, breadth has also been a big issue, with the percentage of companies above their 20- and 50-day moving average falling away to 62% and 53%, despite the market holding new all-time highs. The crux of the matter here is if support for this concentrated group of large market cap stocks gives way then the broader equity index will naturally face a sizeable headwind. Aside from the assessment of market breadth and the other mentioned leading indicators of broader risk sentiment, we have seen the S&P 500 close out Friday trade fairly close to the session high and unchanged on the day.

As a guide, while tactical I would not be surprised to see a pullback, the techincals and price action are so much important than any view one can hold and we really need to see the market confirm this tactical bias before putting money to work in the market. In my view, the short entry comes if and when we see a close through 2565 (the 2 November low), adding on a close through 2544 (the 19th and 25th October double bottom). Until then, short positions in so many indices seem a fairly low probability outcome.

At a sector level and as a guide for Asia, we did see buying in S&P 500 consumer staples and discretionary, but that is unlikely to resonate locally to any great degree. On the downside, we can see energy down 0.8%, weighed by a 0.8% fall in US crude and one should be watching the WTI futures open at 10:00 aedt given the nine rig increase in the weekly Baker-Hughes rig count after the close on Friday to now sit at 938. That said, the market has a keen eye on developments in the Middle East and increasing tensions over Lebanon and if Saudi Arabia is involved then oil traders will always watch closely. Financials and materials closed lower by 0.2%, so that doesn’t give the ASX 200 much to work with.

On the data front, it was a fairly light session, with the University of Michigan survey failing to dampen spirits despite a fall in confidence (printing 97.8 from 100.7 in October). We did see the one-year inflation expectations sub-survey increase to 2.6% and that is somewhat interesting ahead of this Thursday’s October US core CPI (consensus sits for an unchanged read of 1.7%), which is the data highlight of the week. There is always a focus on tax reform, but the market has done a good job in repricing expectations here given the expected strong divergences between the plans from the House and that of the Senate. Notably around the Senate’s delay to corporate tax and also the State and Local Tax (SALT) plan. The process does move up a gear this week with the House largely expected to get the 218 votes needed to pass its version of the reform bill, while the Senate’s initial bill (released last week) has some work to do to. In its current form, it doesn’t fit the cap of a $1.5 trillion deficit over 10 years.

As always a focus on the fixed income markets is a must for macro-focused traders and whether we see a build in yields after the selling and move higher on Friday, notably in the back-end of the curve. Both nominal and ‘real’ (or inflation-adjusted) US 10-year Treasuries moved up six basis points, in turn, causing the 2’s vs 10’s Treasury curve to steepen by 4bp. With a raft of key Fed speakers due through this week and US tax reform hotly debated, amid inflation and retail sales data, I am specifically keen to see how the US 10-year Treasury trades and also whether we see much of a move in the fed funds futures curve and traders increasing or decreasing their implied level of rate hikes through 2018 and 2018. I am not too concerned now about the prospect of a December hike, as this probability now looks to be anchored around 90% and rates traders will need to see a sharp downturn in risk sentiment to price out this probability.

Fed speakers due this week

So aggregating Friday’s news flow and what we have seen through the weekend, which as mentioned has centered on tax reform, Middle East tensions and also Trump’s fairly comical Twitter messages on Kim Jung-un, we can see USD/JPY and AUD/USD unchanged in early trade. This gives us some belief that S&P 500 and SPI futures and other key futures markets should open largely unchanged. Our call then for the ASX 200 sits at 6020, although keep in mind this already reflects 20-points that come out of the market as Westpac and ANZ go ex-div on open. BHP looks detained for an open 0.4% lower (based on its ADR), with no clear lead from commodity markets.

Spot iron ore closed +0.5% higher on Friday, but we see an unconvincing picture in Dalian futures, with iron ore, steel, and coking coal futures closing -0.2%, +0.1% and +0.2%. Copper closed -0.3%, while gold had an interesting session catching a lot of trader attention, where at 03:07 aedt we saw price rapidly fall from $1283 to $1274 on massive volume. Certainly, one to keep an eye on, although the moves are still dwarfed by the sharp move we saw in the Nikkei 225 on Thursday and also the incredible sell-off in Bitcoin, with price trading in a 1364-point range of (7345 to 5981) in the last couple of days. As mentioned last week, one for the very bravest of souls or those who want to trade it from the short-side, it seems.