The S&P 500 and and Nasdaq 100 are making new all time highs. The Russell 2000 and Nasdaq Composite are also at all-time highs. Last week the Dow Transports made a new all-time high. Everything is rising. Of course the financial media are still searching in every dark corner for the crisis that could be, disregarding the welfare of their viewers.

At this point there is only one data point that has yet to confirm renewed strength in the bull market. One more market to make a new all-time high. One last hurdle. The Dow Jones Industrial Average is the lone Index that has yet to make a new all-time high. It would seem that this Index of 30 mega cap stocks should not hold up the party with the other 7000 stocks.

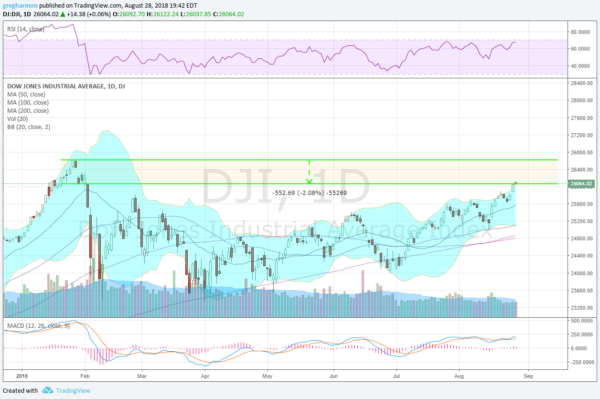

In fact there are plenty of the Industrials that are also at all-time highs, so it is not even all 30 of them. There is only 1 of the 30 that is more that 5% below its high, Chevron (NYSE:CVX). And although the Industrials are 552 points below the all-time high close this is only just over 2% from the top.

Many eyes will continue to watch as historically the Industrials have been the barometer of a bull market. When they make a new all-time high after the Transports also do so, they reconfirm the primary trend as bullish in Dow Theory. Maybe these two sectors do not carry as much importance about the broad market direction as they did in the early 20th Century, or maybe they still do. Either way the debate will rage until a new high is made.

The Industrials do have a lot of support for that to happen. They have made a series of higher highs and higher lows since bottoming at the 200 day SMA in the beginning of April. They also have bullish momentum readings with the RSI strong in the bullish zone and the MACD rising and positive. The Bollinger Bands® are also supportive of further upside as they point higher and are opening.

It would be fun if the market closed out the month and headed into Labor Day Weekend with the Industrials finally making a new high. Three days left to go for that. Or maybe they take the weekend off and wait until September. I can’t wait to see what happens.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.