Dow falls more than 300 points

US stock market pulled back Tuesday led by technology and financial shares. The S&P 500 dropped 1.7% to 2612.62 with technology shares down 3.5%. Seven out of 11 main sectors ended in the red. Dow Jones industrial average lost 1.4% to 23857.71. The NASDAQ Composite index fell 2.9% to 7008.81. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 89.30. Stock indices futures indicate lower openings today.

Market volatility increased recently after President Trump ordered drawing tariffs on at least $50 billion of Chinese goods. Treasury prices rose as investors bid up the haven assets after reports that the White House may crack down on Chinese investments in American technology companies. Chipmaker shares led the retreat Tuesday with NVIDIA Corporation (NASDAQ:NVDA) down 7.7%. In economic news the S&P/Case-Shiller national house price index rose 6.2% compared with a year before. Separately, Conference Board consumer confidence index unexpectedly fell in March, though it remains near an 18-year high.

FTSE leads European indices recovery

European stocks erased previous session losses on Tuesday as trade war concerns abated. Both the euro and British pound turned lower against the dollar. The Stoxx Europe 600 rose 1.2%. The German DAX 30 gained 1.56% to 11970.83. France’s CAC 40 added 1% and UK’s FTSE 100 rose 1.62% to 7000.14. Indices opened 0.5% - 0.9% lower today.

Euro retreated after Erkki Liikanen, Finland’s central bank governor and a member of the European Central Bank’s governing council, commented that the ECB could extend its €1 trillion bond purchases program citing political risks for euro-zone economic recovery. Currently the stimulus program is expected to wrap up in September.

Asian markets fall

Asian stocks are lower today tracking Wall Mart losses overnight. Nikkei lost 1.3% to 21031.31 despite resumed slide in yen against the dollar. Chinese stocks are falling weighed also by reports China is preparing a list of retaliatory tariffs on US imports: the Shanghai Composite Index is down 1.5% and Hong Kong’s Hang Seng Index is 1.8% lower. Australia’s ASX All Ordinaries is down 0.7% with Australian dollar stable against the greenback.

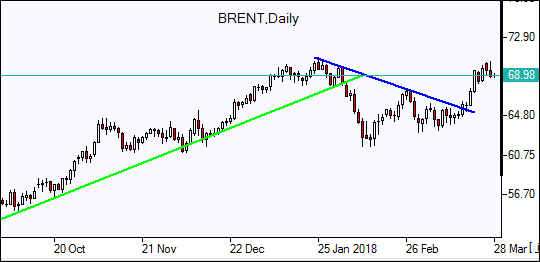

Brent slides

Brent futures prices are edging lower today on rising US inventories expectations. The American Petroleum Institute late Tuesday report indicated US crude inventories jumped by 5.3 million barrels to 430.6 million last week. May Brent lost less than 0.01% to $70.11 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.