Dollar Gains As Trade Deficit Narrows

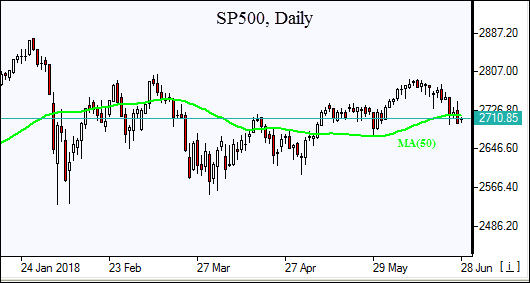

US stock indices erased previous day gains on Wednesday led by technology shares as orders for durable goods fell 0.6% in May following a revised 1% decline in April. The S&P 500 fell 0.9% to 2699.63. The Dow Jones Industrial lost 0.7% to 24117.59. NASDAQ Composite index dropped 1.5% to 7445.08. The dollar strengthening accelerated as the trade deficit in goods narrowed 3.7% to below expected $64.8 billion in May: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.6% to 95.261 and is higher currently. Stock index futures indicate higher openings today.

FTSE 100 Leads European Stock Rebound

European stock indices recovered on Wednesday aided by news President Trump will rely on existing laws rather than new stricter legislation to curb Chinese investments. Both the euro and British pound accelerated slide against the dollar and both are falling currently. The Stoxx Europe 600 rose 0.7%. Germany’s DAX 30 added 0.9% to 12348.61. France’s CAC 40 gained 0.9% and UK’s FTSE 100 jumped 1.1% to 7621.69. Indices opened 0.3% - 0.5% lower today.

Chinese Stock Selloff Persists

Asian stock indices are mixed today while Chinese stocks selloff continues despite President Trump’s decision to use strengthened national security review process to restrict Chinese investment in US technology firms instead of passing new tougher laws. Nikkei ended 1.38 points lower at 22270.39 as yen climb against the dollar continued. China’s stocks are falling: the Shanghai Composite Index is 1% lower and Hong Kong’s Hang Seng Index is down 0.3%. However Australia’s ASX All Ordinaries Index is up 0.3% with Australian dollar little changed against the greenback.

Brent Higher On Big US Crude Stock Draw

Brent Oil Futures are extending gains today after the US Energy Information Administration reported yesterday that domestic crude supplies fell by above expected 9.9 million barrels. Prices ended higher yesterday: August Brent crude rose 1.7% to $77.62 a barrel on Wednesday.