Dollar rebounds on strong manufacturing

US stock indices added to previous session gains on Monday led by technology rally. The S&P 500 gained 0.3% to 2726.71, closing above the 50-day moving average. Dow Jones Industrial added 0.2% to 24307.18. The NASDAQ Composite rose 0.8% to 7567.69. The dollar rebounded on positive manufacturing data: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 94.847 but is lower currently. Stock index futures point to higher openings today.

Treasury yields rose as better than expected manufacturing data signaled enduring strength of US economy. The Institute for Supply Management’s manufacturing index rose to 60.2% in June from 58.7% in May. And Markit’s June manufacturing index’s preliminary reading was updated to 55.4 from 54.6. However construction spending rose 0.4% in May after 0.9% rise in April.

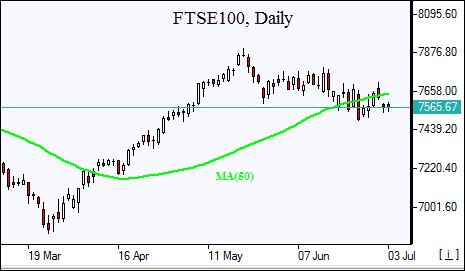

FTSE 100 leads European indices losses

European stock indices erased previous session gains on Monday as trade war concerns weighed on market sentiment. Both the British Pound and euro turned lower against the dollar but are moving higher currently. The Stoxx Europe 600 index lost 0.8%. The DAX 30 lost 0.6% to 12238.17 and France’s CAC 40 fell 0.9%. UK’s FTSE 100 tumbled 1.2% to 7547.85. Indices opened 0.3% - 0.7% higher today.

Market sentiment was weighed by trade war concerns after President Trump Sunday comment he sees his threat to impose global auto tariffs as his biggest weapon to extract concessions from trading partners. Investors are concerned President Trump may act on his threat to impose 20% tariffs on auto imports. The European Union has responded by $300 billion in retaliatory tariffs against US products if Trump follows through on his threat.

Asian indices mixed

Asian stock indices are mixed today. Nikkei lost 0.1% to 21785.54 as yen climb against the dollar continued. Chinese stocks are mixed after Trump Monday comment that “we’ll be doing something” about the World Trade Organization if the United States is not treated properly: the Shanghai Composite Index is up 0.4% but Hong Kong’s Hang Seng Index is 1.5% lower. Australia’s ASX All Ordinaries is up 0.5% despite the Australian dollar turn higher against the greenback as Australia's central bank kept interest rates unchanged.

Brent climbs

Brent futures prices are higher today after Libya declared force majeure on some of its supplies. Prices ended lower Monday on reports Saudi Arabia pumped at a near record rate in May. September Brent crude settled 2.4% lower at $77.30 a barrel on Monday.