Dow logs sixth straight gain

US stocks extended gains on Thursday led by technology shares as Apple (NASDAQ:AAPL) closed at record high. Dow Jones Industrial Average gained 0.8% to 24739.53, sixth consecutive gain. The S&P 500 rose 0.9% to 2723.07 with all 11 sectors finishing higher. The NASDAQ Composite advanced 0.9% to 7404.97. The dollar strengthening stopped: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.4% to 92.685 but is rising currently. Stock indices futures point to mixed openings today.

Technology stocks uptrend is intact with the sector up 7.7% in May. Lower than expected inflation also helped boost investor risk appetite by allaying concerns economy may be overheating: the consumer price index rose 0.2% on month in April when 0.3% increase was expected. The core CPI, which excludes volatile food and energy prices, rose 0.1%, slower than the 0.2% gain in March. Separately the number of people who applied for first-time US unemployment benefits remained at 211,000 for the second straight week, near a 49-year low.

European stocks retreated on Thursday. The euro turned sharply higher against the dollar while the British Pound extended losses, with directions reversed currently. The STOXX Europe 600 index lost 0.1%. Germany’s DAX 30 rose 0.6% to 13022.87. France’s CAC 40 added 0.2% and UK’s FTSE 100 gained 0.5% to 7700.97. Markets opened mixed today.

Italian stocks fell on reports Italy’s far-right League party and populist 5 Star Movement may form a new government. Such a coalition is seen as a euroskeptic alliance which would hurt prospects of the European Union and Italian economy. Pound continued the slide after the Bank of England kept rates on hold indicating it expects to raise its key interest rate in coming years depending on how the economy evolves.

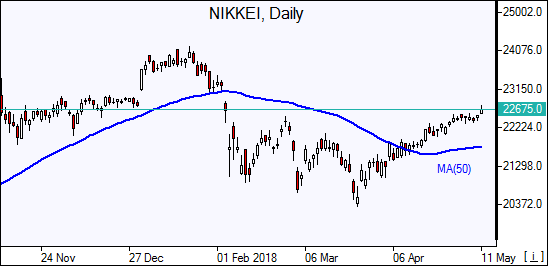

Asian stock indices are mixed today. Nikkei rose 1.27% to 22758.48 with yen little changed against the dollar. Chinese stocks are mixed: the Shanghai Composite Index is 0.4% lower while Hong Kong’s Hang Seng Index is up 0.9%. Australia’s ASX All Ordinaries is down 0.04% as Australian dollar extends its climb against the greenback.

Brent futures prices are edging lower today as traders consider which exporters could replace Iranian sources as US sanctions are reimposed in six months time. They ended higher yesterday: Brent for July settlement rose 0.3% to close at $77.47 a barrel on Thursday.