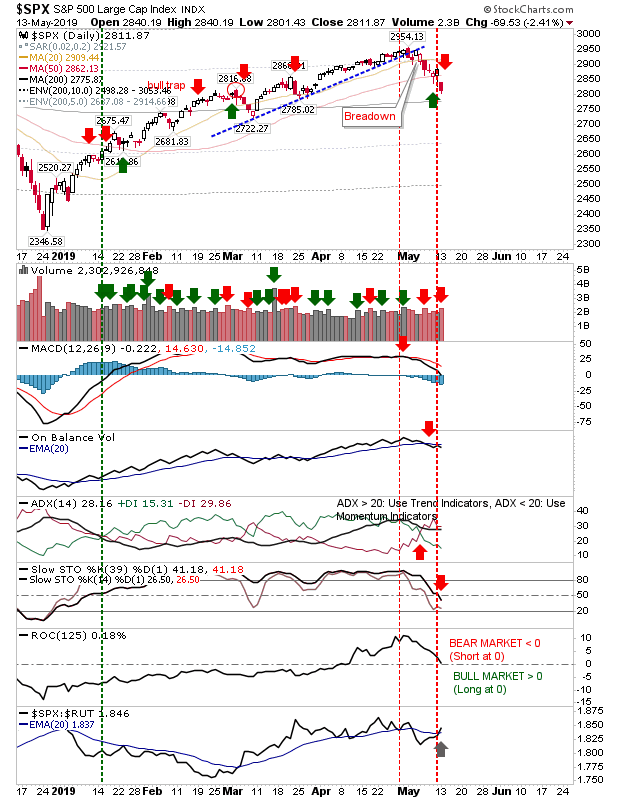

The to-and-fro of the US-Chinese trade war has left markets in a bit of a grey zone and facing uncertainty after holding moving average support. The S&P 500 undercut its 50-day MA on higher volume distribution, but it also came back with relative performance improvement. Technicals are net bearish.

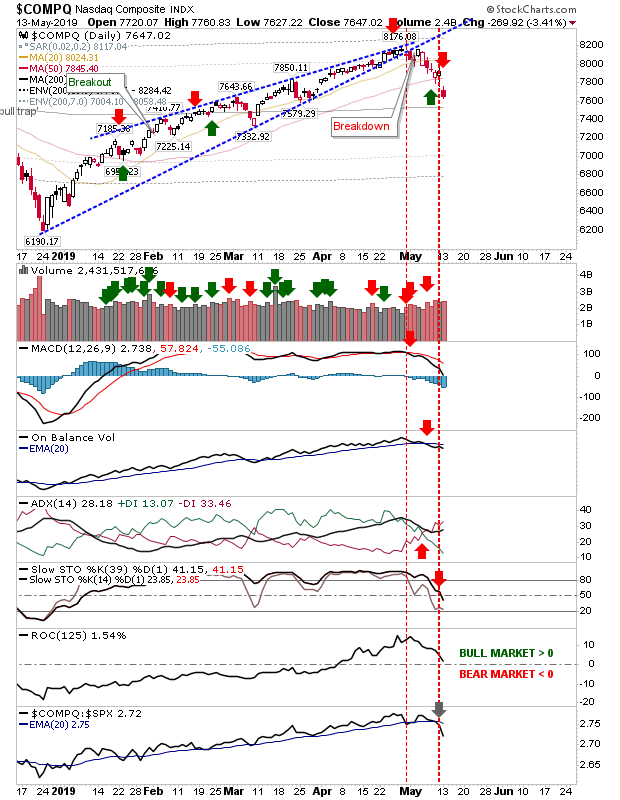

The Nasdaq also took an undercut of the 50-day MA in a similar shift to a net bearish technical picture as the S&P. However, it also lost relative ground against the S&P.

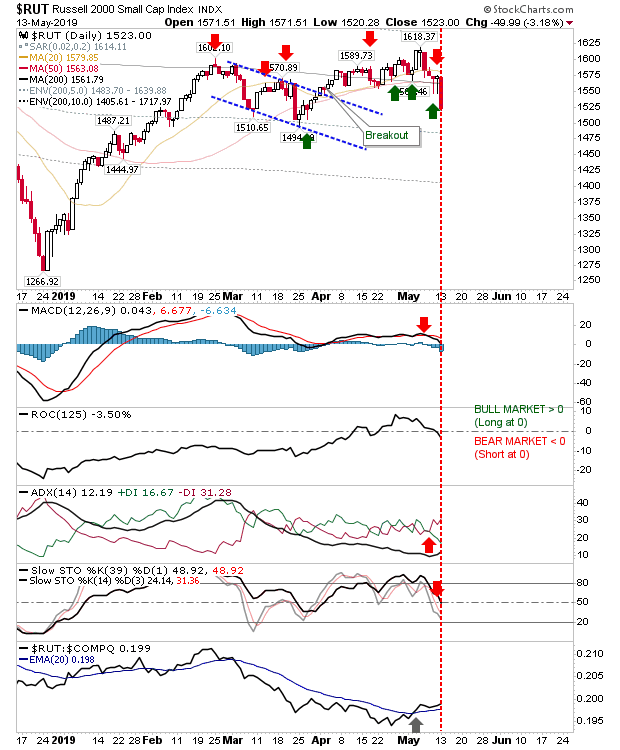

The biggest loss was felt in the Russell 2000. Small Caps took a substantial hit as an investment in speculative issues took a back seat in a more defensive turn. All three key moving averages (200-day, 50-day, 20-day MA) were undercut by today's selling. Technicals are also net negative. Next support test is the March swing low. On a positive front, the index still has a relative advantage against the Nasdaq.

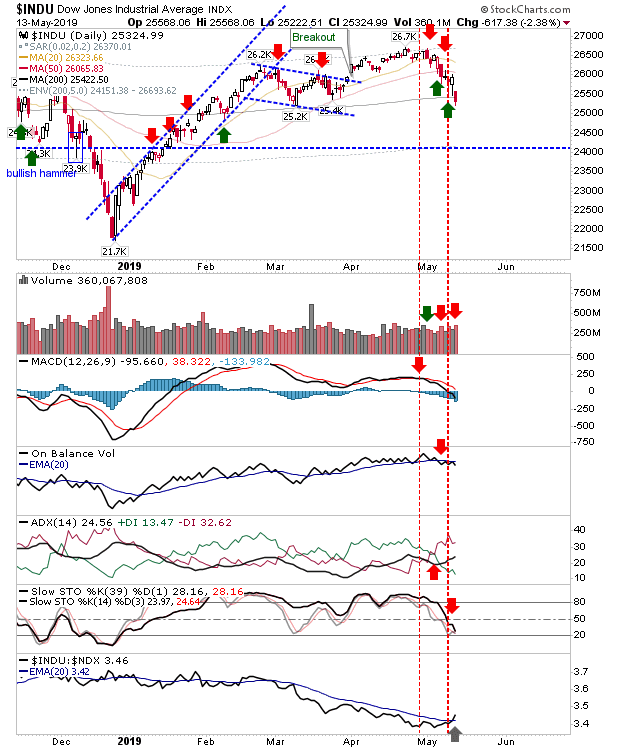

The Dow Jones also took a hit but actually managed to hang on to its 200-day MA. So if you are looking a bounce play, the Dow Industrial average might be the one. It even enjoys a relative performance advantage against the Nasdaq 100.

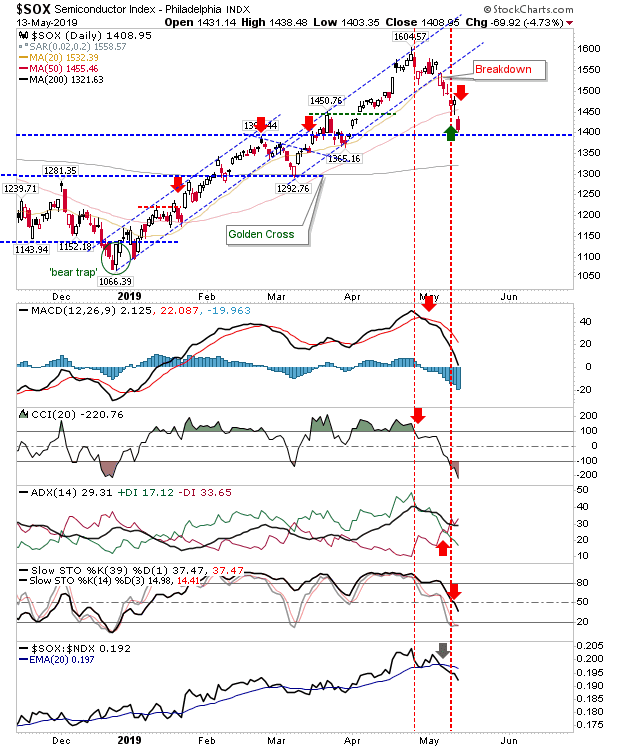

The Semiconductor Index is a mixed bag with a loss of the 50-day MA, but horizontal support at 1,400 is an opportunity for a bullish reboot.

Indices like the Dow Jones and Semiconductor Index will offer bulls something to work with, but if bulls are unable to build a response after the first 30 minutes of trading, then any weak bounce will be pounced on by shorts for the likes of the Russell 2000.