The TLTRO Can Help German Companies

The European Central Bank announced the TLTRO 3 asset repurchase program, which will be implemented from September 2019 to March 2021. Will the DE30 continue rising?

The TLTRO 3 program is designed to stimulate the economy of the Eurozone and may have the most favorable impact on the German economy. The merger plans of the two largest banks Deutsche Bank (NYSE:DB) and Commerzbank (DE:CBKG) may be short-term positive factors for the German stock index. It can reduce the risks of new US sanctions against the Deutsche Bank and reduce management expenses.

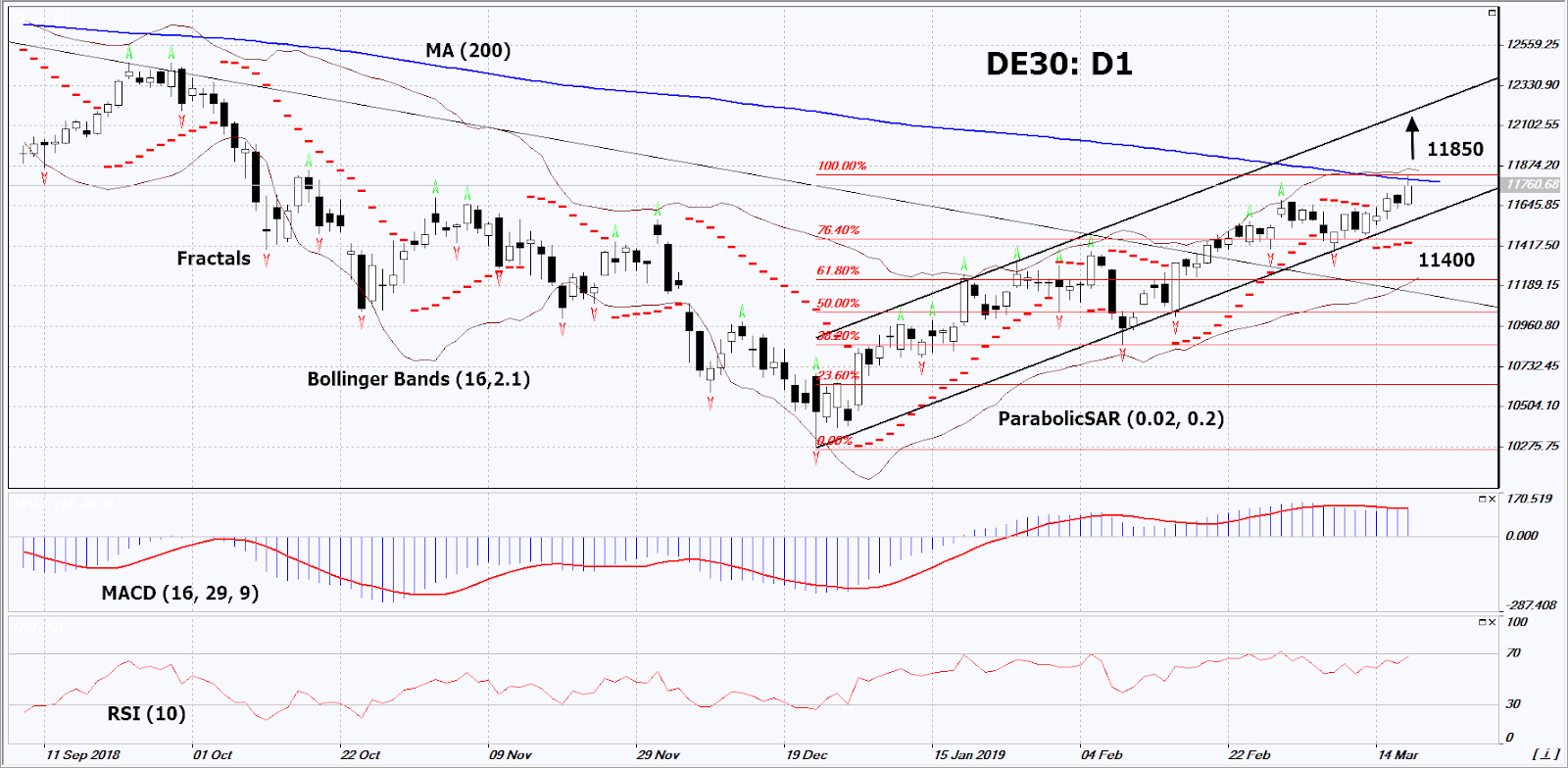

On the daily timeframe, DE30: D1 has been in a rising trend since the beginning of the current year. The further price increase is possible in case of positive economic and corporate news in Germany.

-

The Parabolic Indicator gives a bullish signal.

-

The Bollinger® bands have widened, which indicates high volatility. The lower Bollinger band is titled upward.

-

The RSI indicator is above 50. No divergence.

-

The MACD indicator gives a bullish signal.

The bullish momentum may develop in case DE30 exceeds the last high, the 200-day moving average line and the upper Bollinger band at 11850. This level may serve as an entry point. The initial stop loss may be placed below the two last fractal lows, the Parabolic signal and the support line of the uptrend at 11400. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (11400) without reaching the order (11850), we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary Of Technical Analysis

- Position Buy

- Buy stop Above 11850

- Stop loss Below 11400

Market Overview

- Fed announces interest rate decision today

- US stocks end mostly lower

US stock market ended marginally lower on Tuesday as investors risk appetite was undermined by reports China resists to US demands in trade negotiations. The S&P 500 slipped 0.01% to 2832.57. Dow Jones slid 0.1% to 25887.38. The Nasdaq however rose 0.1% to 7723.95. The dollar weakening accelerated ahead of Fed interest-rate decision today as factory orders maintained steady growth rate of 0.1% in January when an increase was expected. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.2% to 96.35 but is higher currently. Futures on US stock indexes point to mixed openings today.

DAX 30 Outperforms European Indices

European stocks extended gains on Tuesday led by auto maker stocks. The GBP/USD joined EUR/USD’s continued climb with both pairs reversing currently. The Stoxx Europe 600 rose 0.6%. The German DAX 30 gained 1.1% to 11788.41, France’s CAC 40 added 0.2% and UK’s FTSE 100 advanced 0.3% to 7324.

Nikkei Gains While Other Asian Indices Slip

Asian stock indices are mixed today. Nikkei recovered 0.2% to 21608.92 with yen resuming slide against the dollar. Chinese stocks are lower: the Shanghai Composite Index is down 0.01% and Hong Kong’s Hang Seng index is 0.2% lower. Australia’s All Ordinaries Index lost 0.3% despite the Australian dollar continuing its slide against the greenback.

Brent Up

Brent futures prices are edging higher today supported by OPEC cuts and US sanctions on Venezuela and Iran. The American Petroleum Institute late Tuesday report indicated US crude inventories fell by 2.1 million barrels last week and gasoline inventories dropped by 2.8 million. Prices ended marginally higher yesterday. May Brent added 0.1% to $67.61 a barrel on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.