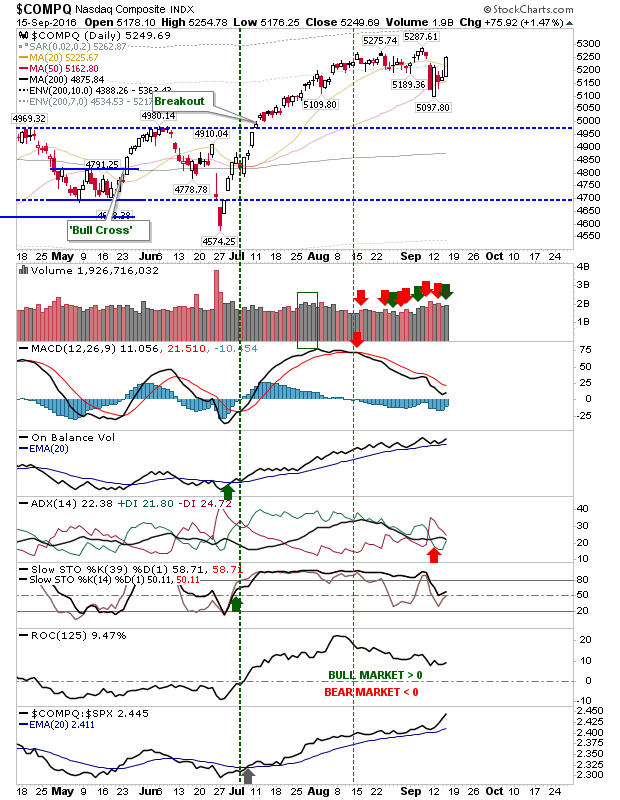

Bulls got their reward with the Nasdaq popping higher following a series of inside days. The coiling action brought about by recent action delivered over a 1% gain. Volume climbed to register an accumulation day. In addition, the post-jobs report breakdown gap was closed, turning the decline into a brief consolidation. A challenge on 5,288 is next.

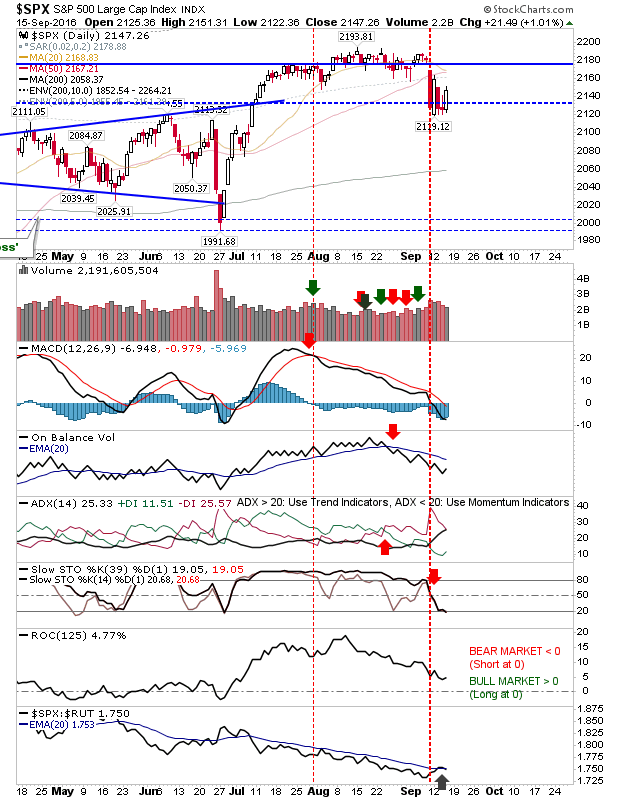

The S&P also managed a 1% gain, but it hasn't yet undermined the prior decline. Technicals remain net bearish, although the relative performance of the index to its peers ticked higher. Despite strength in the Nasdaq, Large Caps still have their work cut out.

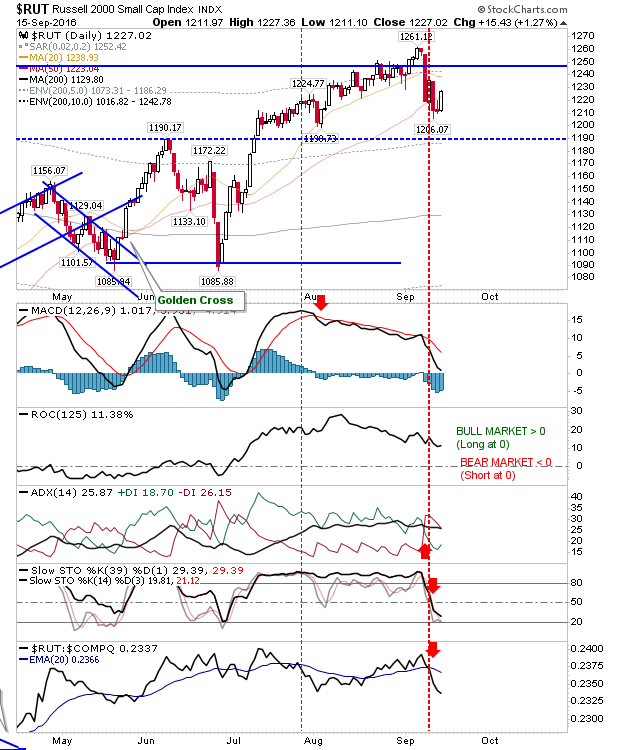

The Russell 2000 experienced a day similar to the S&P, but it doesn't have the relative performance gain experienced by the S&P. Bulls still have a long way to go.

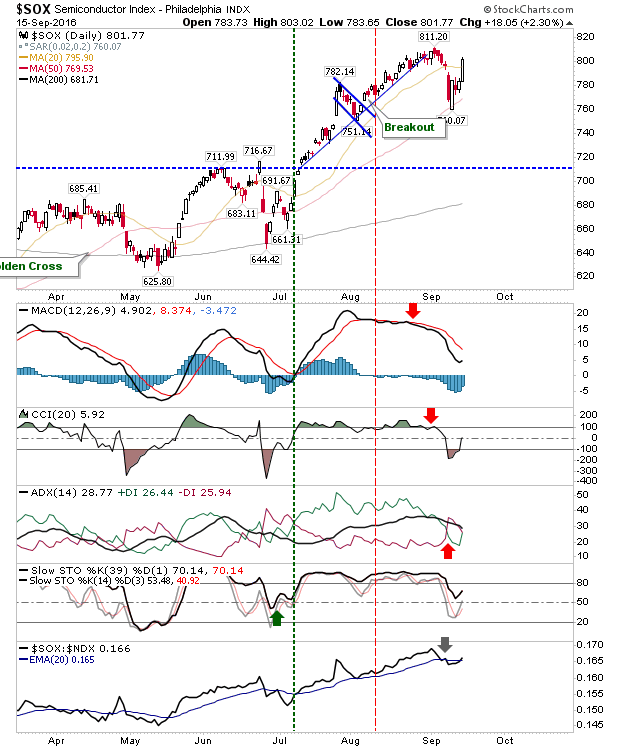

My (frustrating) stopped out copper trade is reaping the benefit of Semiconductor gains. A big move for the index will continue to fund gains in the Nasdaq and Nasdaq 100. Relative performance has also seen a bullish cross against the Nasdaq 100.

For Friday, keep an eye on Tech indices and supporting copper prices. The Nasdaq and Nasdaq 100 are well positioned for follow through gains. Bears need to continue to pressure Large Caps; watch for some early morning upside as optimism extends.