Investing.com’s stocks of the week

It was a mixed day for indices yesterday. Large Caps remain bound by wedge support/resistance, but Tech broke to the upside Monday from similar wedges and held those breakouts yesterday.

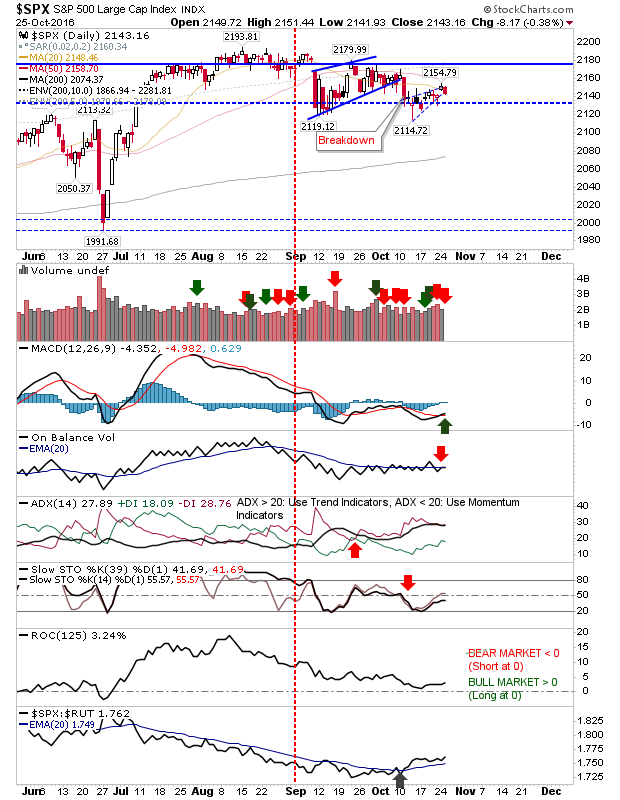

There was little change for the S&P 500 over the last couple of days. The one technical change was the MACD trigger 'buy' as other technicals stayed on the bearish side.

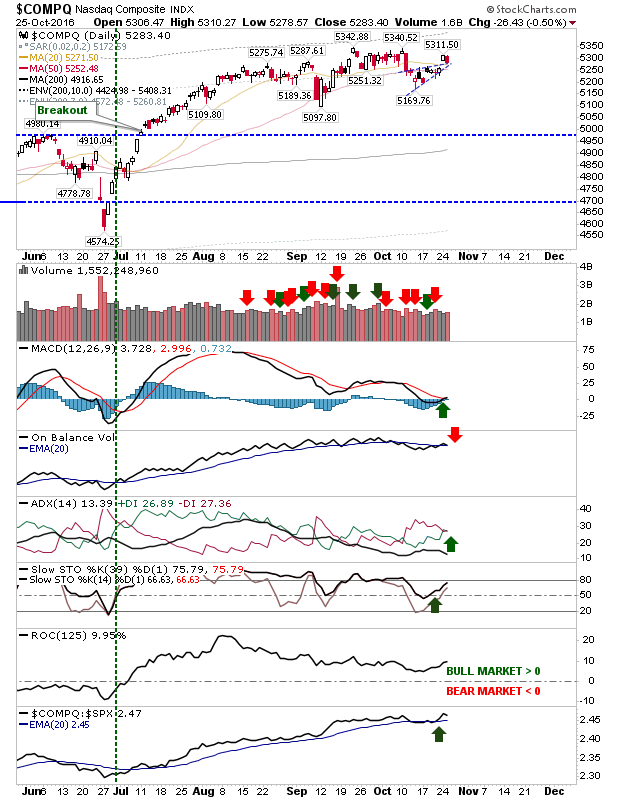

Meanwhile, the NASDAQ cleared wedge resistance Monday and was able to hang on to the breakout despite yesterday's loss. It too enjoyed a MACD trigger 'buy', but had an On-Balance-Volume 'sell' to contend with too.

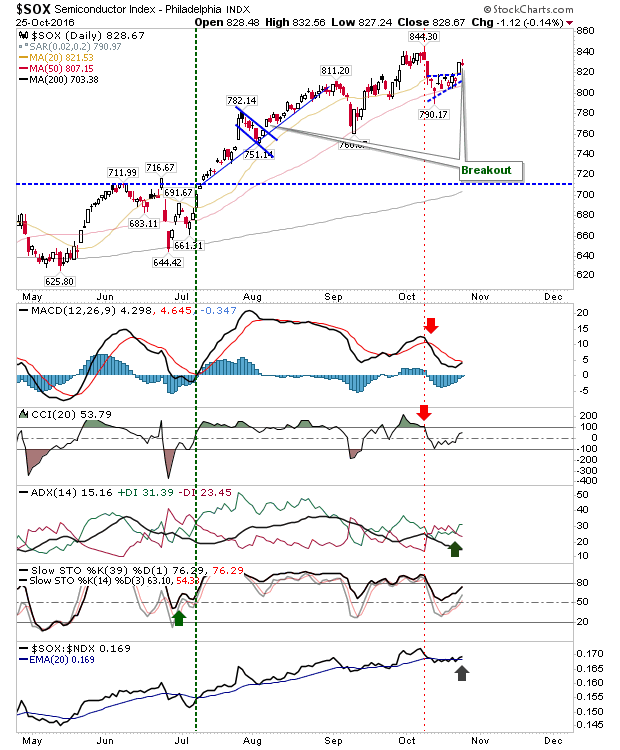

The Semiconductor Index had a better day. It suffered very little loss on Monday's gain and it's on the verge of a MACD trigger 'buy'. This will help the NASDAQ and NASDAQ 100 hold on to their breakouts.

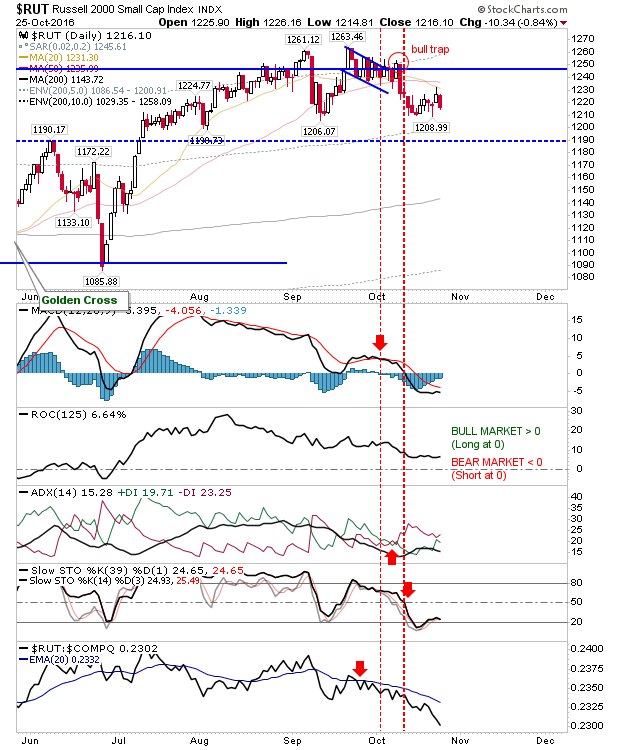

The Russell 2000 had looked to kick start a recovery, but yesterday's loss turned what had the makings of a swing low into a potential 'bear flag'; watch for follow-through downside today.

Things are a little different for today. The Russell 2000 had set up for a swing low, but yesterday's action delivered a greater than expected loss and didn't offer a bullish follow-through. While the NASDAQ has offered a clean break higher and is holding those gains in the face of yesterday's loss; bulls may find some joy here.