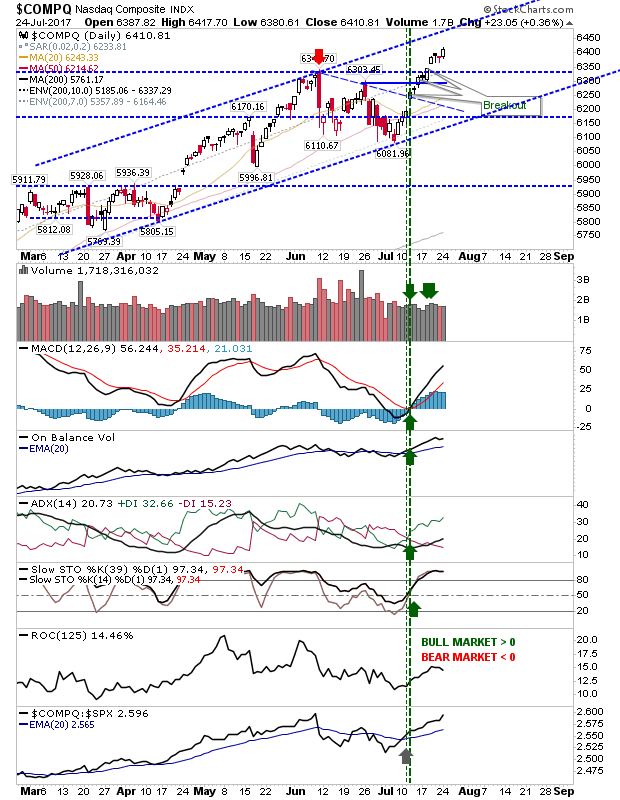

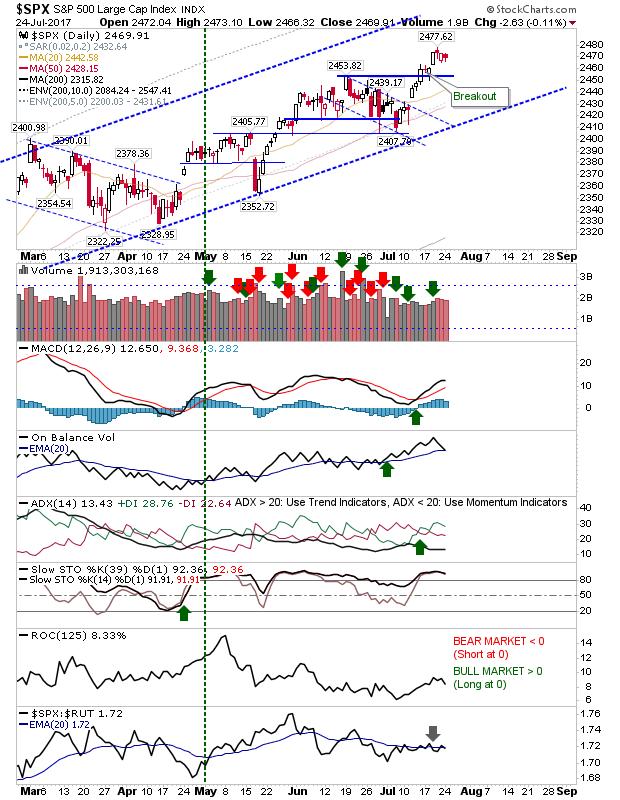

Yesterday, tech markets continued the good work from Friday as buyers continued to bid up the NASDAQ and NASDAQ 100. Large Caps posted small losses but this was more about attention elsewhere than any Large Cap specifics.

The NASDAQ experienced a mini-breakout from the consolidation over the last 3 days (traders on the hourly time frame may find some joy here) which keeps the index on course to test larger upper channel resistance. Technicals are net bullish but its the relative performance against peer indices which is doing particularly well; Large Caps in particular.

The S&P drifted a little lower yesterday but not enough to undo the action from Friday. Technicals are still bullish but On-Balance-Volume is on the verge of a 'sell' trigger.

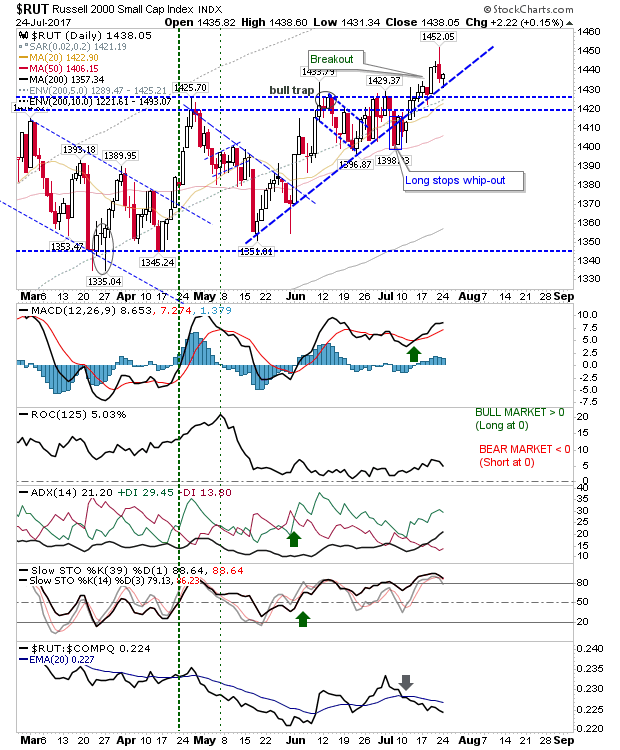

The Russell 2000 stopped the rot as it dug in at rising support. However, the test of support will probably take another dip in a play to knock out stops. Another round of sideways action is likely but if it can hold above 1,420 then long term buyers may get a new chance to take a bite of the cherry.

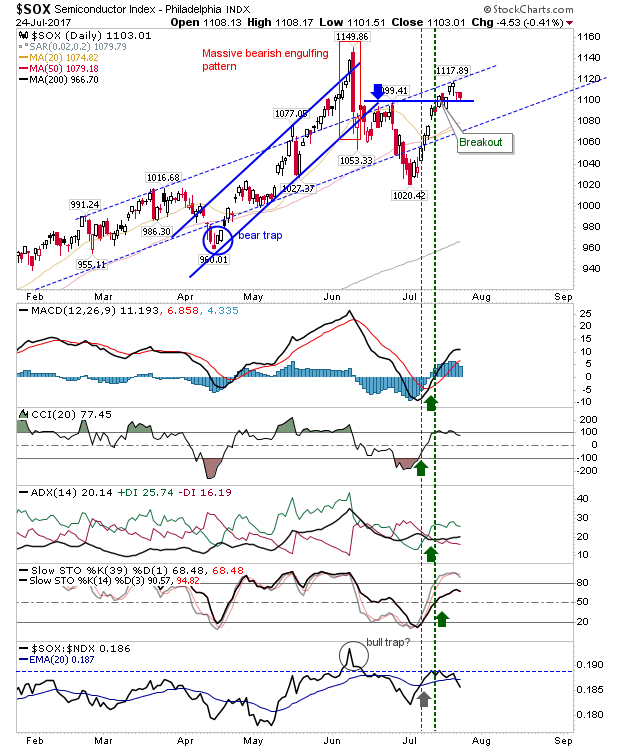

Action in the Semiconductor Index was more muted than Tech indices but buyers of the NASDAQ and NASDAQ 100 will require participation from Semiconductors to sustain any long-term advance in these indices. Unfortunately, despite the gains in the aforementioned indices, the Semiconductor Index is struggling with the June bearish engulfing pattern and needs to consume the supply generated from this pattern if NASDAQ and NASDAQ 100 gains are to hold.

For the week ahead, keep an eye on the Semiconductor Index and Small Caps. Consider a sell-off in the Russell 2000 as a possible buying opportunity unless the 1-day losses are greater than 1%.