At the beginning of October, fears that the Fed’s quitting on easing may dry up the market dominated opinion. Now the fears are easing as central banks are injecting funds into markets by turns. As the Fed is no longer playing in this field, the BOJ has placed bets on the game. Participants were shocked by BOJ’s unexpected easing policy to expand the Japanese monetary base by 80 trillion each year.

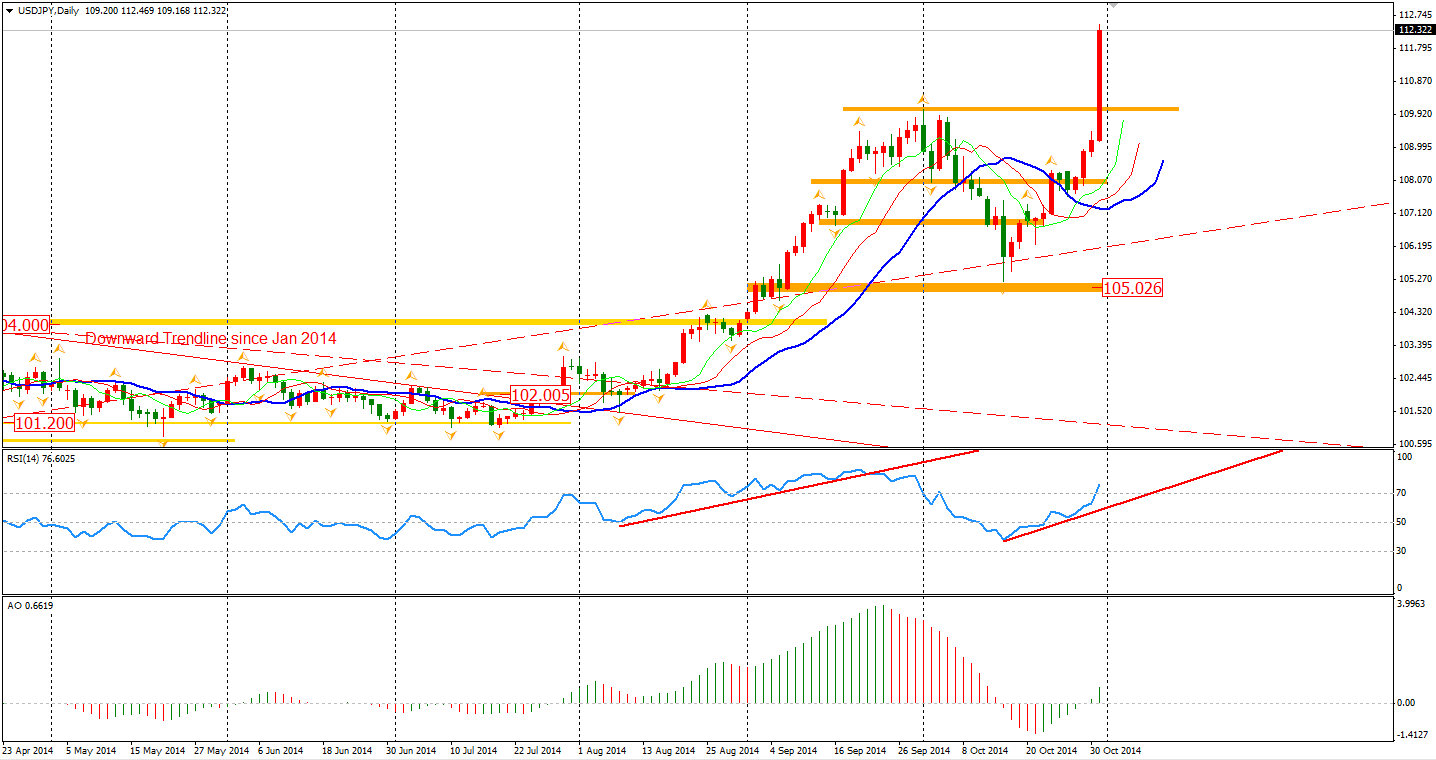

The yen slumped by 2.94% last Friday and by 3.7% in the last week. The Dollar Yen rose to 112.32, the highest level since 2008 and 8.4% higher than it was six months ago. Now that the market understands the determination of BOJ there will certainly be more space open for the Yen’s depreciation. The long term target level for the Dollar Yen can be probably set beyond 120.

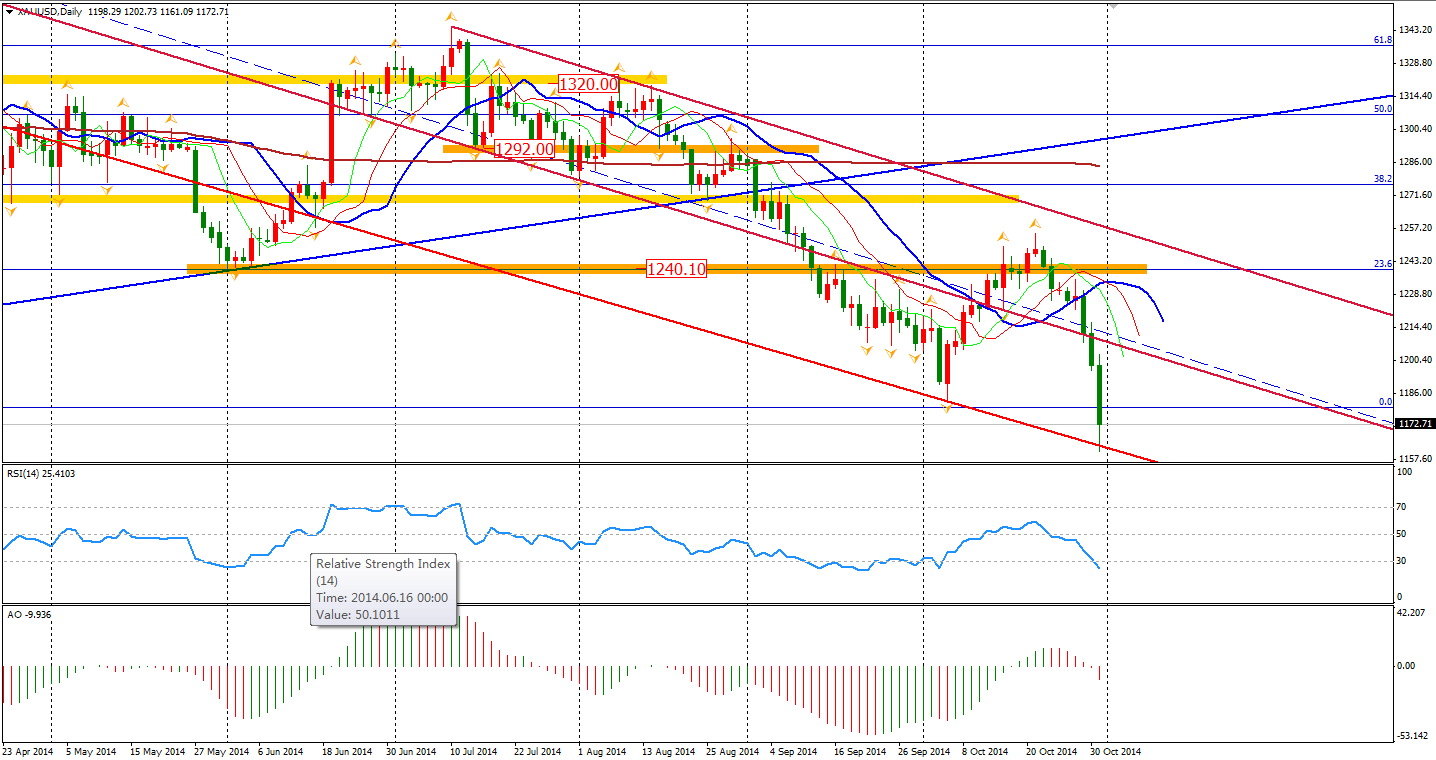

In other astonishing news – on Friday, gold prices fell below the year bottom level of $1180. The Gold price plummeted down 2.7% following two straight falling days to $1172 per ounce. The day low was $1161 at the lower band of the channel. The breakout has signalled another major fall on gold prices like that slump of April 2013 when gold lost $250 in just three days of trading.

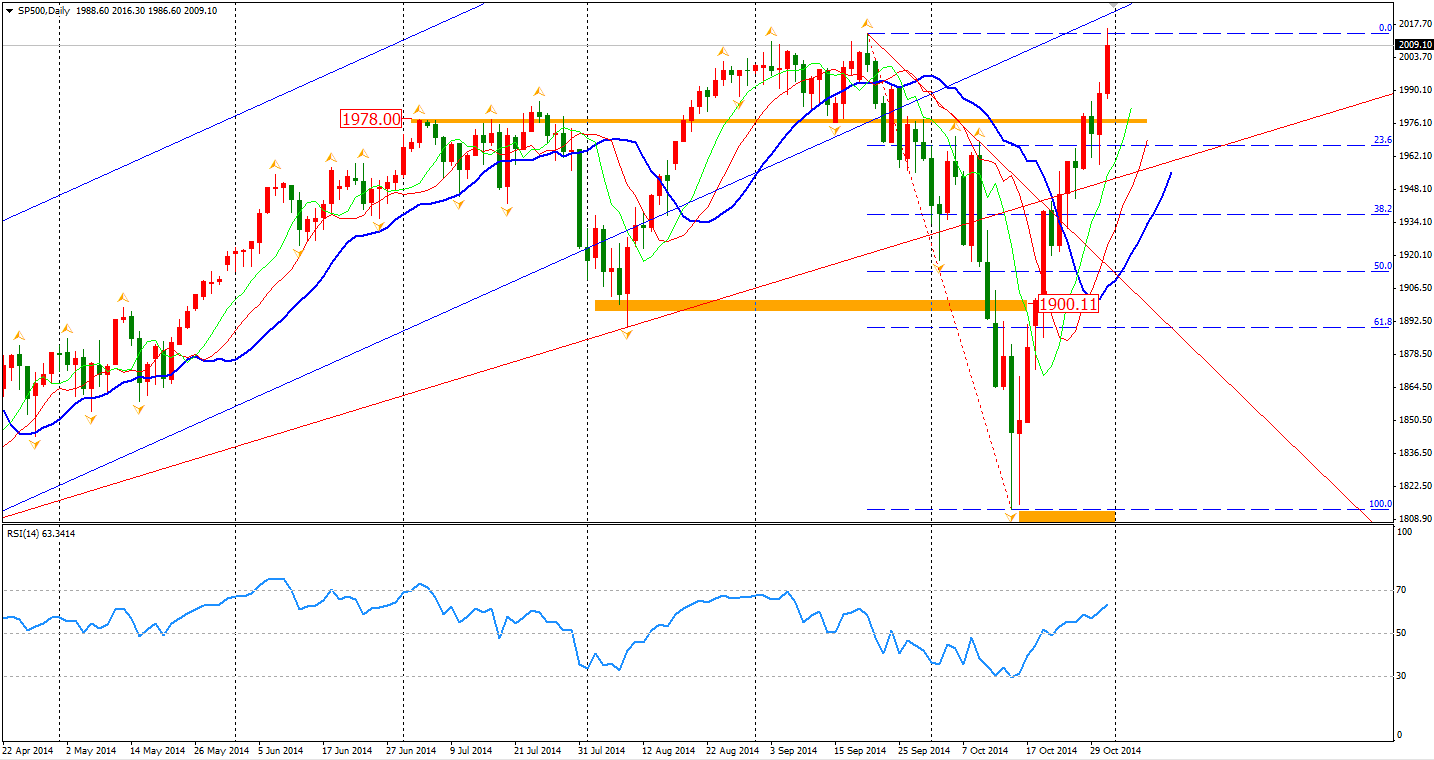

The global stock markets seemed inspired by the BOJ decision. The Nikkei Stock Average rocketed by 755 points or 4.83% to 16414. The Shanghai Composite also surged by 1.22% to 2420. ASX 200 gained 0.92% to 5526. In the European stock markets, the UK FTSE was up 1.28%, the German DAX edged up 2.33% and the French CAC 40 Index gained 2.22%. The US market refreshed an all-time high following the European and Asian markets. The Dow and S&P 500 has risen 10% from their October bottom and NASDAQ reached its newest high since 2000. The S&P 500 gained 1.17% to 2018. The Dow rose by 1.13% to 17390, while the Nasdaq Composite Index surged by 1.41% to 4631.

On the data front, Australia Building Approvals will be released at 11:30 am. Chinese HSBC Final Manufacturing PMI will be out at 12:45 AEST and UK Manufacturing PMI will be at 20:30 AEST.

Have a great trading day!

Anthony

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Surging Stocks, Sliding Gold Sets Tone For November

Published 11/02/2014, 06:25 PM

Surging Stocks, Sliding Gold Sets Tone For November

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.