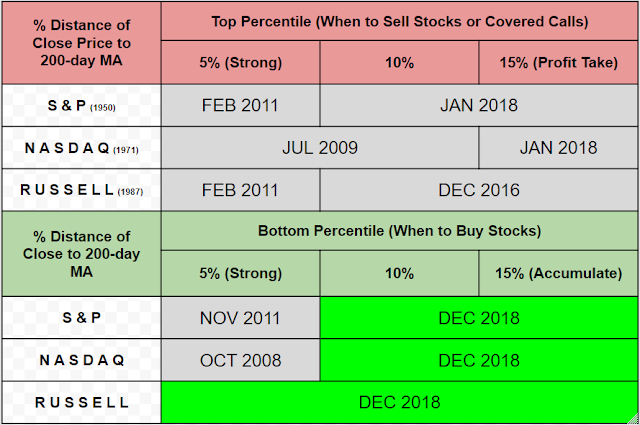

Now the panic will start, but Investors should be rubbing their hands in glee. Yesterday the Russell 2000 dropped into the 5% zone of historic weakness with the NASDAQ in the 10% zone (S&P unchanged in the 10% zone). Shorts will be happy too but will need to be mindful of snap bear rallies which can quickly clock up 20% gains—and eat up profits (without breaking the broader bearish trend).

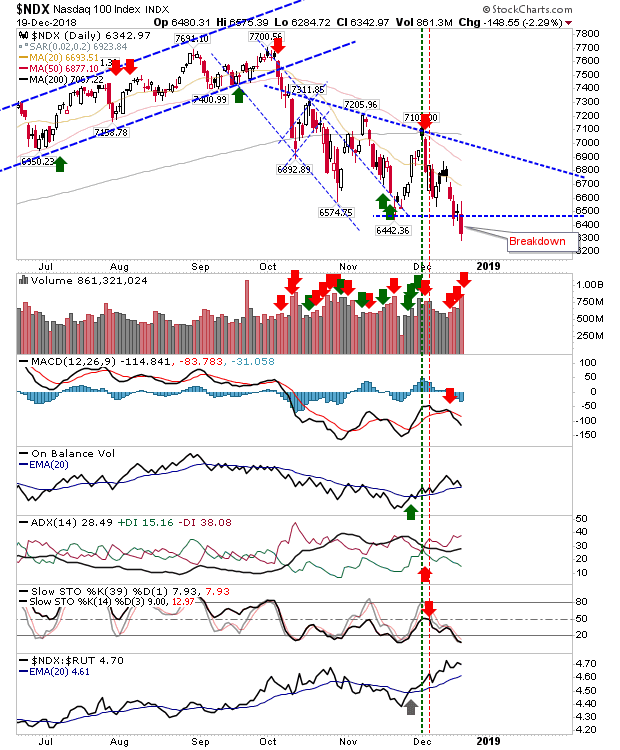

The NASDAQ 100 broke November swing low support on heavier volume distribution. It's one of the few indices with a bullish technical in on-balance-volume. Luckily for NASDAQ 100 holders, it's outperforming the Russell 2000.

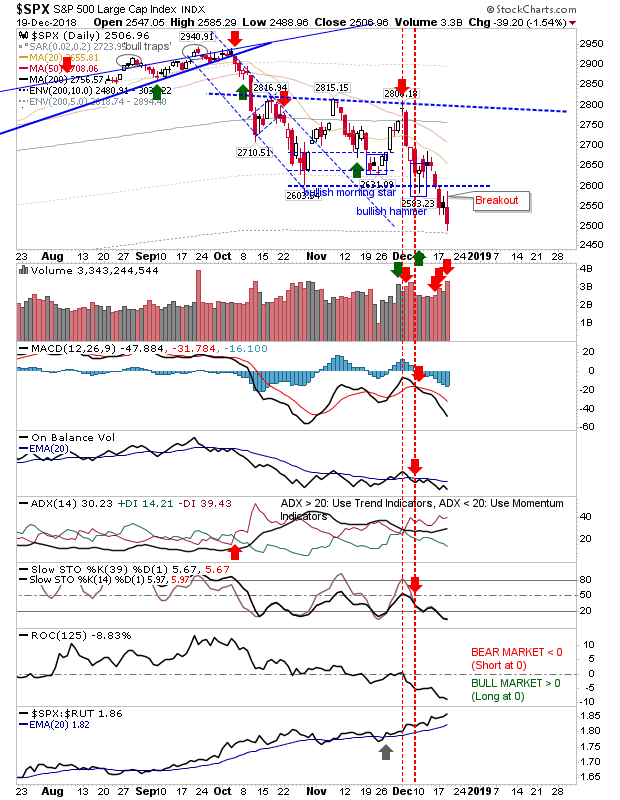

The S&P had given up December's swing low—bullish hammer support—last week, then yesterday, accelerated lower on higher volume. It still has a performance advantage over the Russell 2000 but it's not exactly attractive. Alternative support remains elusive. Investors can keep on accumulating.

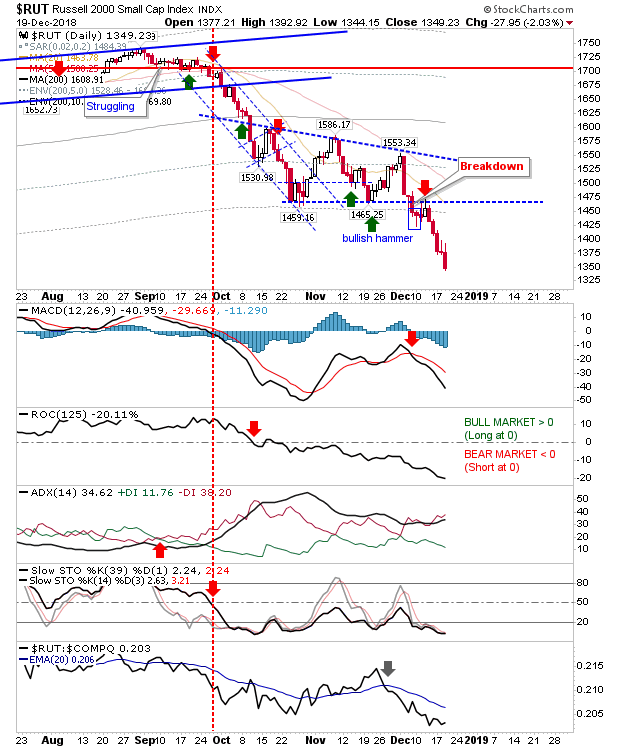

The Russell 2000 has moved further away from support and is looking ready for a snap bounce (although there is no reversal candlestick in play). Investors can accelerate the buying with the index now in "Strong Buy" territory.

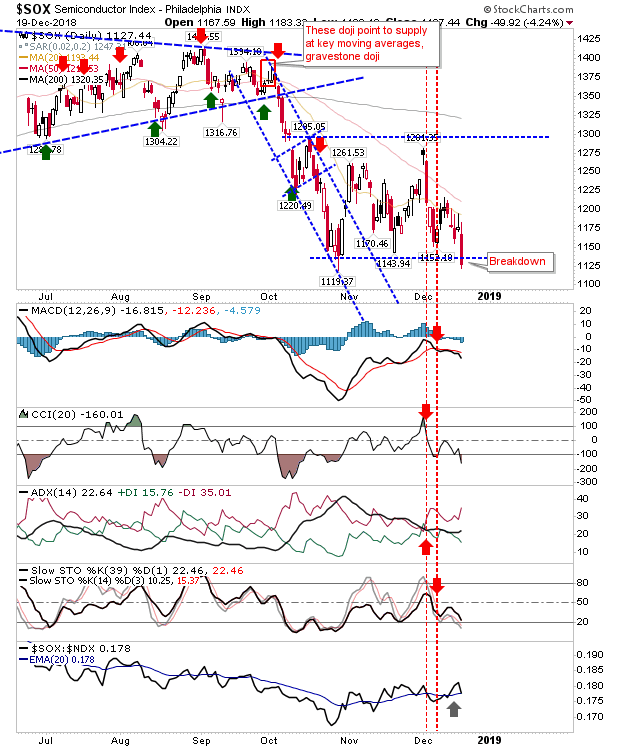

Semiconductors took a big hit as the October swing low was undercut by yesterday's 4%+ loss. Semiconductors had looked like they were attempting to build a sideways pattern but this was negated by yesterday's breakdown.

The rest of the year will likely be looked at through gaps in the fingers of the hand over the face. Santa won't be visiting markets this year.