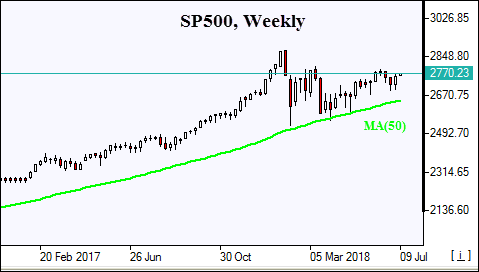

S&P 500 logs solid gain after two weekly losses

US stock indices extended gains Friday on strong June jobs report while US officially imposed tariffs on $34 billion of Chinese imports. S&P 500 rose 0.9% to 2759.82, ending 1.5% higher for the week. Dow Jones industrial average added 0.4% to 24456.48. The Nasdaq rallied 1.3% to 7688.39. The dollar turned sharply lower despite a stronger than expected rise in nonfarm payrolls by 213,000 in June: the US dollar index shows a measure of the dollar’s strength against a basket of six rival currencies, fell 0.4% to 94.01 and is lower currently. Stock index futures point to higher openings today.

European stocks snap three-weak slide

European stocks added to previous session gains on Friday. The GBP/USD joined EUR/USD's climb and both pairs are higher currently. The Stoxx Europe 600 Index gained 0.2%, ending 06% higher for the week. The DAX 30 rose 0.3% to 12496.17. France’s CAC 40 ended 0.2% higher and UK’s FTSE 100 gained 0.4% to 7617.70. Indices opened 0.4% - 0.5% higher today.

Chinese stocks lead Asian indices gains

Asian stock indices are rising today as investors’ risk appetite was supported by strong US jobs data. Nikkei rose 1.2% to 22052.18 helped by yen turn lower against the dollar. Chinese stocks are rising after China’s securities regulator said on Sunday it plans to ease restrictions on foreign investment in stock listed on the Shanghai or Shenzhen exchanges: theShanghai Composite Index is up 2.5% and Hong Kong’s Hang Seng Index is 1.5% higher. Australia’s ASX All Ordinaries is up 0.2% despite the Australian dollar continued climb against the greenback.

Brent drops on surprise US stocks increase

Brent futures prices are extending losses today. Prices ended lower yesterday after a surprise buildup in US domestic crude inventories. The Energy Information Administration reported Thursday that crude stockpiles rose by 1.2 million barrels last week when a drop was expected. Brent for September settlement closed 1.1% lower at $77.39 a barrel on Thursday.