Modest losses were undone by yesterday's swoop by buyers. This will have forced many shorts to cover, particularly those who decided to take advantage of the weakness. The seasonally positive 'Santa rally' may be perfectly timed here if the November high can be taken out.

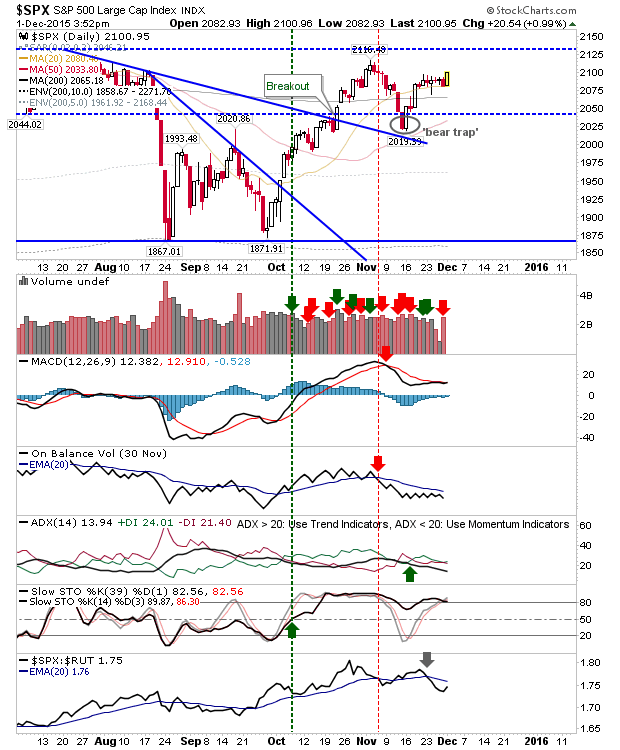

The S&P reversed the move lower after it failed to crack support of the tight range. Bulls look to be making a better fist of this, and there is a good chance for some follow through higher. On the negative side, the index's relative performance remains a problem as it sharply underperforms against both Tech and Small Cap Indices. It also have negative technicals in the form of On-Balance-Volume and MACD, although the latter is just shy of a 'strong buy' signal.

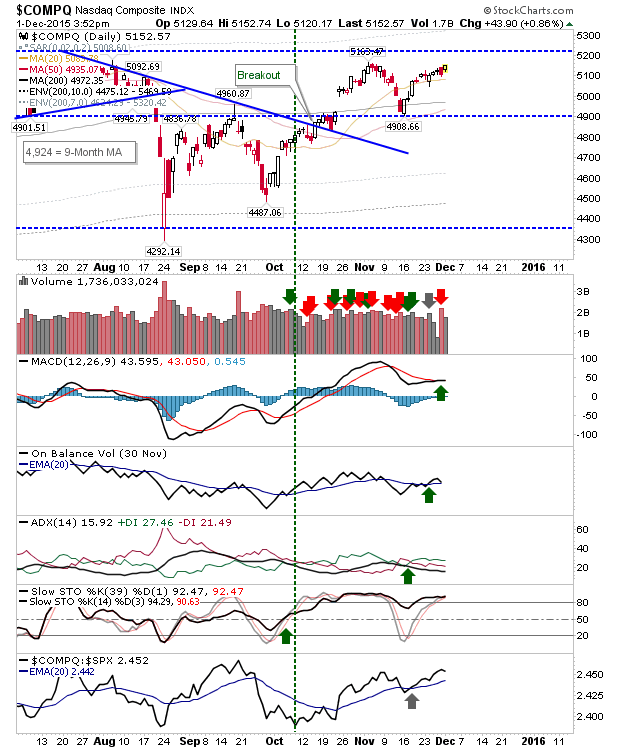

The Nasdaq is just a few points shy of getting past the November high. Volume is maybe a little disappointing, but positive action has returned all technicals to net bullish.

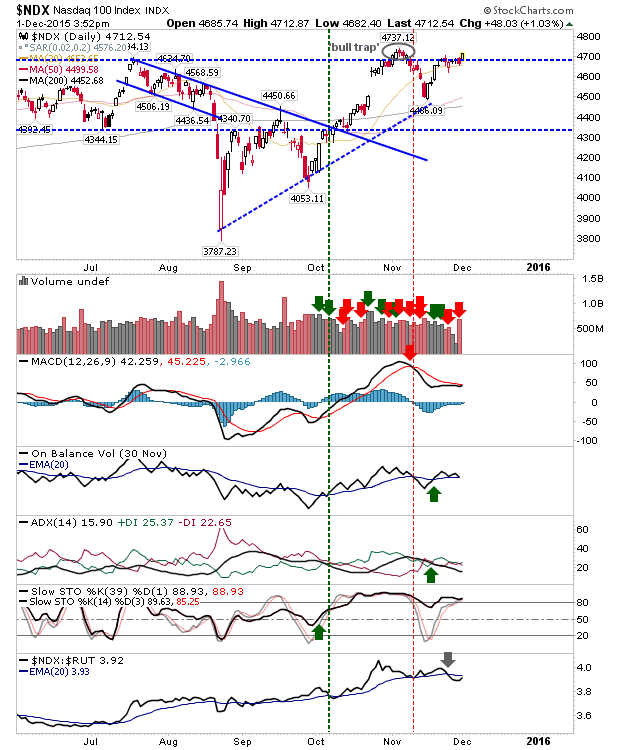

The Nasdaq 100 is doing better as it challenges the October/November 'bull trap'. The index is slightly under-performing against the Russell 2000, but this could quickly change.

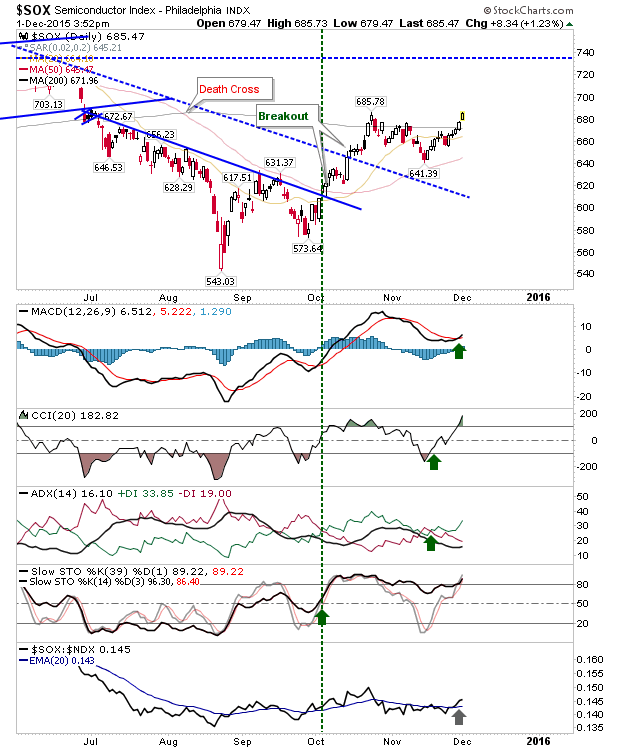

The Semiconductor Index continued its run of good form. It added over 1% as it followed through on its recent 'strong buy' in the MACD. This is looking very healthy for long term investors.

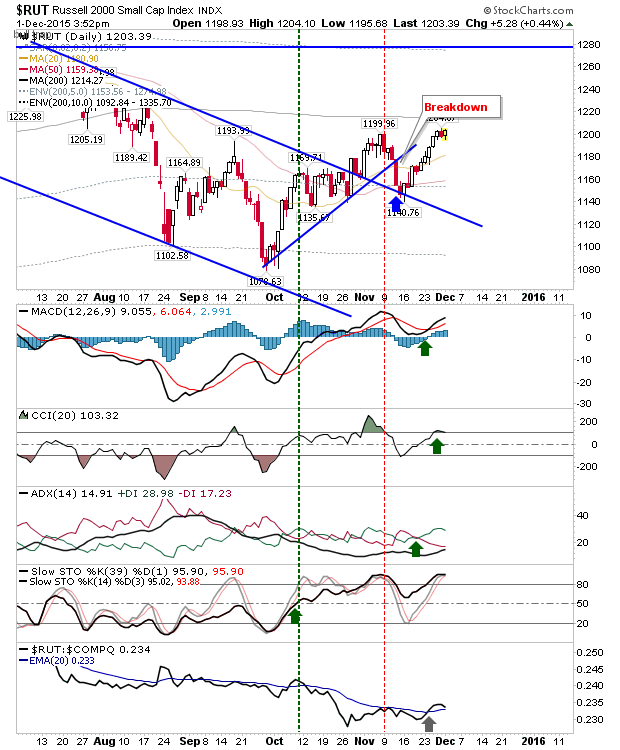

Finally, the Russell 2000 took a step closer to its 200-day MA. The recent rally has helped the index outperform its peers, but it needs to maintain this momentum if it's to get past the 200-day MA.

Now it will be case of a turning the screw on shorts and looking for the Russell 2000 to challenge and break through its 200-day MA, and for the Nasdaq 100 to negate the 'bull trap'.