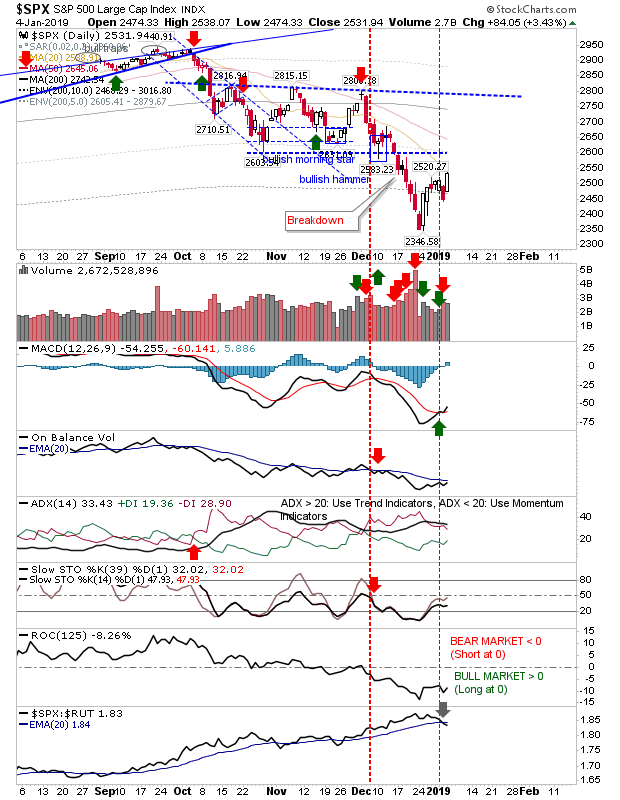

Friday was the finish markets needed to offset the losses from Apple's (NASDAQ:AAPL) earlier in the week earnings release. Once again, markets proved resilient in the face of bad news and this is bullish. Those who have been buying the oversold (investor) signals can continue to do so. With the move towards the 200-day MA the strength of the investor 'buy' signals weakens; so those buying on the 12-month window can slow to once a month until the next leg down begins.

For the S&P, Friday's gain built support for the MACD trigger 'buy' although it lost relative strength against the Russell 2000. Other technicals remain negative as Monday will see its first test of the 20-day MA (soon to be followed by a test of its 200-day MA) and support lows from the October-December period.

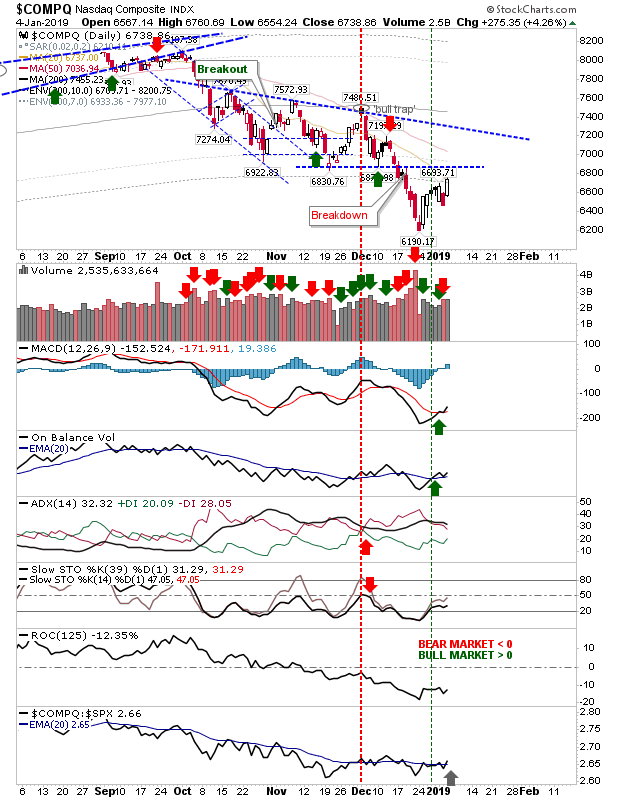

The best one day gain came from the NASDAQ. Along with a relative performance gain against the S&P, and an expansion of the 'buy' signals in the MACD and On-Balance-Volume, the gain in the index will have wiped out any shorts who may have jumped on Friday's weakness. Next up is the 20-day MA.

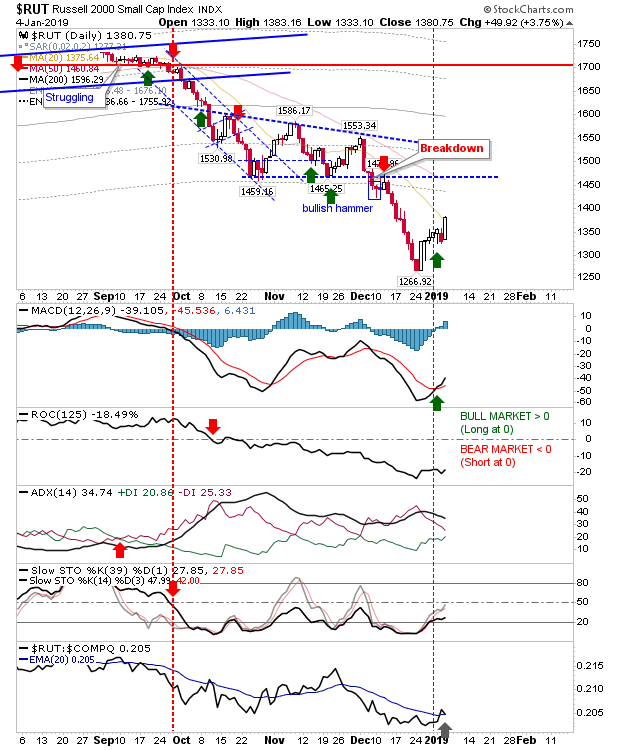

The Russell 2000 has the most room to run before challenging supply from October-November. Unlike the S&P and NASDAQ it has managed to cross above the 20-day MA. There was a relative performance gain against these indices and this should encourage money flow into more speculative Small Cap stocks - another sign that a significant swing low is in place. There is still much work to do but it's a good start.

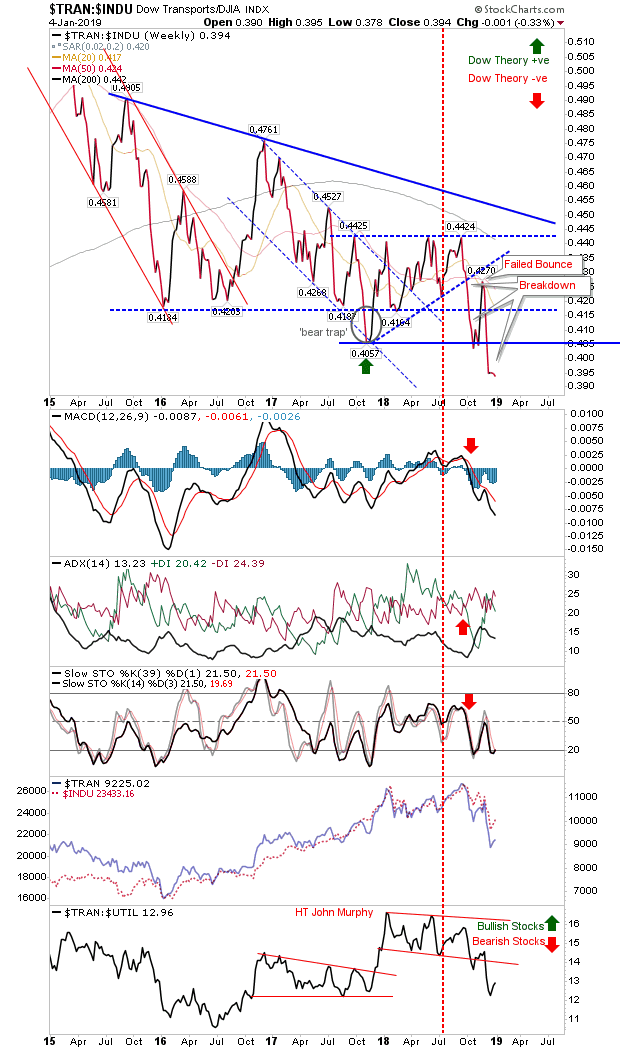

In other charts, the relationship between the Dow Index and Transports accelerated to new lows. Next support levels are at 0.36, 0.35 and 0.30.

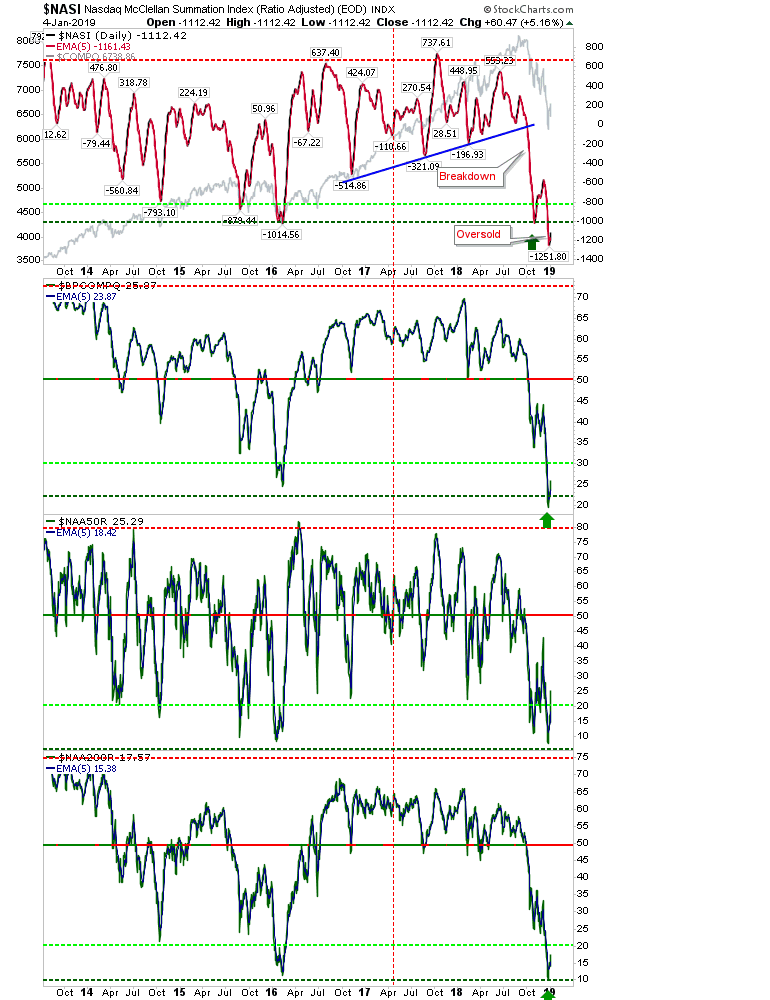

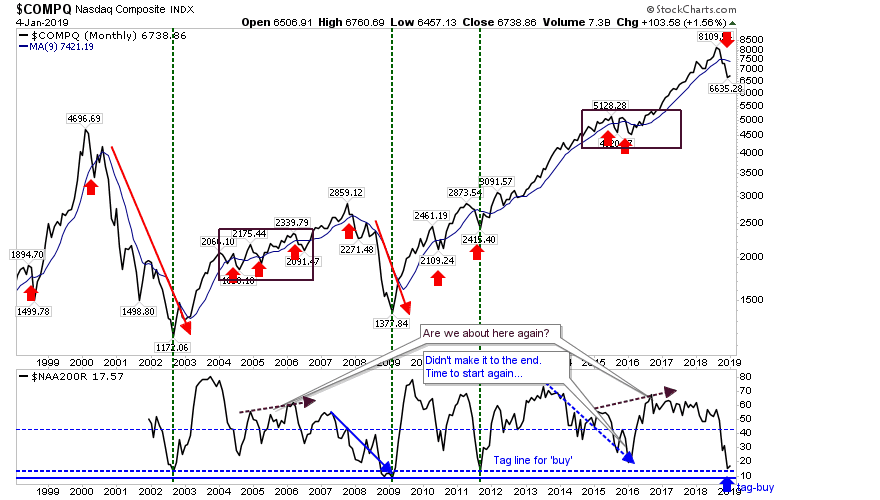

Another look at the significance of the percentage of NASDAQ stocks above the 200-day MA; it tagged the 2011 level.

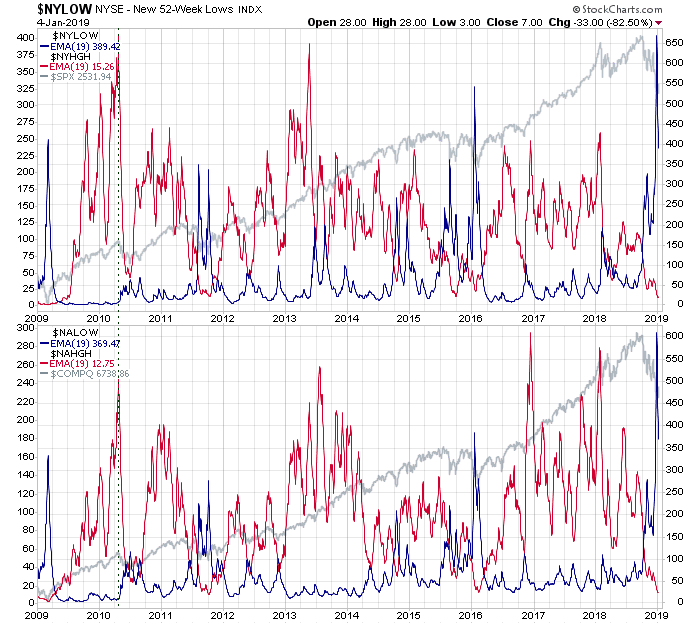

The EMA of new lows spiked at new highs (again surpassing the extremes of 2016)—another tick in the major low category.

For this week, look for a challenge inside the Oct-Dec congestion level. Shorts can look to attack this test but this bounce has managed to shrug off bad news fairly easily—so there is a high chance of failure for such trades.