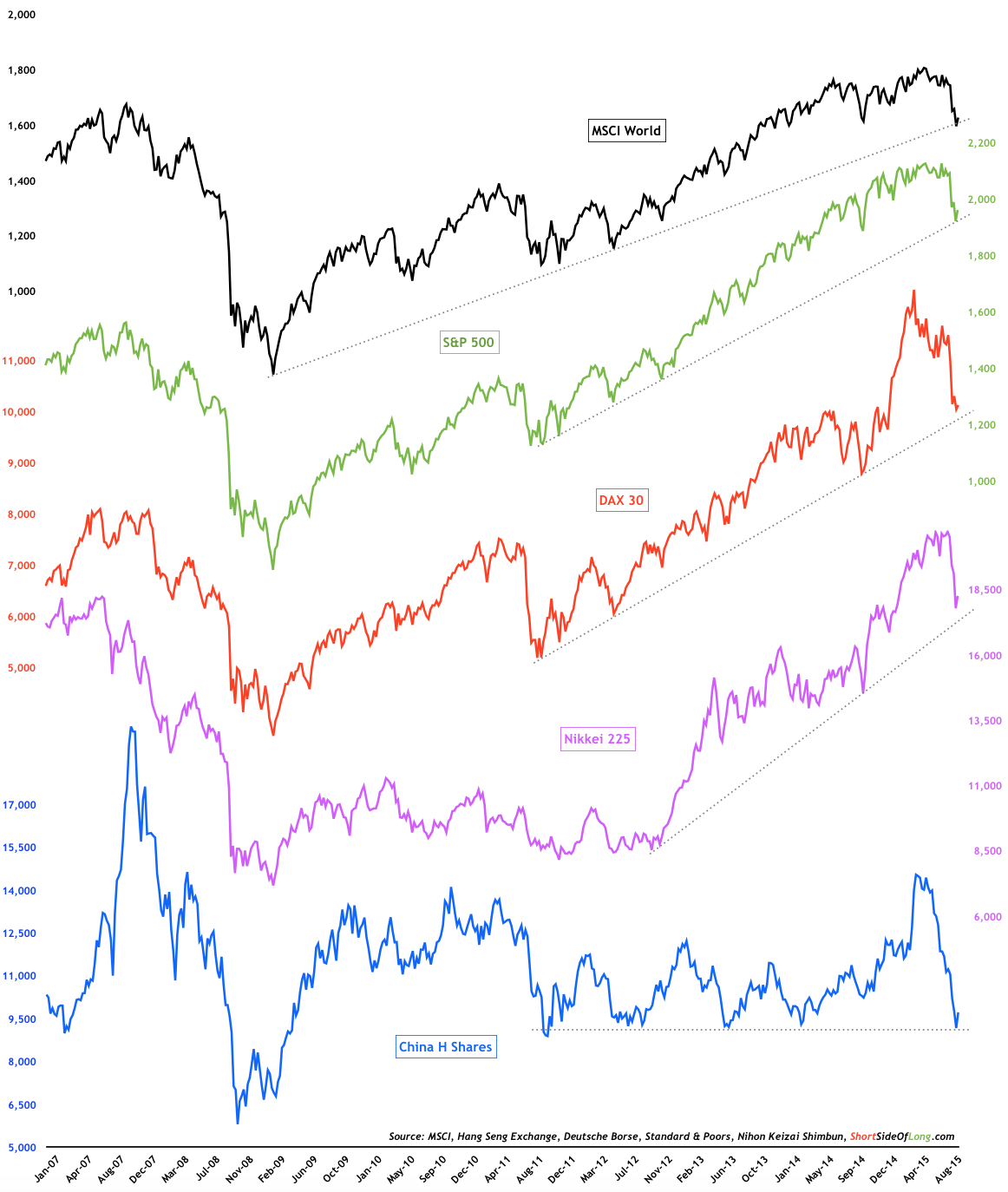

Global equity markets are attempting to bounce of rising trend lines

The chart above has appeared many times on our site. We are basically looking at a trend of major global equity markets and top economies in the world. MSCI World Index represents developed economies priced in US dollars, S&P 500 represent the US economy, while DAX 30 and Nikkei 225 German and Japanese economies, respectively. Finally, we have Chinese H Share Index, instead of the Shanghai Composite (which is a closed market that has very little foreign investment).

The technical price picture is very interesting. All of the markets seem to have found initial support from bullish investors either on or near uptrend lines. The MSCI World Index is attempting to bounce off an important trend line that dates back to March 2009. It is critical for this index to hold here, otherwise further selling could signal a change in trend.

Finally, Chinese markets have experienced most of the selling pressure, with the H Share Index declining almost 40% in 5 months. With the index incredibly oversold, so far it has managed to find support at 9,000 level last seen at the beginning of 2014. A break below this price range could send the Chinese stocks back to March 2009 price range of 7,000 points.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.