S&P 500 logs monthly gain

US markets reversed most of previous day gains on Thursday as trade war concerns came to fore again after US imposed tariffs on steel and aluminum imports from the European Union, Canada and Mexico starting Friday. Dow Jones industrial average lost 1% to 24415.84. The S&P 500 slid 0.7% to 2705.27, but closed 2.2% higher for the month. The NASDAQ Composite fell 0.3% to 7442.12. The dollar weakening slowed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.1% to 93.96 but is rebounding currently. Stock index futures point to higher openings today.

Global trade war scenarios got more real after Canadian Prime Minister Justin Trudeau said Ottawa would impose a 25% tariff on Steel imports from the US, a 10% tariff on aluminum and other US goods, Mexico said it would target several US goods in response and the EU has announced it may target industries such as whiskey and motorcycles. Market reaction to positive economic news was muted: spending on consumer goods rose sharply for a second straight month in April, up 0.6%, the PCE index, the Fed’s preferred inflation gauge, was up 0.2% on month instead of expected 0.1%, and the Chicago purchasing managers index came in at 62.7, compared with the previous level of 57.6.

DAX slumps most as European indices slip

European stock indices ended lower on Thursday as US imposed earlier announced tariffs on EU steel and aluminum imports. Both the euro and British pound continued rebound against the dollar with euro up currently while Pound is lower. The StTOXX Europe 600 lost 0.6%. Germany’s DAX 30 dropped 1.4% to 12604.89. France’s CAC 40 fell 0.5% and UK’s FTSE 100 slid 0.2% to 7678.20. Markets opened 0.5% - 0.9% higher today.

Jean-Claude Juncker, president of the European Commission, tweeted that EU will defend Europe’s interests. The EU has threatened to impose $3.5 billion of tariff on US agriculture, steel and industrial products. In response Trump has threatened to impose import tax on European cars. In Italy the antiestablishment League and 5 Star Movement have agreed to revive a coalition government, withdrawing the candidacy of Paolo Savona for finance minister. In economic news inflation jumped to 1.9% in April in euro-zone, closer to ECB’s 2% target.

Asian markets down

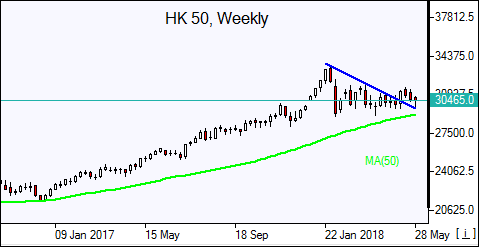

Asian stock indices are mostly lower today. Nikkei slid 0.1% to 22171.35 in choppy trade despite resumed yen slide against the dollar. Chinese stocks are lower as Caixin China manufacturing PMI held steady in May : the Shanghai Composite Index is 0.7% lower while Hong Kong’s Hang Seng Index is up 0.2%. Australia’s All Ordinaries Index is down 0.4% despite Australian dollar continued slide against the greenback.

Brent slips

Brent futures prices are extending losses today. They ended lower yesterday after the US Energy Information Administration reported gasoline stockpiles rose 500,000 barrels last week while crude oil inventories fell unexpectedly by 4.2 million barrels when a build was expected. Brent for August settlement closed 0.2% lower at $77.56 a barrel on Thursday.