Financials lead stock market pullback

US markets continued retreating Tuesday after three day weekend as trade war concerns weighed on market. The S&P 500ended 1.2% lower at 2689.86 led by financial stocks down 3.4%. Dow Jones industrial average lost 1.6% to 24361.45. The NASDAQ Composite index fell 0.5% to 7396.59. The dollar strengthening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 94.774 but is falling currently. Stock indices futures indicate higher openings today.

Trade war concerns were spurred after the US said it will use 25% tariffs announced earlier on $50 billion of Chinese goods unless Beijing addresses the issue of theft of American intellectual property. The final tariff list will be published by June 15, additionally Washington will impose restrictions on investment by Chinese companies in the United States as well as export controls for goods exported to China. Details of the investment and export controls will be announced by June 30. The statement came ahead of Commerce Secretary Wilbur Ross’s visit Beijing planned this week aimed at getting China to agree to firm numbers for additional US exports to the country: President Trump wanted China’s trade surplus with America to shrink by $200 billion in two years. Positive economic reports were shrugged off: the S&P/Case-Shiller national index of home prices edged up 6.5% compared with a year ago in March from 6.34% in February, and the consumer confidence index hit 18-year high at 128 in May from 125.6 in April.

DAX leads major European indices retreat

European stock indices extended losses Tuesday as fears of possible Italy departure from euro zone persisted. Both the British Pound and euro accelerated the slide against the dollar but both currencies are rising currently. The Stoxx Europe 600 fell 1.4%. The German DAX 30 sank 1.5% to 12666.51. France’s CAC 40 lost 1.3% and UK’s FTSE 100 tumbled 1.3% to 7632.64. Markets opened mixed today.

Political uncertainty In Italy weighed on investor confidence with new elections a virtual reality after President Sergio Matarella appointed a former International Monetary Fund official as interim prime minister as he rejected the 5 Star Movement and League coalition’s prime minister candidate Giuseppe Conte. After that the 5 Star Movement and League parties called to hold new elections.

Chinese stocks lead Asian indices tumble

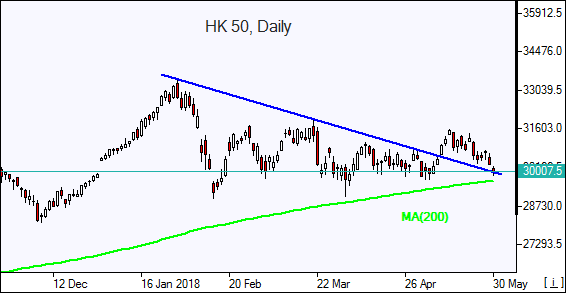

Asian stock indices are lower today as concerns about little progress in US-China trade negotiations added to worries spurred by continuing political uncertainty in Italy. Nikkei dropped 1.5% to 22018.52 despite the resumed yen slide against the dollar. Chinese stocks are lower as China said it was surprised by US statement about tariffs and investment restrictions and would defend its interests: the Shanghai Composite Index is down 2.5% and Hong Kong’s Hang Seng Indexis 1.4% lower. Australia’s All Ordinaries Index is down 0.5% with Australian dollar turning higher against the greenback.

Brent futures prices are steady today after falling considerably following reports the Organization of the Petroleum Exporting Countries and Russia may raise oil output in the second half of the year because of concerns about Venezuela output and Iran oil supply shortage. Prices ended marginally higher yesterday: July Brent gained 0.1% to $75.39 a barrel Tuesday.