Dollar strengthens

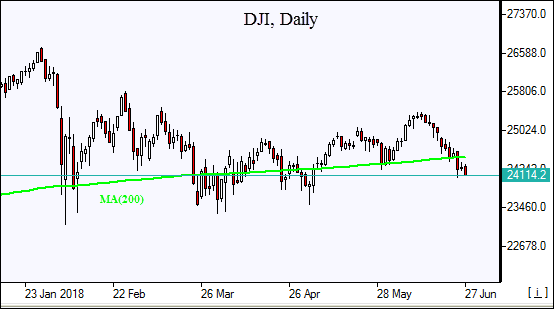

US stock indices edged higher Tuesday led by energy shares. The S&P 500 ended 0.2% higher at 2723.06. Dow Jones Industrial Average inched up 0.1% to 24283.11. The NASDAQ Composite index rose 0.4% to 7561.63. The dollar strengthening resumed as The S&P/Case-Shiller national index rose 6.4% for the year in April: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.4% to 94.989 but is lower currently. Stock index futures point to lower openings today.

DAX sill biggest loser among European indices

European stock indices crept higher Tuesday as investors pondered the impact of tariff measures on European economy after President Trump ordered tariffs on steel and aluminum imports from EU. The euro and British Pound’s slide against the dollar continued but both currencies are higher currently. The Stoxx Europe 600 added less than 0.1%. The German DAX 30 dropped 0.3% to 12677.97. France’s CAC 40 slipped less than 0.1% but UK’s FTSE 100 gained 0.4% to 7537.92. Indices opened flat to 0.2% higher today.

Asian indices rout continues

Asian stock indices are falling today after the US House of Representatives overwhelmingly passed a bill on Tuesday to tighten foreign investment rules. Nikkei lost 0.3% to 22271.77 as the yen turned higher against the dollar. Chinese stocks are falling despite China's central bank decision to cut banks' reserve requirement ratios to boost market liquidity: theShanghai Composite Index is down 1.1% and Hong Kong’s Hang Seng ndex is 1.4% lower. Australia’s ASX All Ordinaries is down 0.03% despite Australian dollar’s continued slide against the greenback.

Brent rises

Brent futures prices are extending gains today as US warned nations importing crude oil from Iran to wind down importing oil from the country by November 4. The American Petroleum Institute reported late Tuesday that US crude inventories fell by 9.2 million barrels to 421.4 million. Prices ended higher yesterday: August Brent fell 2.1% to $76.31 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.