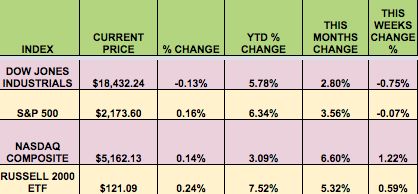

Markets: The market rallied in July, bouncing back from the 2-day Brexit late June swoon, in spite of Crude Oil falling over -18% for the month. Positive earnings reports from some large firms, such as Amazon (NASDAQ:AMZN) and Alphabet Inc (NASDAQ:GOOGL), propelled the Tech sector to the top of the pack, and put the NASDAQ way out in front of the S&P 500 and the Dow, both of which hit several all-time highs in July.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: American Midstream Partners LP (NYSE:AMID), Costamare Inc (NYSE:CMRE), KNOT Offshore Partners LP (NYSE:KNOP), TESSCO Technologies Incorporated (NASDAQ:TESS), Tsakos Energy Navigation Ltd (NYSE:TNP), Banco Bradesco Sa (NYSE:BBD), Crestwood Equity Partners LP (NYSE:CEQP), Capital Product Partners LP (NASDAQ:CPLP), Delek Logistics Partners LP (NYSE:DKL), Golar LNG Partners LP (NASDAQ:GMLP), Green Plains Partners LP (NASDAQ:GPP), Hoegh LNG Partners LP (NYSE:HMLP), Martin Midstream Partners LP (NASDAQ:MMLP), Global Net Lease (NYSE:GNL).

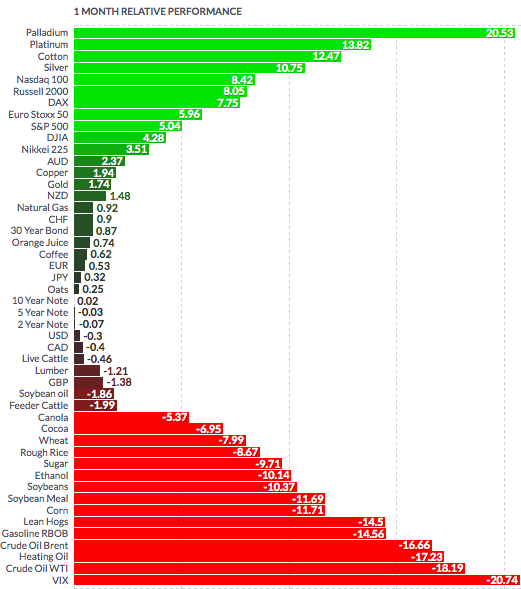

Volatility: The VIX fell -10% this week, finishing at $13.85 VIX Futures lost over -20% in July, as the market rallied.

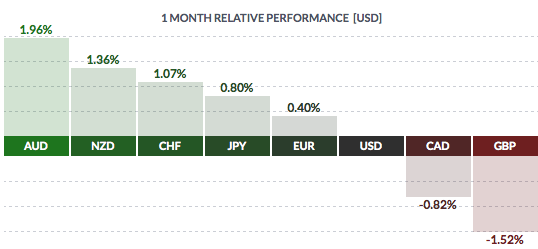

Currency: The US dollar pulled back vs. most currencies in July, except for the beleaguered British pound and the Canadian loonie.

Market Breadth: 11 of the Dow 30 stocks rose this week, vs. 14 last week. 50% of the S&P 500 rose this week, vs. 28% last week.

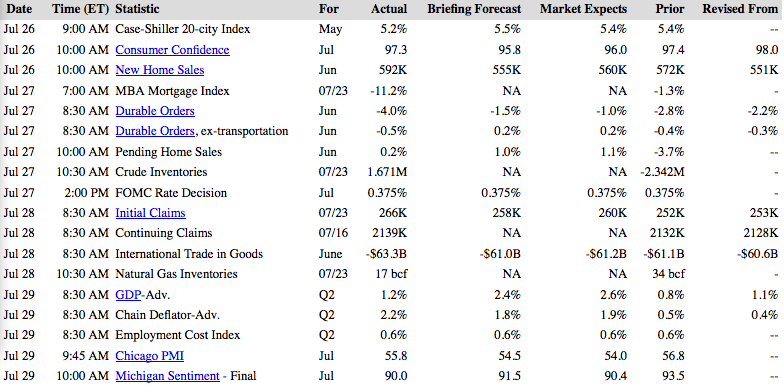

US Economic News: As expected, the Fed didn’t raise rates this week. Consumer Confidence remained strong in July. Housing continued to impress, with June New Home Sales hitting 592K, the most since Feb. 2008. The initial Q2 GDP estimate underwhelmed, hitting just 1.2%, vs. the forecast for 2.6%.

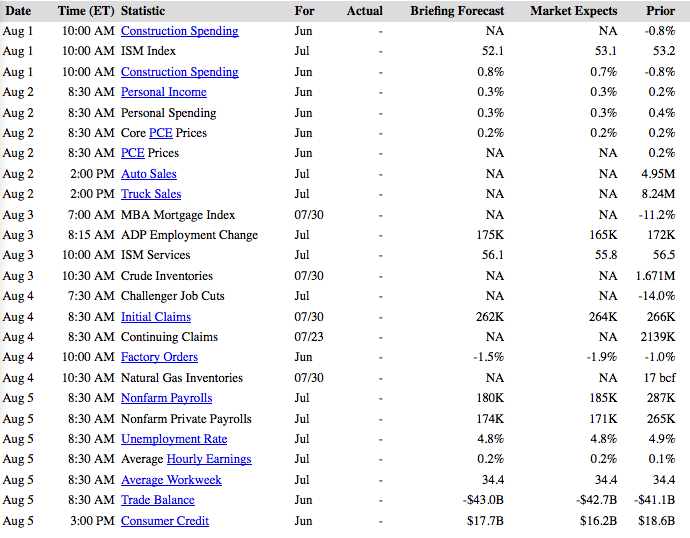

Week Ahead Highlights: ADP issues its July Employment report on Wed., ahead of the heavily anticipated BLS Non-Farm report, which comes out on Friday. Will July meet or even surpass the forecasts for 180 – 185K jobs, and fan the dormant flames of a possible Sept. rate hike? Stay tuned…

Next Week’s US Economic Reports:

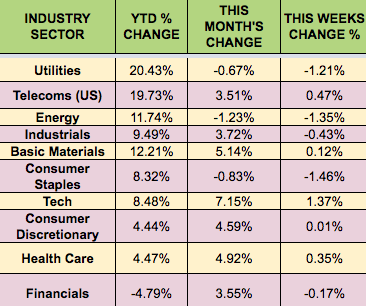

Sectors and Futures:

Tech led the pack by a wide margin, helped by a resurgent Apple (NASDAQ:AAPL), and upbeat earnings reports from Amazon and Alphabet (NASDAQ:GOOGL). Energy trailed, thanks to Crude Oil’s retreat. Defensive stocks are still on top year-to-date, with Utilities and Telecoms leading, as Financials continue to trail – no rate hike in sight yet, although the Fed did hint at a possible September hike.

Palladium and Platinum led in July, with Crude Oil futures falling over -18%: