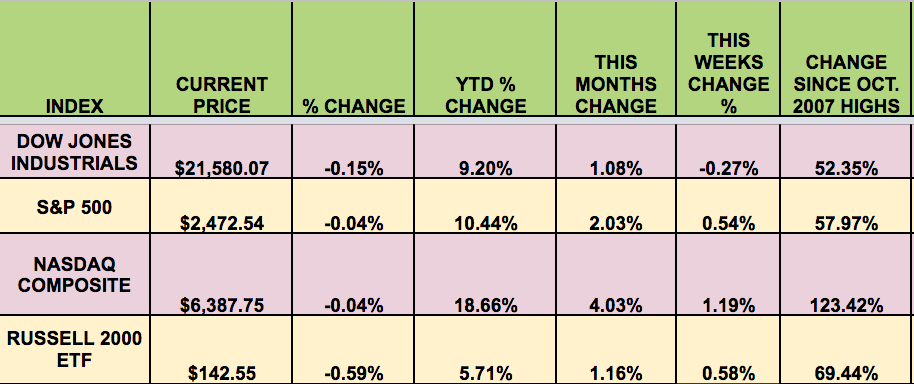

Markets: Another week of all-time highs for the DOW, S&P, NASDAQ, and the RUSSELL 2000, fueled by rising crude prices through most of the week, as WTI crude hit an 8-week high mid-week. It was the 3rd straight week of a drop in US oil supplies.

Energy prices hit a snag, though, on Friday, due to a report which said that OPEC production was rising. OPEC’s July oil supply was set to rise by 145,000 barrels per day compared to June, according to tanker-tracking firm PetroLogistics.

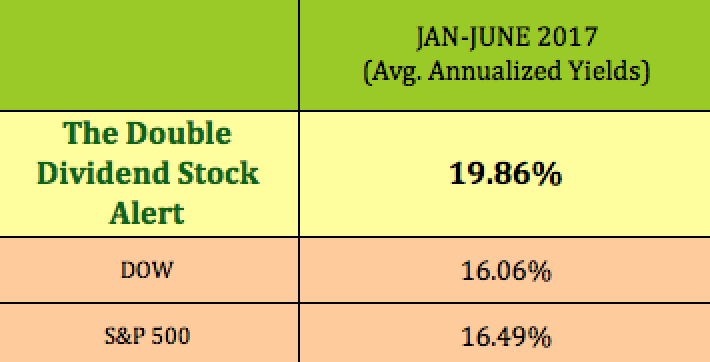

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: RY, BX, CLDT, STB, EPD, GEL, O, OHI.

Volatility: The VIX fell 1.5% this week, finishing at $9.36, its lowest close since December1993. Big traders have grown weary of losing $ on S&P 500 hedges, which have turned out to be unnecessary, Since the VIX is based upon options bought for the S&P 500, as the S&P has churned steadily higher, there has been less interest in hedging it, which has brought the VIX down to historically low levels.

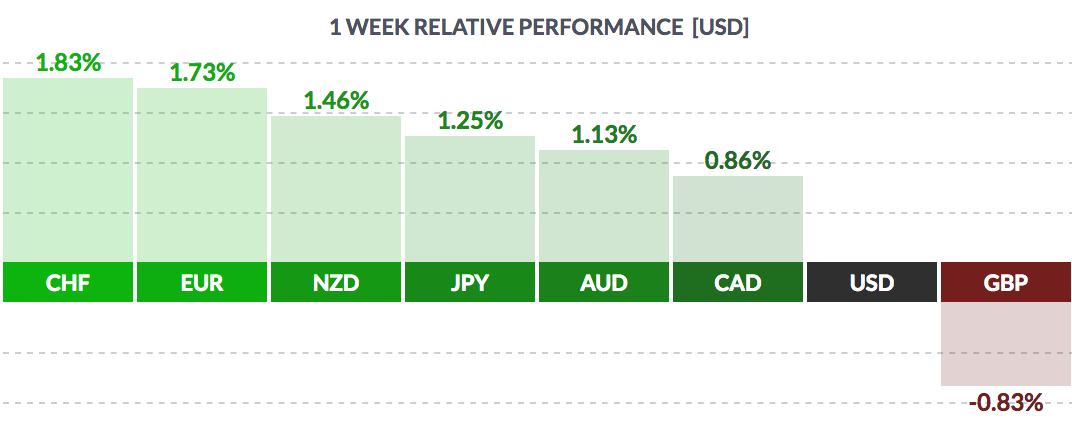

Currency: The $ fell vs. most other major currencies again this week, (except the pound), as the ECB began to sound a bit more hawkish – the euro has risen 10.9% vs. the US $ thus far in 2017:

Market Breadth: 16 of the DOW 30 stocks rose this week, vs. 24 last week. 64% of the S&P 500 rose, vs. 74% last week.

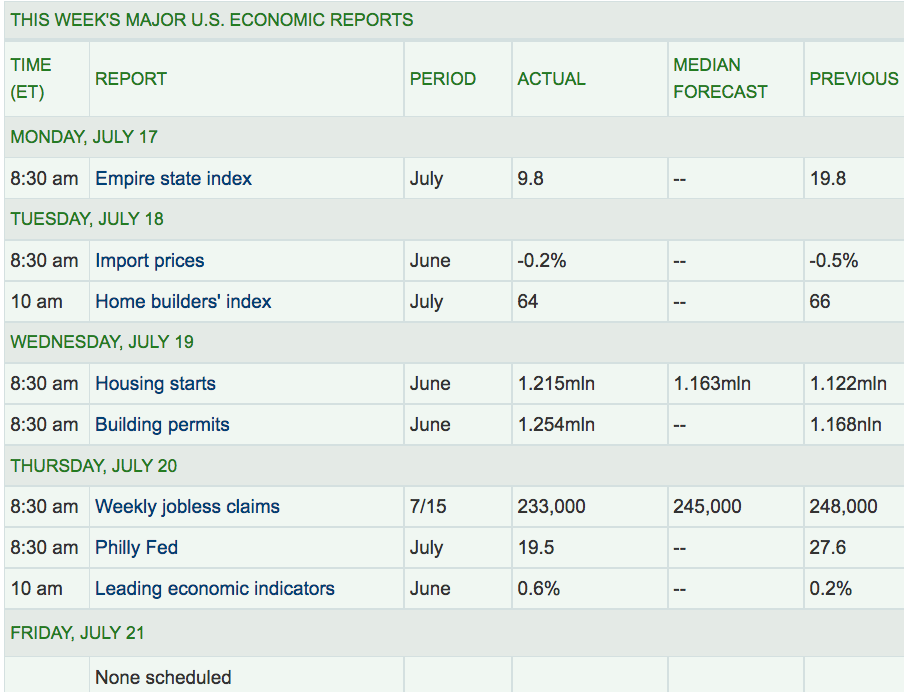

Economic News: Housing data was upbeat for June – both Housing Starts and Permits had a good bump up vs. May, and Refinance volume rose 13%. The Leading Economic Indicators index also surprised to the upside, climbing .6% in June.

However, Reuters reports that “mortgage banking income fell by double digits on a percentage basis at most regional banks that have reported earnings results so far, and is expected to drop more than 40 percent this year relative to last year,.

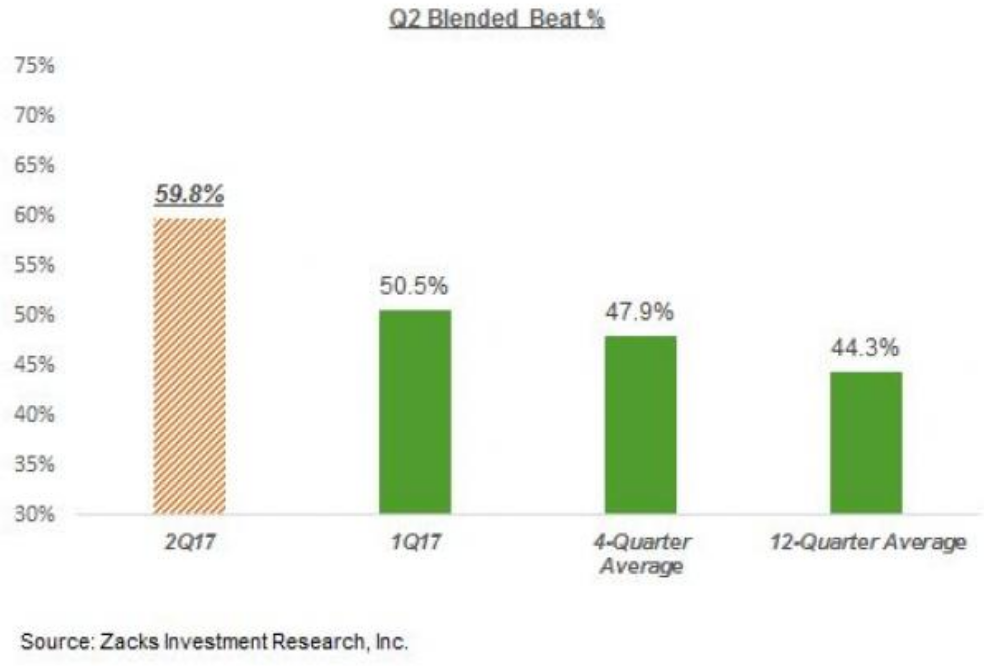

Earnings News: “Earnings and revenue growth pace is steadily going up relative to pre-season expectations. Total Q2 earnings for the index are currently expected to be up +8.6% from the same period last year +4.7% higher revenues.”

“The +8.6% growth rate is the blended growth rate; it combines the actual growth for the 97 S&P 500 members that have reported with estimates for the still-to-come 403 index members. At the start of the quarter, the expectation was for earnings growth of +7.9%, which came down as the quarter unfolded, reaching as low as +5.6% just ahead of the start of the reporting season. Since plenty of results are still to come, the actual Q2 earnings growth could very well go above +10%, which will follow the +13.3% earnings growth in the preceding quarter.”

“Q2 growth is broad-based and not dependent on one or two sectors. There is strong growth contribution from the Finance, Technology and Energy sectors in Q2, but we have 11 of the 16 Zacks sectors on track to produce more earnings than the year-earlier period.”

(Source: Zacks/NASDAQ)

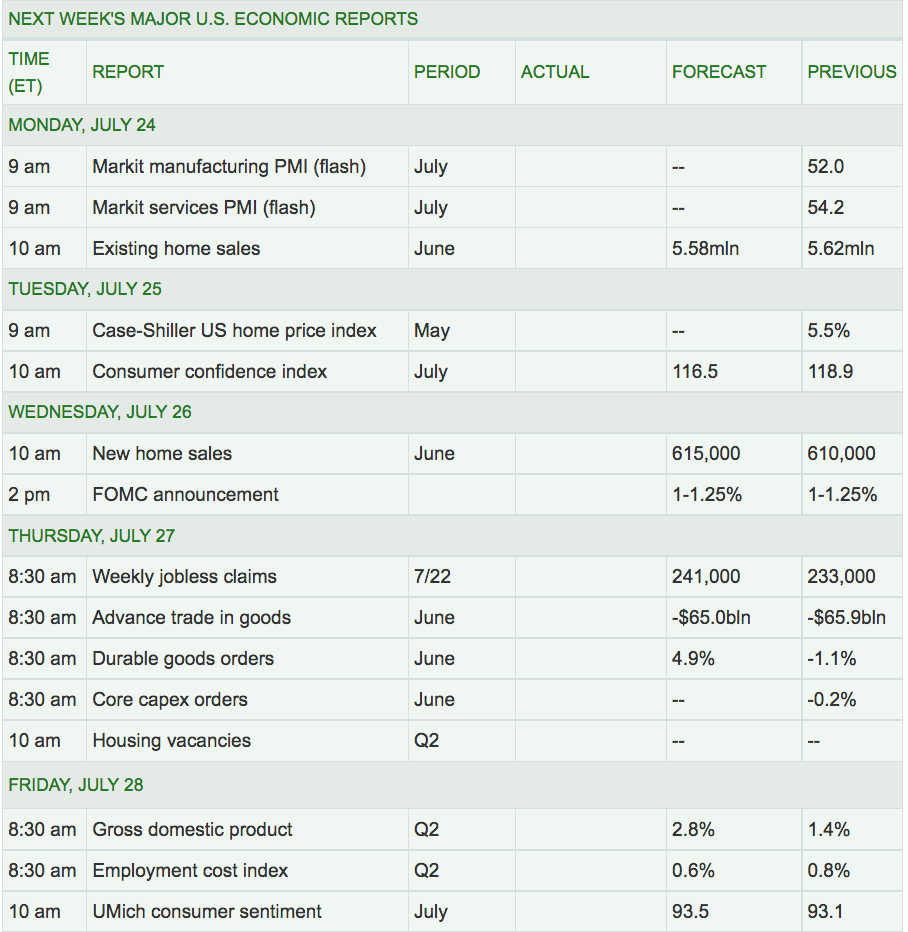

Week Ahead Highlights: Q2 Earnings season rolls on, with 12 more DOW stocks reporting, including Exxon Mobil (NYSE:XOM), which is embroiled in a suit vs. the US government for alleged Russian sanction violations back in 2014. Boeing (NYSE:BA), McDonald’s (NYSE:MCD), Ford (NYSE:F), GM (NYSE:GM), Coca (NASDAQ:COKE), 3M (NYSE:MMM), Amazon (NASDAQ:AMZN), and Starbucks (NASDAQ:SBUX) also report, among many others.

The Fed’s Open Market Committee will also issue a statement on Wednesday, which will, hopefully, be a non-event.

Next Week’s US Economic Reports: It’ll be a heavy data week, with several Housing reports due out, Consumer Sentiment, and a Q2 GDP estimate due out on Friday.

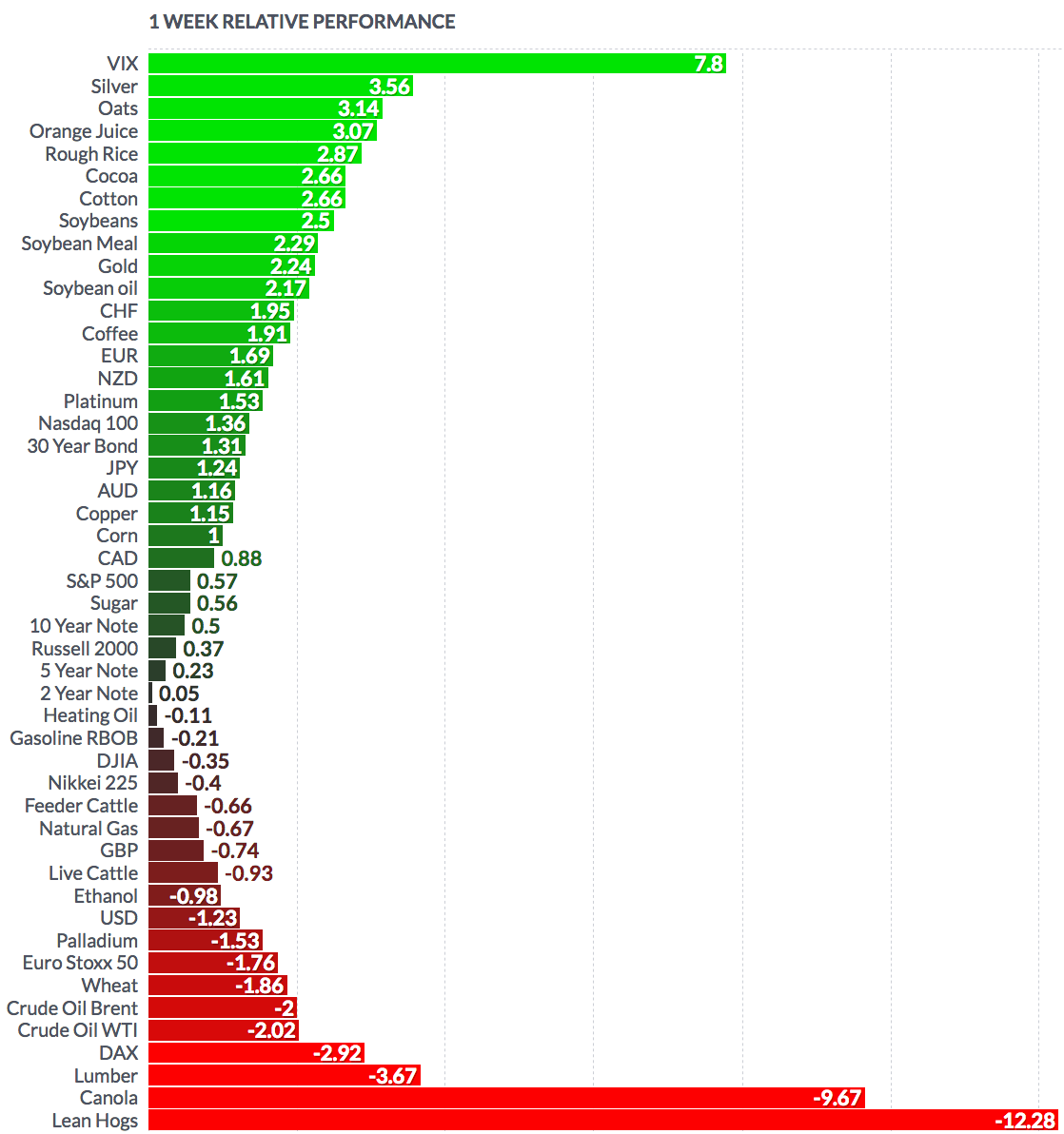

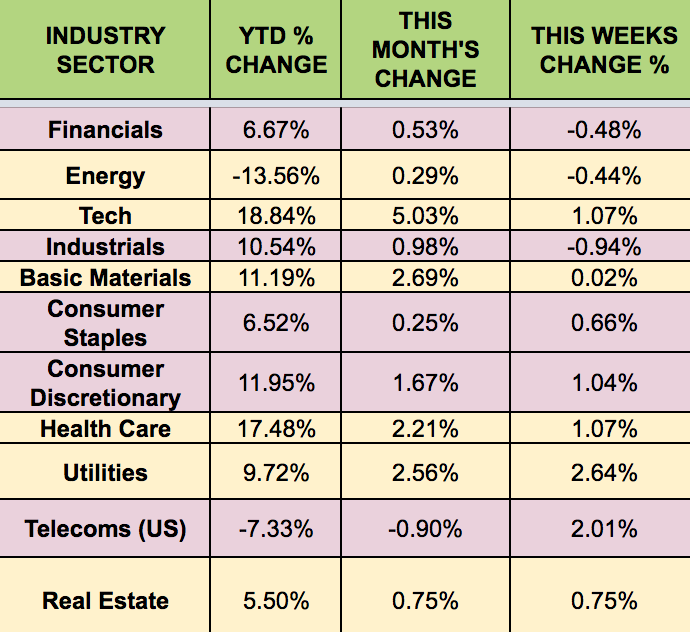

Sectors & Futures: The Utility sector led this week, as Industrials trailed.

WTI Crude futures lost 2% on Friday, due to report citing rising OPEC production. The US oil rig count fell by 1 rig to 764, according to oilfield services firm Baker Hughes. Natural gas was down -.67% this week: