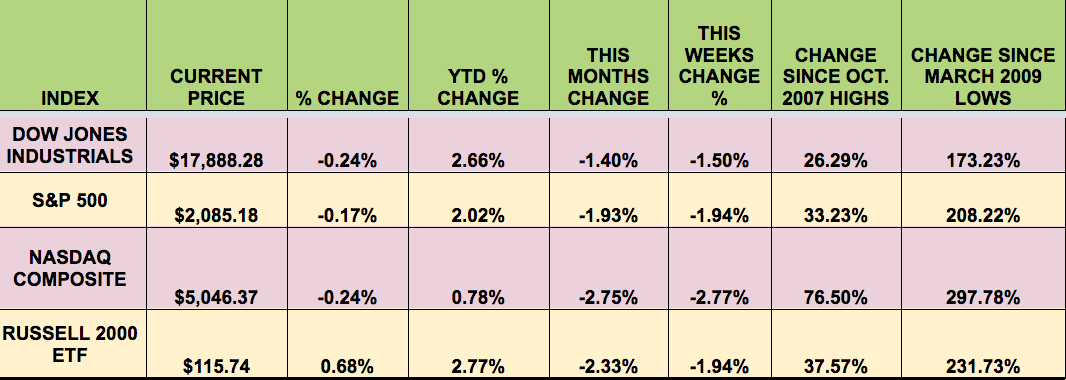

Markets: All 4 indexes fell again this week, following Crude oil declines, and continued tensions about the upcoming election. However, the S&P 500 is still only less than 5% below its all-time high.

Looking back a few years shows how far the market has come – the S&P is up 208% vs. its March 2009 lows, while the DOW is up 173%. The Tech-heavy NASDAQ has done even better – it’s up almost 300%, and the Russell Small Caps (NYSE:RSCO) are up 231%. Clearly, the market has enjoyed this slow recovery, which is the 4th longest in US history.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: (NYSE:FBR), (NYSE:EVA), (NYSE:ARR), (NYSE:BPL), (NASDAQ:FSC), (NASDAQ:FSFR).

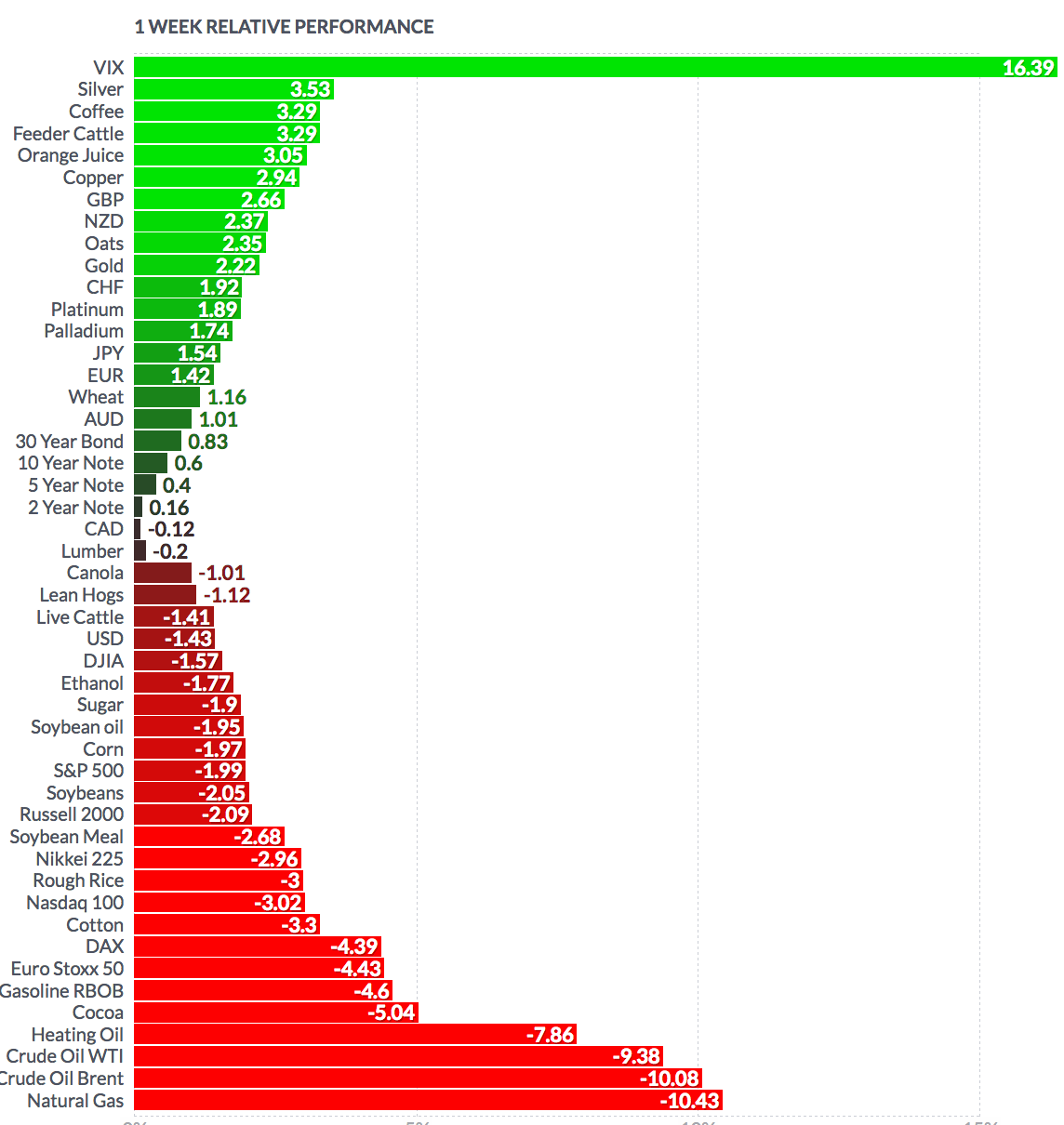

Volatility: The VIX soared 39% this week, finishing at $22.51.

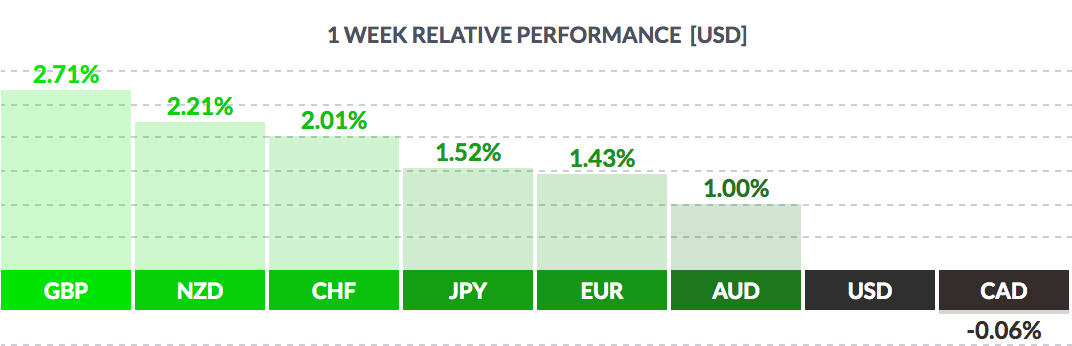

Currency: The dollar fell vs. most other major currencies, except the Canadian loonie.

Market Breadth: 2 of the DOW 30 stocks rose this week, vs. 17 last week. 26% of the S&P 500 rose this week, vs. 40% last week.

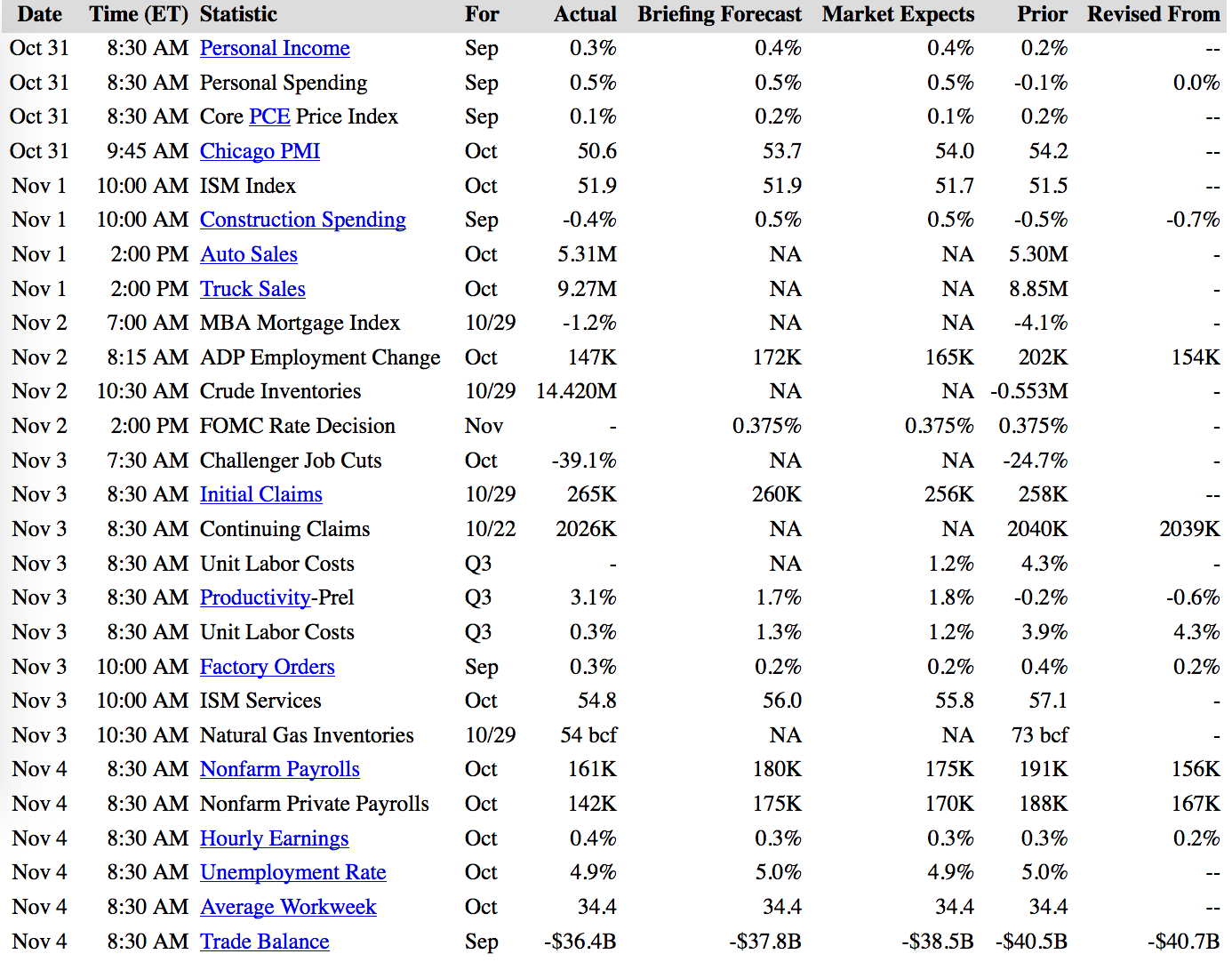

US Economic News: It was a “Goldilocks” Payrolls Report, with avg. hourly earnings up 2.8%, best since the crisis. The Unemployment rate fell to 4.9%, and while the 161K jobs created was slightly lower than the 175K forecast, the previous 2 months’ figures were both revised upward by a total of 44k jobs. Productivity also rose 3.1%, better than forecasts.

Employment in professional and business services continued to trend up in October

(+43,000) and has risen by 542,000 over the year.

Health care employment rose by 31,000 in October.

employment in financial activities continued on an upward trend (+14,000),

with a gain in insurance carriers and related activities (+8,000).

As expected, the Fed left rates unchanged, but a December hike looks very probable.

Week Ahead Highlights: The It’s all about the US election next week, with very little economic data on tap. The Q3 earnings season has already witnessed most of the large cap action, with 85% of the S&P 500 , and all but 4 of the DOW 30 having reported. Approx. 69% of reporting S&P 500 firms have beaten estimates, while 22% have missed estimates, and 9% have met estimates.

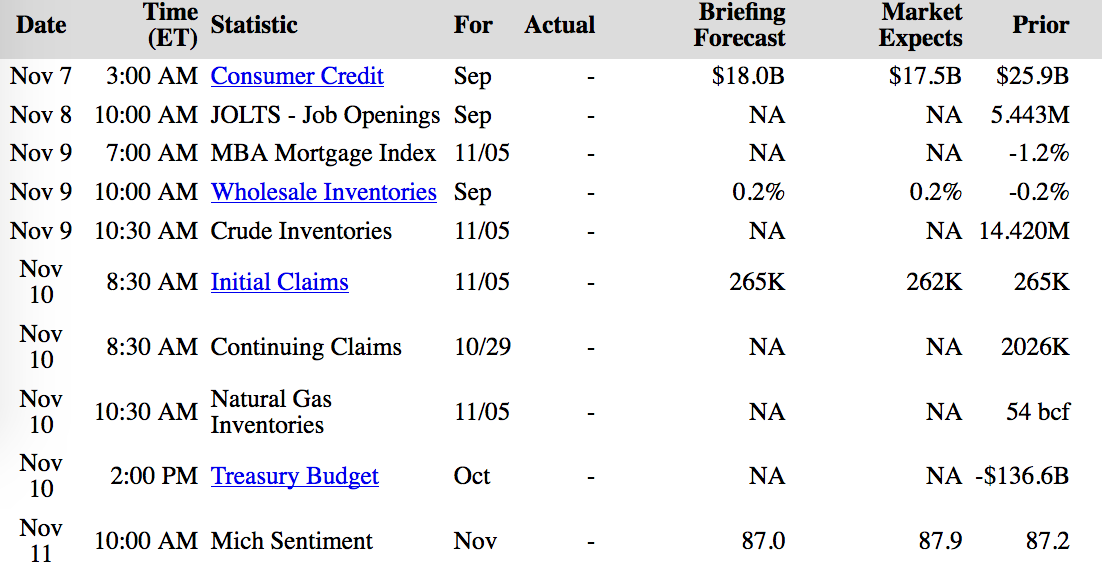

Next Week’s US Economic Reports:

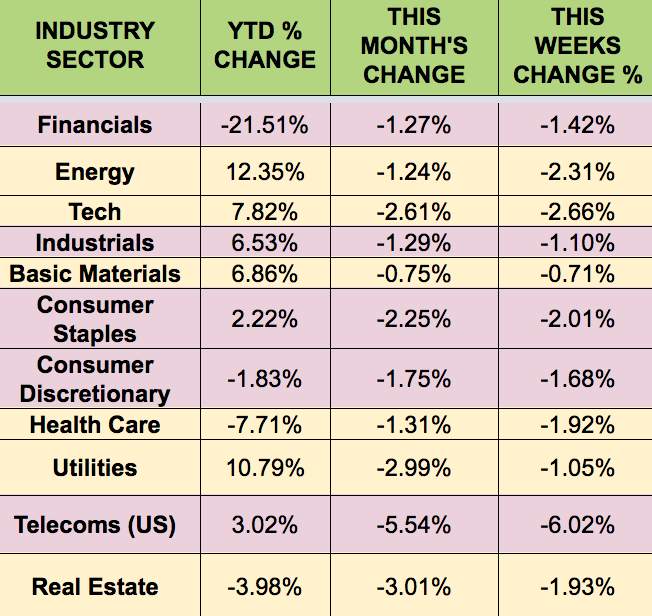

Sectors & Futures: Basic Materials caught a bit of a break this week – they fell the least, due to a falling US dollar, as Telecoms lagged.

Crude oil futures fell again this week, down over -9% this week, on continuing doubts about an OPEC production cut agreement. Silver and coffee led: