Does Your Portfolio Need More Protection In This Volatile Market?

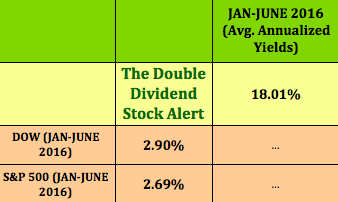

Check out our returns in 2016:

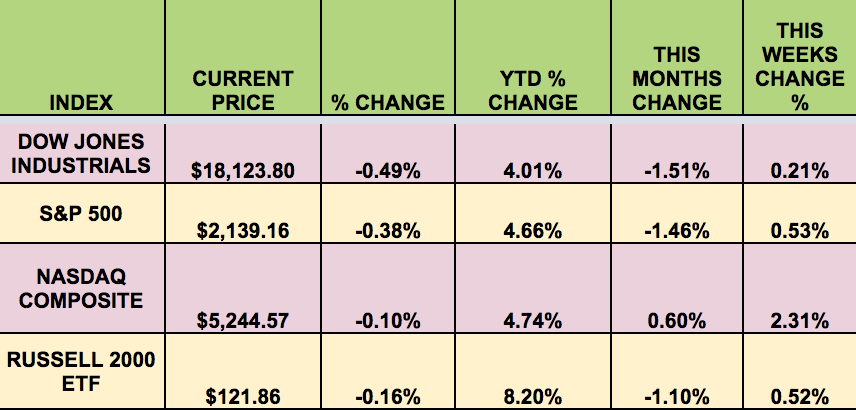

Markets: The indexes gained this week, with the Tech-heavy NASDAQ leading by a long shot, aided by Apple Inc (NASDAQ:AAPL)'s 11%-plus gain.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: NASDAQ:AINV, NYSE:FSIC, NASDAQ:GAIN, NASDAQ:GLAD, NASDAQ:GOOD, NYSE:MAIN, NASDAQ:PFLT, NASDAQ:PNNT, NYSE:EURN, NASDAQ:CPTA, NASDAQ:SLRC, NASDAQ:OXBR, .

Volatility: The VIX fell 12% this week, finishing at $15.37.

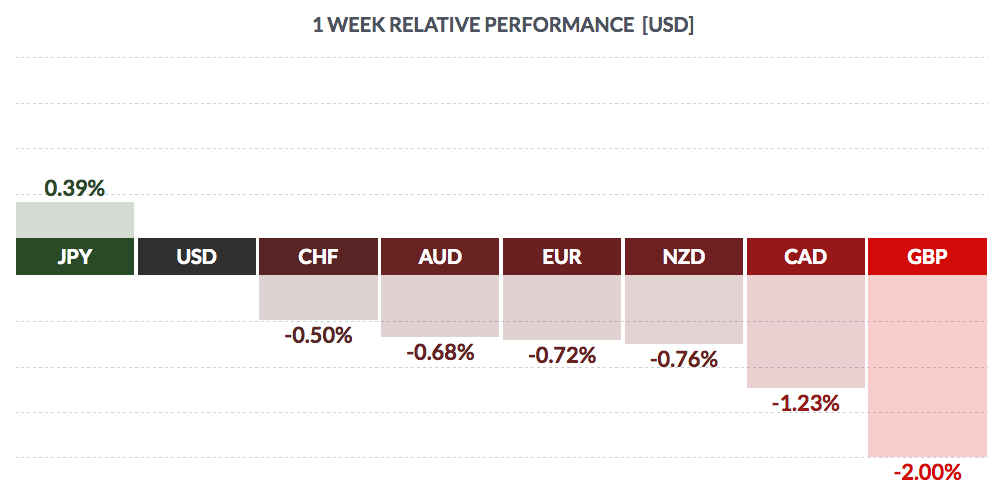

Currency: The $ rose vs. most other major currencies, as bonds sold off in world markets.

Market Breadth: 15 of the Dow 30 stocks rose this week, vs. 4 last week. 52% of the S&P 500 rose this week, vs. 15% last week.

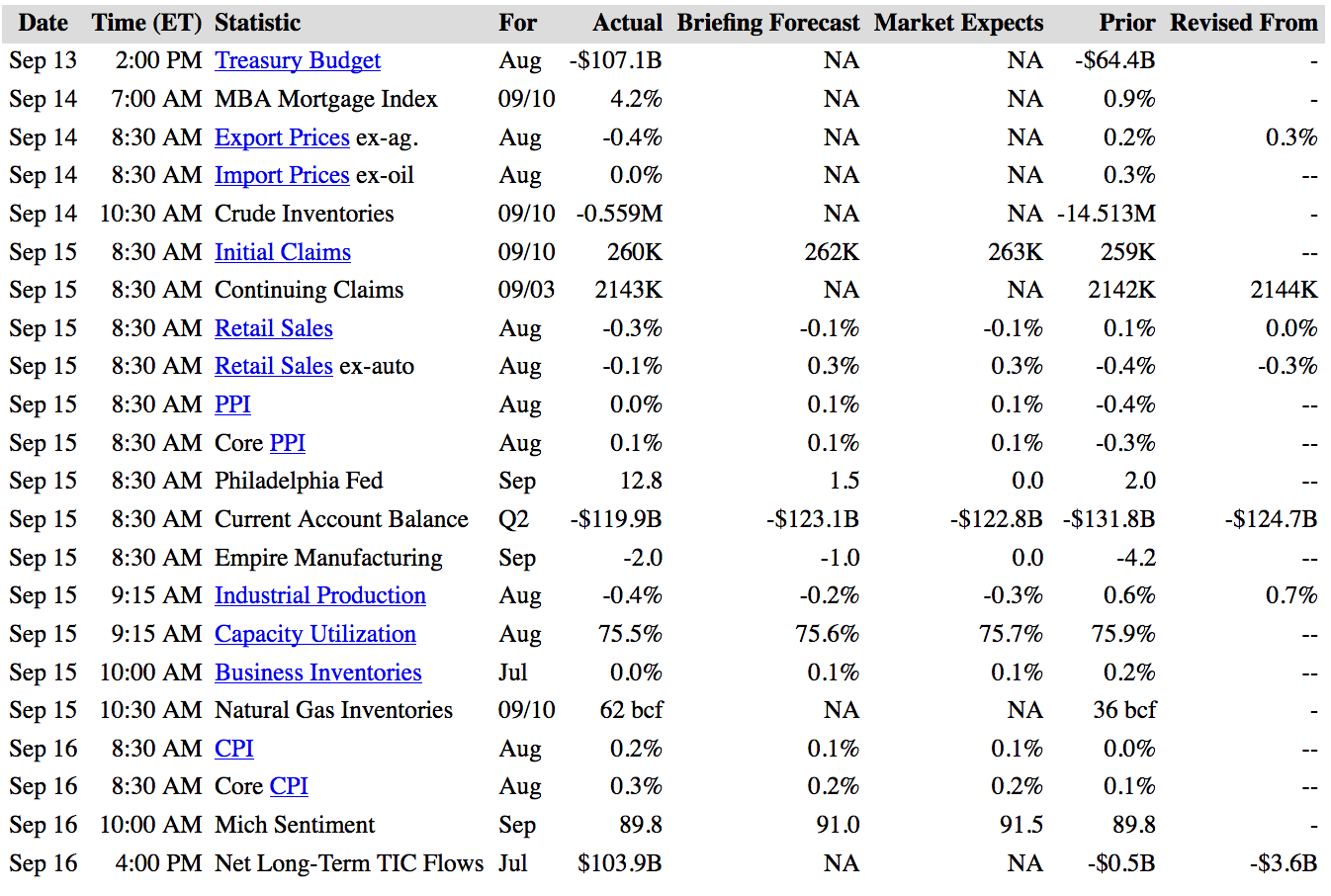

US Economic News: Philly Mfg. jumped unexpectedly, while NY Empire State fell more than forecasted. Retail Sales disappointed, with Ex-Auto Sales falling -0.1%, vs. the 0.3% forecast. Core inflation rose 0.3%, higher than forecasts.

Our latest Seeking Alpha articles:

“Tasty, Low Profile High Dividend Stock Pays Monthly, Yields 8%” (SATURDAY)

“Outperforming High Dividend Stock Yields 12%, Upped Guidance, Estimates Rising” (SUNDAY)

Our latest monthly Dividend Stocks Blog article: (AUGUST)

“New Preferred High Dividend Stock Trading Below Call Value”

(You can read our latest articles on our Dividend Stocks Blog)

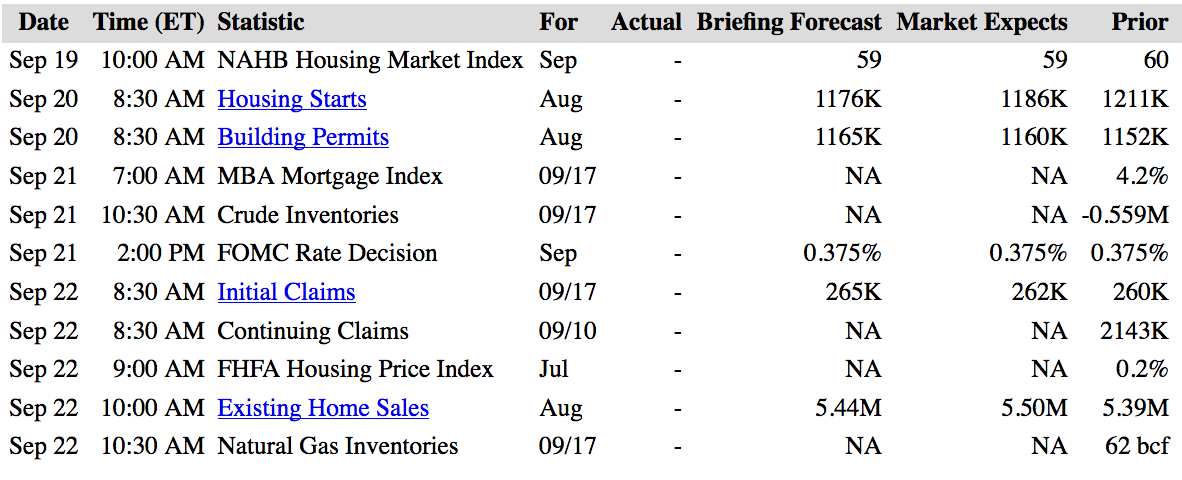

Week Ahead Highlights: The Fed’s highly anticipated rate meeting is next week, Sept. 20-21. Futures markets now put a 22% chance of a rate hike at this meeting. Housing will be in the spotlight, with KB Home (NYSE:KBH) and Lennar (NYSE:LEN) reporting, and the Housing Starts report due out on Tuesday.

Next Week’s US Economic Reports:

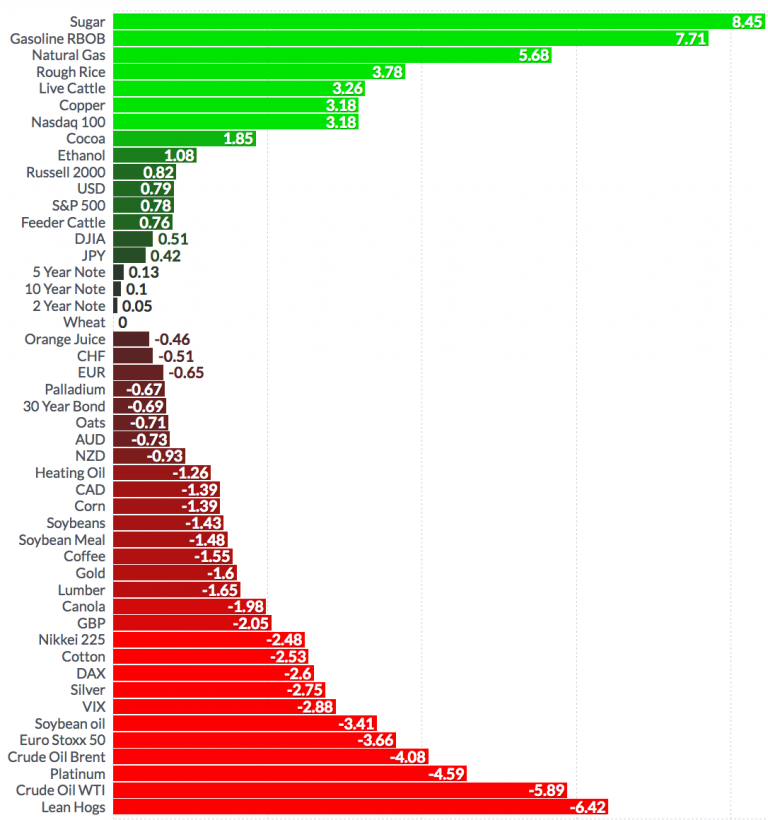

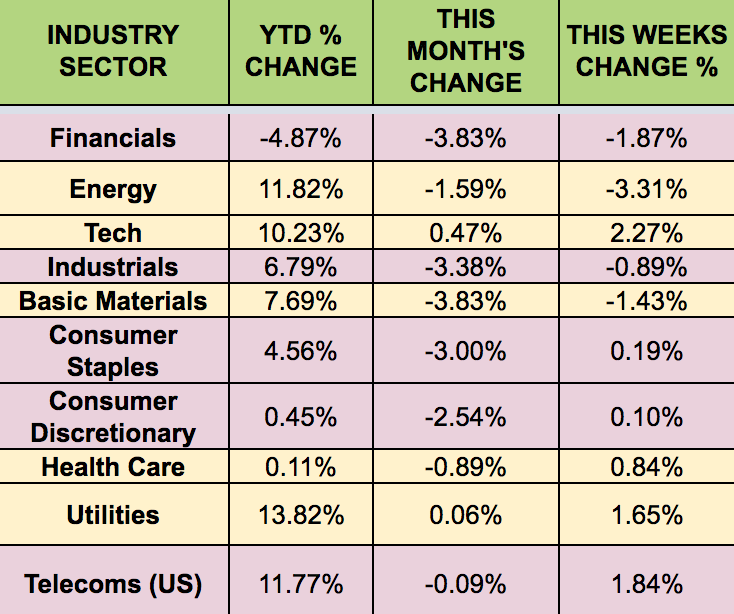

Sectors & Futures:

The Tech sector led this week, as the Energy sector trailed, with Crude prices falling.

Crude Oil futures fell -5.89% this week, while Natural Gas and Gasoline both rose: